This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

All Eyes on The FOMC Meeting; Asia ex-Japan CDS Spreads Tighten to February Levels

July 26, 2023

.png)

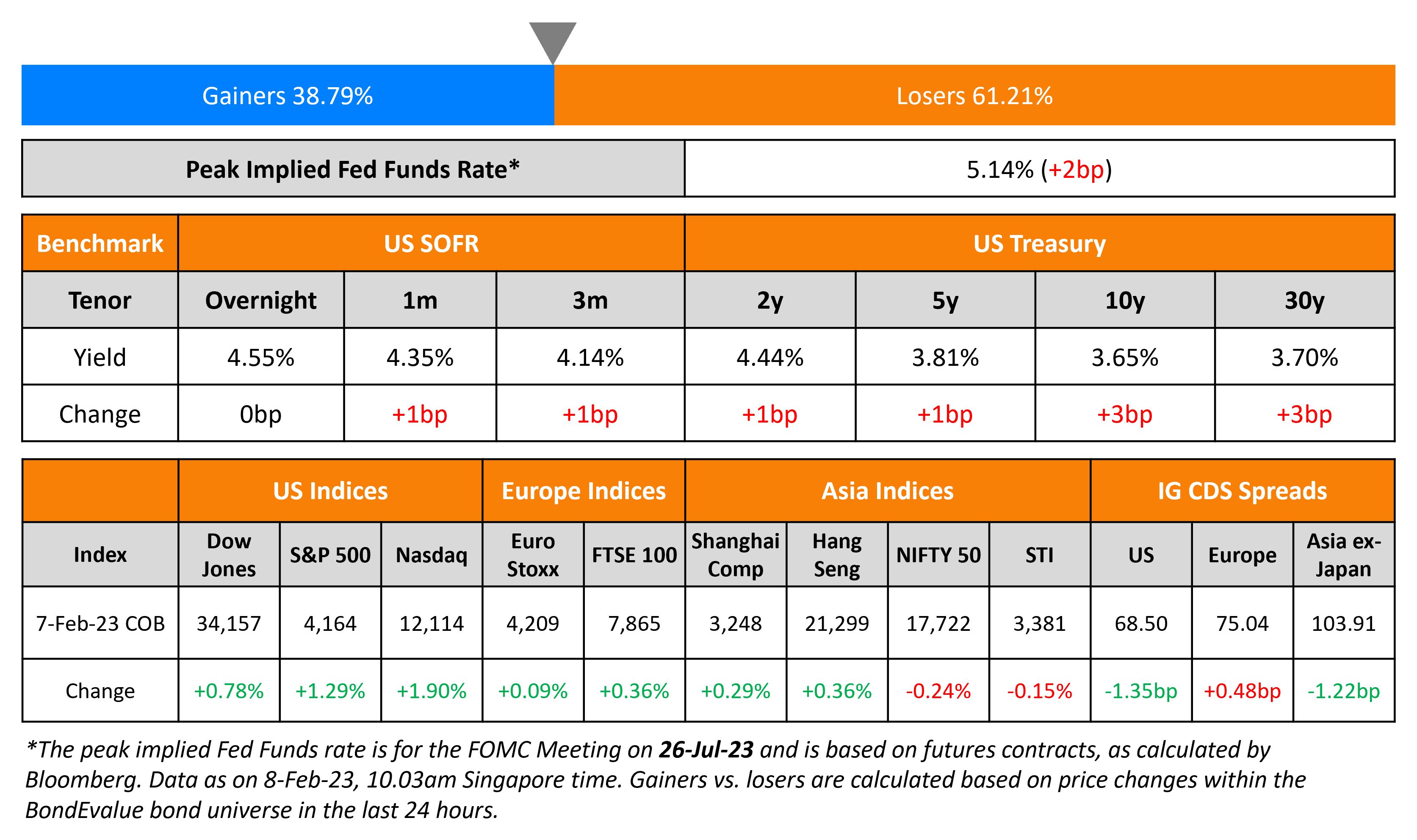

US consumer confidence index hit a 2-year high at 117, rising from 110.1 last month and higher than forecasts of 111.8. Analysts note that the number bolsters the case for a ‘soft landing’ narrative over time if anything, for the US economy. The peak Fed Funds rate moved 3bp higher to 5.45%. Treasury yields were higher by 3-5bp across the curve on Tuesday. The focus now shifts to the Fed’s guidance on the future path of rates, beyond the 25bp hike all but certain today. US IG credit spreads tightened 0.1bp while HY CDS spreads were wider by 1.7bp. The S&P rose 0.3% and Nasdaq closed higher by 0.6%.

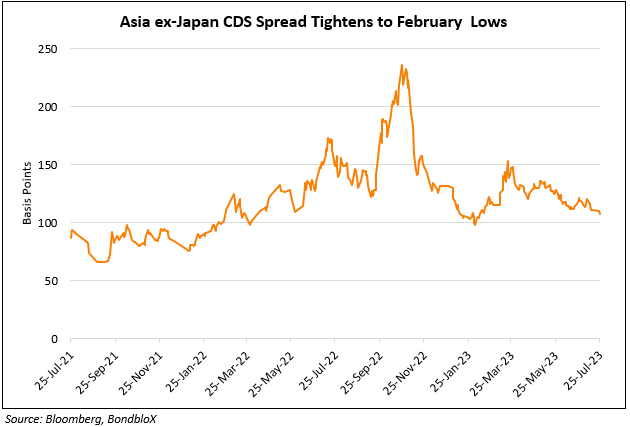

European equity indices were near flat. European main CDS spreads were wider by 0.1bp and Crossover CDS widened 2.5bp. Asia ex-Japan CDS spreads tightened sharply by 4bp to its lowest level since February, helped by the Chinese Politburo’s stance to ease conditions to support the nation’s recovery path and help the property sector. Asian equity markets have opened lower this morning.

.png)

New Bond Issues

- Hangzhou Qiantang $ 3Y at 6.7% area

Shangri-La Hotel raised S$160mn via a 5Y bond at a yield of 4.4%. The senior unsecured bonds are unrated but are guaranteed by its parent company, Shangri-La Asia. It received orders over S$235mn, 1.5x issue size. Banks and fund managers bought 76% and private banks took 24%. Singapore accounted for 99% and others 1%. Proceeds will be used for general corporate purposes. The new bonds are priced 24bp tighter to its existing 4.1% 2027s that yield 4.64%. This marks the issuer’s return to the SGD-denominated bond market since 2021.

Embraer raised $750mn via a 7Y bond at a yield of 7.125%, from an initial guidance at the mid 7% area. The senior unsecured bonds have expected ratings of BB+/BB+ (S&P/Fitch). The newly issued notes have a make-whole call. Embraer’s new notes priced 71.5bp tighter vs. lower-rated Bombardier’s 7.5% 2029s (B2/B by Moody’s/S&P), currently yielding 7.84%. Proceeds will be used to finance a tender offer for their existing bonds, as well as for general corporate purposes. The tender offer is for its outstanding 2028s, 2025s and 2027s, up to a maximum of $500mn, in this order of priority. Bondholders who tender the notes before 7 August 2023 (Early Tender Date) will receive an early consent fee of $30 per $1,000 in principal. The tender offer considerations for the 2028s, 2025s and 2027s are $985, $960 and $956.25 per $1,000 in principal, respectively. The 2025s and 2027s are currently trading at 98-99 while the 2028s are at 101 cents on the dollar.

Rating Actions

- Guacolda Energia S.A. Downgraded To ‘CC’ From ‘CCC+’ On Tender And Exchange Offer Announcement, Outlook Still Negative

Term of the Day

Soft Landing

A soft landing refers to a slowdown in the economy, whereby it stops growing but does not lead to a recession. Thus, for example in a soft landing, the central bank would raise interest rates just enough to prevent an economy from overheating and experiencing high inflation, whilst also not triggering a stark increase in unemployment and a recession that would lead to a hard landing. Many market participants expect the rate hikes by the Fed and the economic trajectory to lead to a ‘soft landing’ this year or early next year.

Talking Heads

On Further Fed Rate Decisions Beyond July

Veronica Clark, economist at Citigroup

“They will be leaving all options open…They will certainly stay cautious after only a couple of months of softer inflation data which is not enough for them to be convinced the job is done.”

Vincent Reinhart, chief economist at Dreyfus and Mellon

“The question after the meeting is, do they go again…You listen at (the July FOMC) meeting to see how much Powell at the press conference embraces the Summary of Economic Projections or puts some distance in.”

On the Possibility of a Deep US Recession – DoubleLine Capital CIO Jeffrey Sherman

“A multitude of economic indicators we look at are flashing either warning or recessionary signals…By the time they cut, it will be 100 basis points…The bond market is telling the Fed that they’ve overtightened and they will have to cut rates…But the Fed will be a little late to cut, maybe in an emergency meeting. But the idea that the Fed is going to cut 25 or 50 basis points and that’s going to solve everything isn’t going to be the case.”

On an Expected Rise in Global Bond Issuances

Fabianna Del Canto, co-head of capital markets for EMEA at Mitsubishi UFJ Financial Group

“With interest rates at or near peaks, we expect markets to take confidence with more certainty around the rate cycle…This confidence provides a more certain backdrop for issuance into September.”

Blair Shwedo, head of IG trading at US Bancorp

“The issuance window for the second half of the year should be pretty well supported if market conditions stay how they have been in the last month or two.”

Giulio Baratta, head of IG finance debt capital markets for EMEA at BNP Paribas

“Issuance in September will be sustained by market technicals after the quieter summer weeks of lower supply…After that we will see whether monetary policy tightening is done and that will decide the rest of the year.”

On the Attractiveness of El Salvador’s Bonds – investment analyst at Converium Capital Nadir Cura

“El Salvador still offers attractive value when compared to other stressed EM sovereigns, many of which are struggling with substantially larger fiscal deficits and external funding gaps.”

On the Value of Chinese Government Bonds

Akira Takei, team lead for global fixed income at Asset Management One

“Never in my entire career (have I invested in China bonds due to the nation’s property woes, capital controls and heightened geopolitical tensions with the West)…If we invest in Chinese government bonds, there is a chance that we cannot get back that money…It’s very hard to envisage where the robust economy is coming from in China, especially in relation to debt.”

Tatsuya Higuchi, executive chief fund manager at Mistubishi UFJ Kokusai Asset Management

“The slowdown of the economy is much faster than the other countries in the world, so there is a return with investing in CGBs…We couldn’t find any market with more than 2%” yields and a steeper yield curve…Chinese government bonds, overall, are very good to invest in because their yields might go down further…(it is) much easier to have duration risk in the Chinese bond market.”

Hideo Shimomura, senior portfolio manager at Fivestar Asset Management

“I don’t think we would want to enter now due to factors ranging from regulatory issues surrounding their bond market, a not-completely-free market overall…I do not hold a bullish view on China nor do I plan to invest for now.”

Top Gainers & Losers – 26-July-23*

Go back to Latest bond Market News

Related Posts: