This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

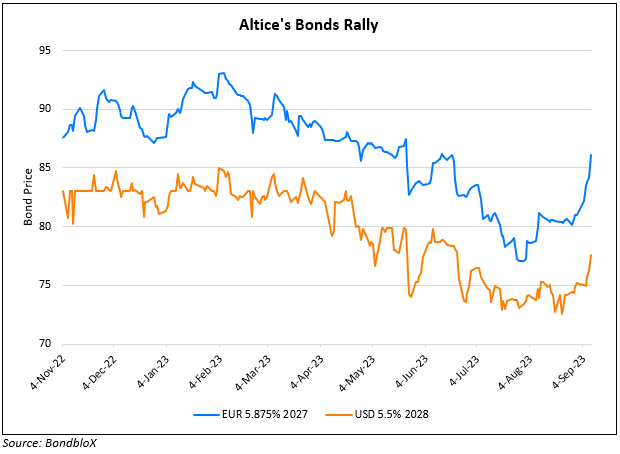

Altice’s Bonds Rally on Asset Sale Plans

September 8, 2023

Cable and telecoms company Altice Group’s bonds rallied across the curve after reports that the company was planning asset sales in order to cut debt. The planned sale involves a part of the capital of Altice France, as well as options for Portugal Telecom and its ad-tech company Teads, as per Le Monde newspaper. The group was also said to plan selling its data centres in France to Morgan Stanley Infrastructure Partners for €1bn. Reuters notes that Altice has a combined debt of $60bn across three separate entities, that will have to be refinanced and may require an extension of its maturities.

For more details, click here

Go back to Latest bond Market News

Related Posts: