This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

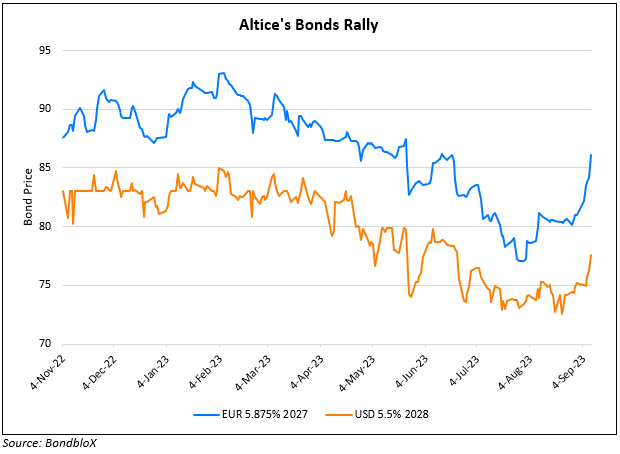

Altice’s Dollar Bonds Drop on Possible Creditor Cuts Amid Deleveraging

March 21, 2024

Altice’s executive sounded a warning to creditors by saying that the latter may have to take cuts to meet the company’s leverage targets. Altice’s creditors may have to participate in “discounted transactions” to cut leverage. The company has decided to reduce its leverage below 4x EBITDA and target 4.5x earnings. Following the CEO’s comments on doing “whatever it takes” to delever itself, they have agreed to disposing their media and data center businesses and is evaluating how to use those proceeds. The group’s debt pile amounts to over $60bn, and Altice France, including the carrier SFR, has €24.3bn in overall debt with €1.8bn due in 2025. Altice France last week signed an agreement to sell Altice Media and news channel BFM TV for €1.55bn.

Altice’s 5.5% 2028s fell 8.9 points to 75.6, yielding 14%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Altice’s Bonds Rally on Asset Sale Plans

September 8, 2023

ONGC to Raise $525mn To Redeem Bonds Next Month

June 16, 2021