This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

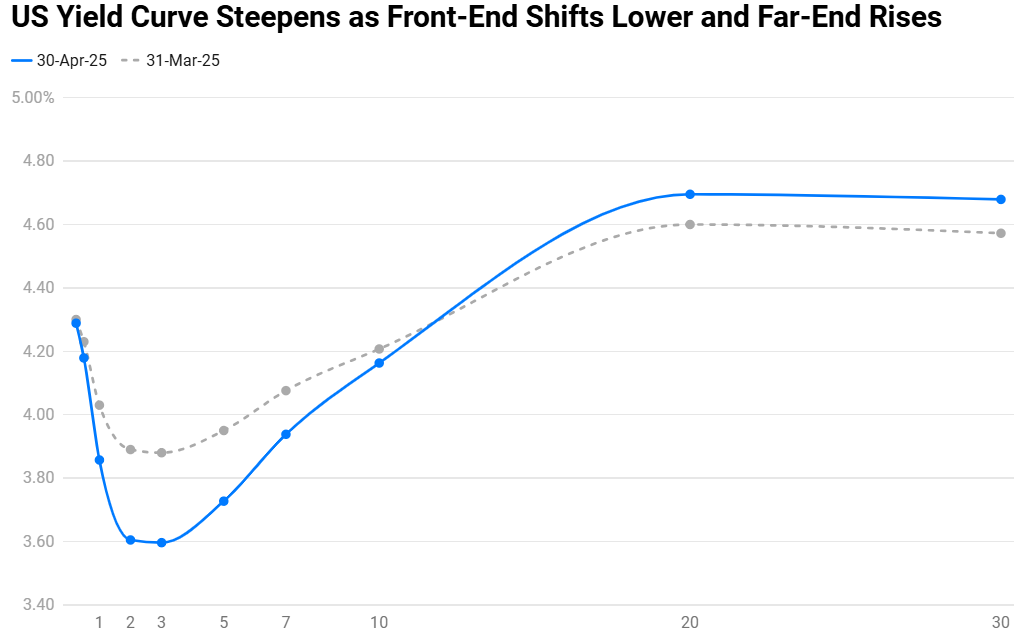

April 2025: Mixed Month for Dollar Bonds as IG Outperforms HY on Broad Risk-off; Yield Curve Steepens

May 2, 2025

April 2025 was a mixed month for bond investors with 54% of dollar bonds ending higher (price returns ex-coupons). Investment Grade (IG) dollar bonds performed better than High Yield (HY) dollar bonds. 62% of IG dollar bonds ended in the green as compared to 73% of HY dollar bonds ending in the red. This was primarily fueled by a broad risk-off sentiment until recently, following the tariff skirmish between the US and China, with markets trying to assess the impact of the trade war. Besides, markets also showed concern over reports that US President Donald Trump was exploring options to fire Fed Chairman Jerome Powell. This sentiment eased after Trump’s clarifications later on not having any such plans and his comment that tariffs on China will “come down substantially”. Markets continue to pricing-in a total of 100bp in rate cuts by the Fed in 2025 with the first cut being expected by July.

April saw the Treasury yield curve bull steepen, where the 2Y, 3Y and 5Y yields fell 24-28bp while the 10Y was broadly stable. The long-end, i.e., 20Y and 30Y yields rose by 10bp each. US Non Farm Payrolls (NFP) for March came-in at 228k, surprising analysts’ estimates of 140k. However, AHE YoY rose 3.8%, softer than expectations of 4.0%. The unemployment rate rose to 4.2% from 4.1%. Looking at inflation, both US CPI and Core CPI YoY were softer than expectations, rising by 2.4% and 2.8% respectively. The ISM Manufacturing reading worsened and contracted to 49.0, and the Services PMI also worsened to 50.8. Retail Sales rose by 1.4% while the consumer confidence index continued to stay soft at 86.0.

The IG-space saw bonds of sovereigns like Indonesia and Philippines among the top gainers along with bonds of corporates like PLN, Pertamina and KfW. The losers in this space included bonds of Telefonica Moviles Chile, SolarEdge Technologies, Borr Drilling, Macy’s and Grupo Televisa. Bonds of CK Asset were also among the top losers owing to the scrutiny of the CK Hutchison port deal with Blackrock by the Chinese authorities and Panama government

Hertz’s bonds (yielding over 13% currently) rallied by 20-30% during the month on the back of its plans to raise debt to boost its liquidity. Ecuador’s dollar bonds (yielding over 12%) also rallied by 20-25% in the month after Daniel Noboa’s Presidential victory. Vanke’s dollar bonds (yielding over 15%) continued to rally from the prior month, higher by 8-10% after it redeemed its onshore notes, following it with support to repay its debt. Argentina’s dollar bonds (yielding over 11%) were also among the top gainers after securing a $20bn deal with the IMF. Bonds of Bally’s Corporation (yielding over 18%) were among the top losers in the HY space dropping by 20-23% after Fitch downgraded it to B-. Following them were Transocean’s bonds (yielding over 12%) which saw a drop of by 14-17%. Xerox’s bonds dropped further 12-14% from the previous quarter after it reported a poor financial quarter. Kohls’ bonds (yielding over 13%) continued to fall by 5-15% amid store closures due to underperformance and downgrade by Fitch. Pakistan’s dollar bonds (yielding over 12%) fell by 4-9% after rising tensions with India. Angola’s dolalr bonds(yielding over 13%) dropped by as much as 9% due to economic strain from falling oil prices and global trade tensions, leading to its limited access to international bond markets.

Issuance Volumes

Global corporate dollar bond issuances stood at $231bn in April, 32% lower than the $339bn seen in March. As compared to April 2024, issuance volumes were down 17% YoY. 83% of the issuance volumes came from IG issuers with HY comprising 11% and unrated issuers taking the remaining 6%.

Asia ex-Japan & Middle East G3 issuance stood at $28bn, down 36% MoM, while being up 19% YoY. 81% of the issuance volumes came from IG issuers with the remainder coming equally from HY and unrated issuers.

Largest Deals

THe largest deals globally were led by bank issuances following their earnings announcements. Morgan Stanley’s and Wells Fargo’s $8bn four-part deals each, followed by JPMorgan’s and Goldman Sachs’ $6bn two and three-part deals respectively, led the tables. Besides, Palladium Global’s ~€9.5bn two-part deal, Paychex’s $4.2bn three-part deal and Walmart’s $4bn four-trancher also completed the list of the largest deals.

In the APAC and Middle East, AgBank of China’s $800mn deal, Hong Kong International Qingdao’s $750mn issuance and Transurban Finance’s $727mn deal. Besides, the region also saw $500mn issuance each by state-owned entities like Fujian Zhanglong, Coastal Emerald and Zhangzhou City Transportation. .

Top Gainers & Losers

Go back to Latest bond Market News

Related Posts: