This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

African HY Sovereigns Deliver Impressive Total Returns

October 16, 2025

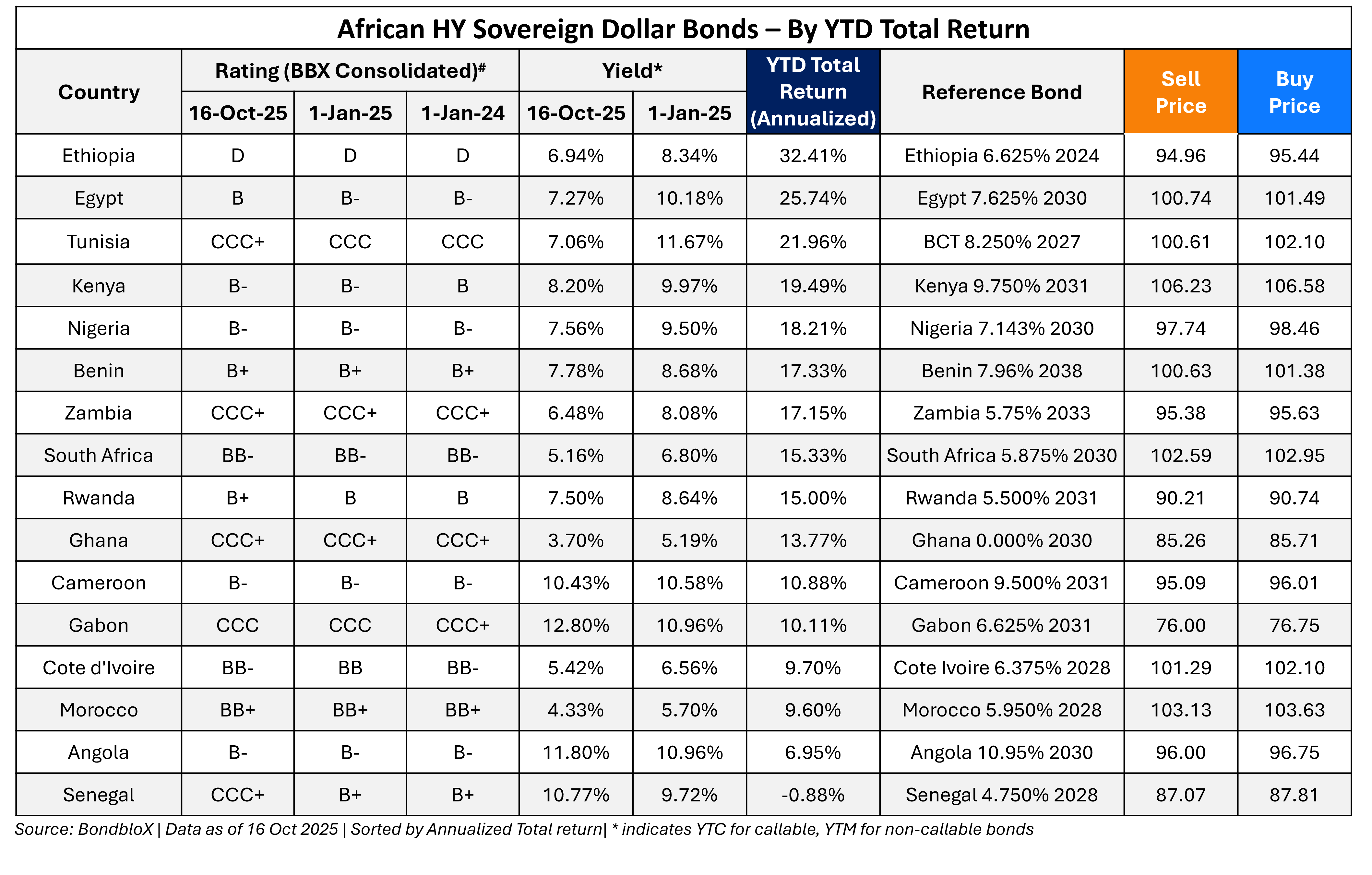

Emerging Market (EM) sovereign bonds have shown a strong performance in 2025, underpinned by easing global monetary policy, attractive carry, moderating inflation, and improved investor sentiment. Performance has differed across regions: the iBoxx LSF USD African Sovereigns recorded a YTD total return of 13.3% as of 16 October, outperforming both the Bloomberg EM Asia TRI Index (7.66%) and the Bloomberg EM LATAM TRI Index (9.64%).

Within Africa, hard-currency sovereign bonds have delivered double-digit returns, supported by improved liquidity conditions and robust investor demand, creating a favorable environment for Eurobond issuance. One of the region’s top performers has been Egypt – its dollar bonds have delivered an annualized total return YTD of over 25%. Egypt was just recently upgraded to B from B- by S&P on the back of stronger foreign reserves and solid GDP growth. The year also saw several African issuers returning to the international bond markets after extended periods. Angola, for example, recently raised $1bn via a 5Y bond at a yield of 9.25%, its first issuance since 2022. In addition, the region witnessed a surge in Sukuk issuances, highlighting growing diversification in sovereign funding sources. The table below lists all African high yield sovereigns with dollar bonds outstanding – sorted by their annualized total return (YTD).

# BBX Consolidated Rating Methodology:

- If ratings are unavailable from all rating agencies -> Unrated

- If ratings are only available from one rating agency -> Assign that rating.

- If ratings are available from two rating agencies -> Assign the lower of the two ratings

- If ratings are available from three rating agencies, of which two ratings are the same -> Assign the rating which is the same as the two same ratings.

- If ratings are available from three rating agencies, of which all three ratings are different -> Assign the middle rating

Go back to Latest bond Market News

Related Posts:

S&P Gives Positive Outlook on Kenya and Nigeria

July 12, 2023

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024