This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Alibaba Launches $ Bond; SBI, Indonesia, MS Price $ Bonds

November 19, 2024

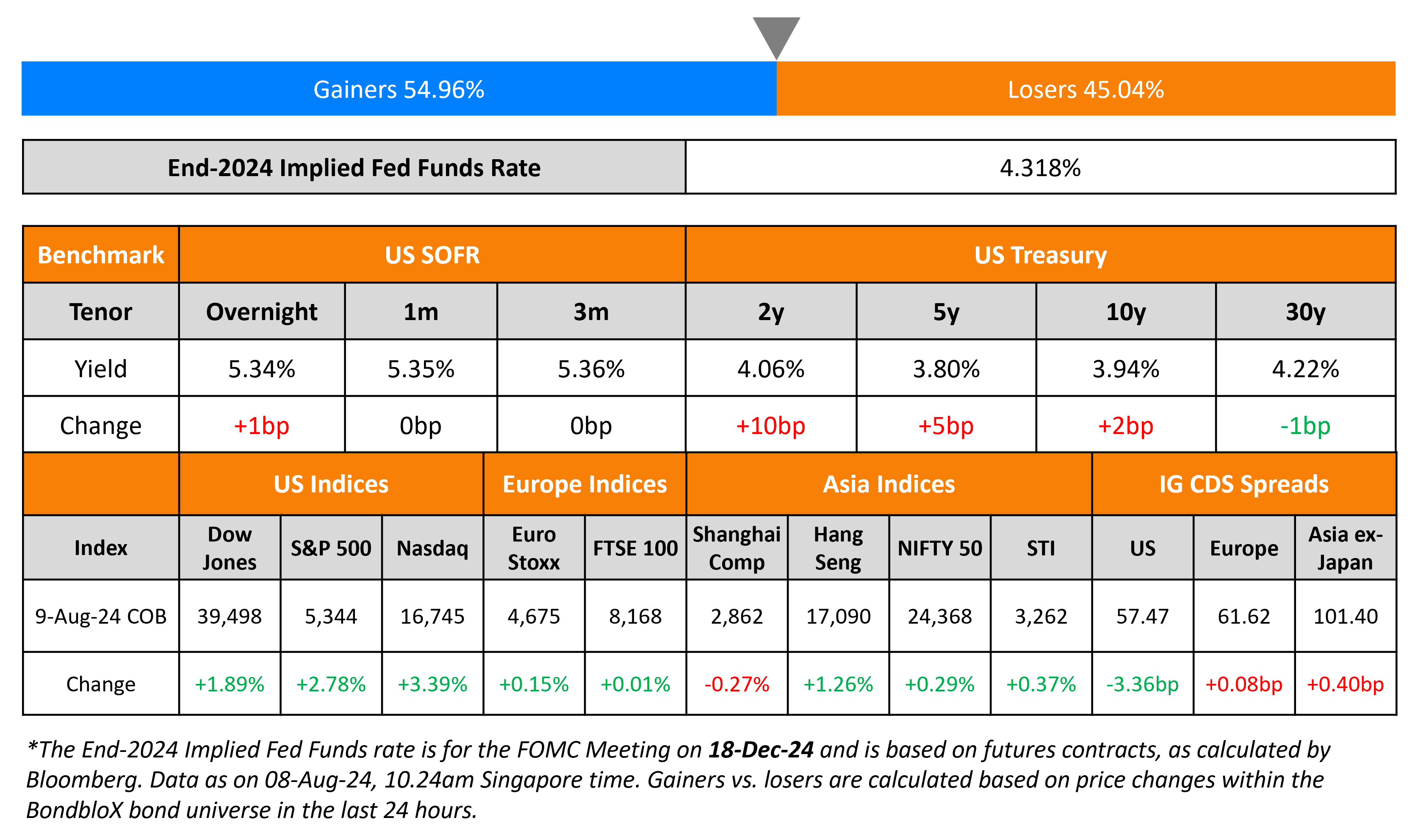

US Treasuries inched higher across the board, with yield having fallen by about 3bp. Yields on the long-end, particularly the 30Y tenor saw its highest level since late-May this year, reaching 4.61% briefly yesterday. There were no major data points out of the US yesterday. US IG and HY CDS spreads tightened by 0.3bp and 2.4bp respectively.

Looking at US equity markets, S&P and Nasdaq closed higher by 0.4% and 0.6% respectively. European equities closed mixed. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.5bp and 4.2bp respectively. Asian equities opened broadly mixed this morning. Asia ex-Japan CDS spreads widened by 0.4bp.

New Bond Issues

- Alibaba $ 5.5Y/10.5Y/30Y at T+90/115/130bp area

State Bank of India raised $500mn via a 5Y bond at a yield of 5.129%, 23bp inside initial guidance of T+115bp area. The senior unsecured bonds are rated Baa3/BBB- (Moody’s/Fitch). The bonds have a change of control (CoC) put at 101. A CoC would occur if the aggregate of direct and indirect India government shareholding falls below 51%. Proceeds will be used for general corporate purposes and to meet funding requirement of SBI’s foreign offices/branches.

Indonesia raised $2.75bn via a three-part deal. It raised:

- $1.1bn via a 5.5Y bond at a yield of 5.00%, 30bp inside initial guidance of 5.30% area. The new bonds were priced roughly in-line with its existing 2.85% 2030s that yield 4.98%.

- $900mn via a 10Y bond at a yield of 5.25%, 25bp inside initial guidance of 5.50% area. The new bonds were priced at a new issue premium of 8bp over its existing 4.7% 2034s that yield 5.17%.

- $750mn via a 30Y at a yield of 5.65%, 20bp inside initial guidance of 5.85% area. The new bonds were priced at a new issue premium of 16bp over its existing 5.15% 2054s that yield 5.49%.

The bonds are rated Baa2/BBB/BBB. Net proceeds will be used to meet part of its general financing requirements.

Morgan Stanley raised $3bn via a 31NC30 bond at a yield of 5.516%, 22bp inside initial guidance of T+115bp area. The senior unsecured notes are rated A1/A-/A+. Proceeds will be used for general corporate purposes.

Sabadell raised €500mn via a 6.5NC5.5 green bond at a yield of 3.518% 30bp inside initial guidance of MS+155bp area. The senior non-preferred notes are rated BBB-/BBB, and received orders of over €1.55bn, 3.1x issue size.

New Bond Pipeline

-

NAB hires for $ 3Y/3Y FRN bond

-

Republic of Turkiye hires for $ 5Y Sukuk bond

-

Emirates NBD hires for $ 5Y bond

-

Adani Renewable Units hires for $ 20Y bond

-

Tata Capital hires for $ bond

Rating Changes

-

Fitch Upgrades Swiss Re to IFS ‘AA-‘; Outlook Stable

-

Moody’s Ratings upgrades Mongolia’s rating to B2; outlook stable

-

TUI Cruises Upgraded To ‘BB-‘ On Stronger Earnings And Deleveraging; Outlook Stable; Proposed Notes Rated ‘B+’

-

Fitch Upgrades TUI Cruises to ‘BB-‘/Stable; Rates Proposed Notes ‘B+(EXP)’

-

Moody’s Ratings upgrades TUI Cruises’ CFR to Ba3 from B1, outlook stable

-

Xerox Holdings Corp. Downgraded To ‘B+’ From ‘BB-‘ On Transformation Plan Execution Challenges; Outlook Negative

-

Spirit Airlines Inc. Downgraded To ‘D’ On Chapter 11 Bankruptcy Filing; EETC Ratings Lowered

-

iHeartCommunications Inc. Rating Lowered To ‘CC’ From ‘CCC+’ On Announced Debt Restructuring; Outlook Negative

Term of the Day

Senior Non-Preferred (SNP) Bond

Senior non-preferred (SNP) notes are type of debt security that banks issue as part of their Tier 3 capital. These bonds have an inherent bail-in feature where in the case of bankruptcy, creditors holding these notes may be subject to conversion into shares. In a liquidation scenario, SNP bonds are ranked higher than Subordinated Bonds. However, they rank inferior to Senior Preferred Bonds or Senior Unsecured Bonds.

Talking Heads

On Buyers Flocking to Bonds After 30-Year Yield Hit Highest Since May

Ed Al-Hussainy, a strategist at Columbia Threadneedle

“The starting point in yields is so elevated that it just gives you much bigger cushion to be wrong”

Michael Contopoulos, Richard Bernstein

“There is a general acknowledgment that growth is strong, inflation is not completely slain, that budget deficits likely widen and that there is little reason for the long end to go down”

On Nomura expecting Fed to pause rate-cut cycle in December

“We currently expect tariffs will drive realized inflation higher by the summer, and risks are skewed towards an earlier and more prolonged pause”… Fed no longer expected to cut interest rates at its December policy meeting… expects Fed to deliver only two 25bp rate cuts at its March and June meetings in 2025.

On ‘Go for Gold’ as Central Banks Buy, Fed Cuts in ‘25 – Goldman Sachs

“Go for gold”… target of $3,000 an ounce by December 2025… higher demand from central banks, while a cyclical lift would come from flows to exchange-traded funds as the Federal Reserve cuts… Trump administration may also aid bullion

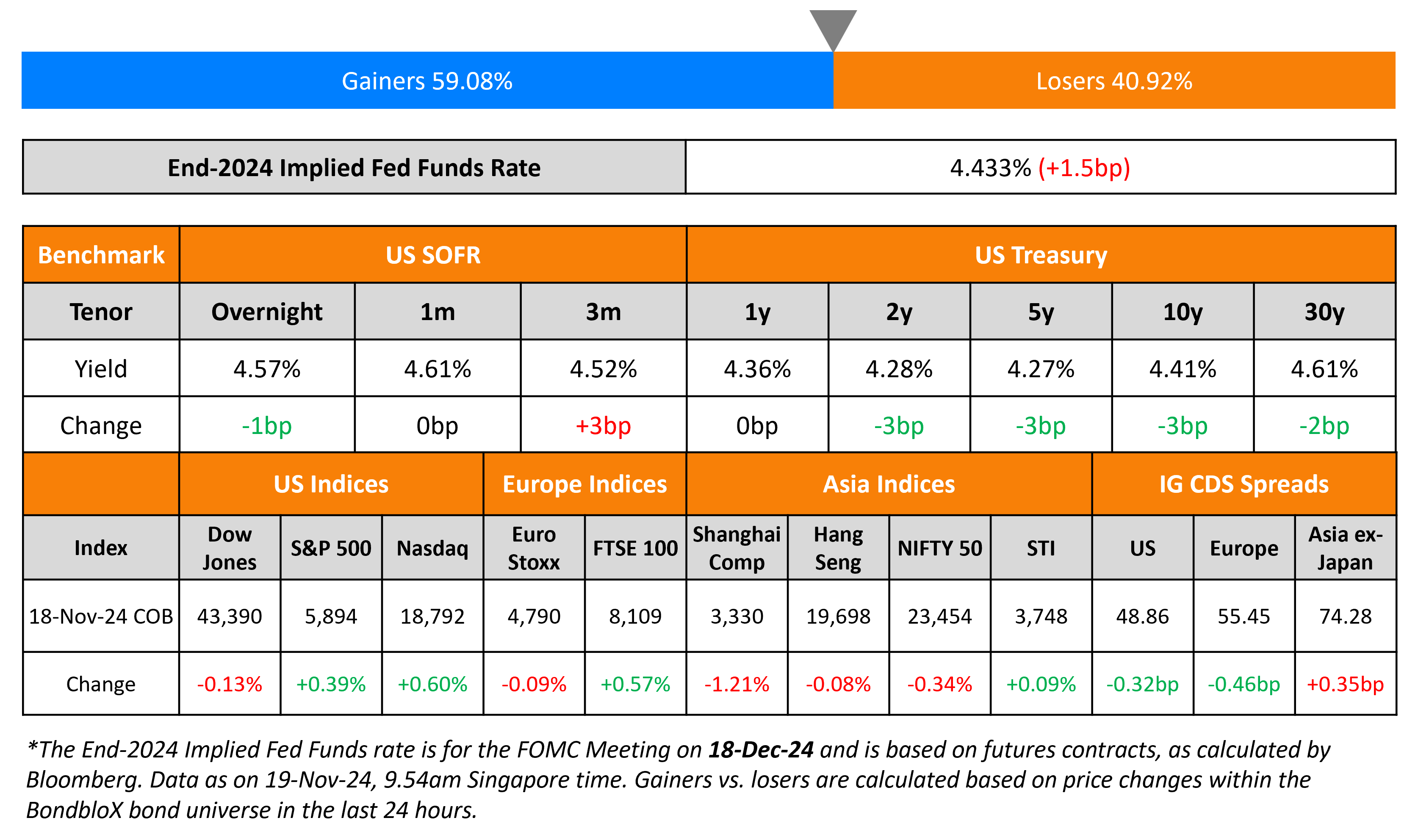

Top Gainers and Losers- 19-November-24*

Go back to Latest bond Market News

Related Posts: