This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Adani Renewables Relaunches $ Bond

November 20, 2024

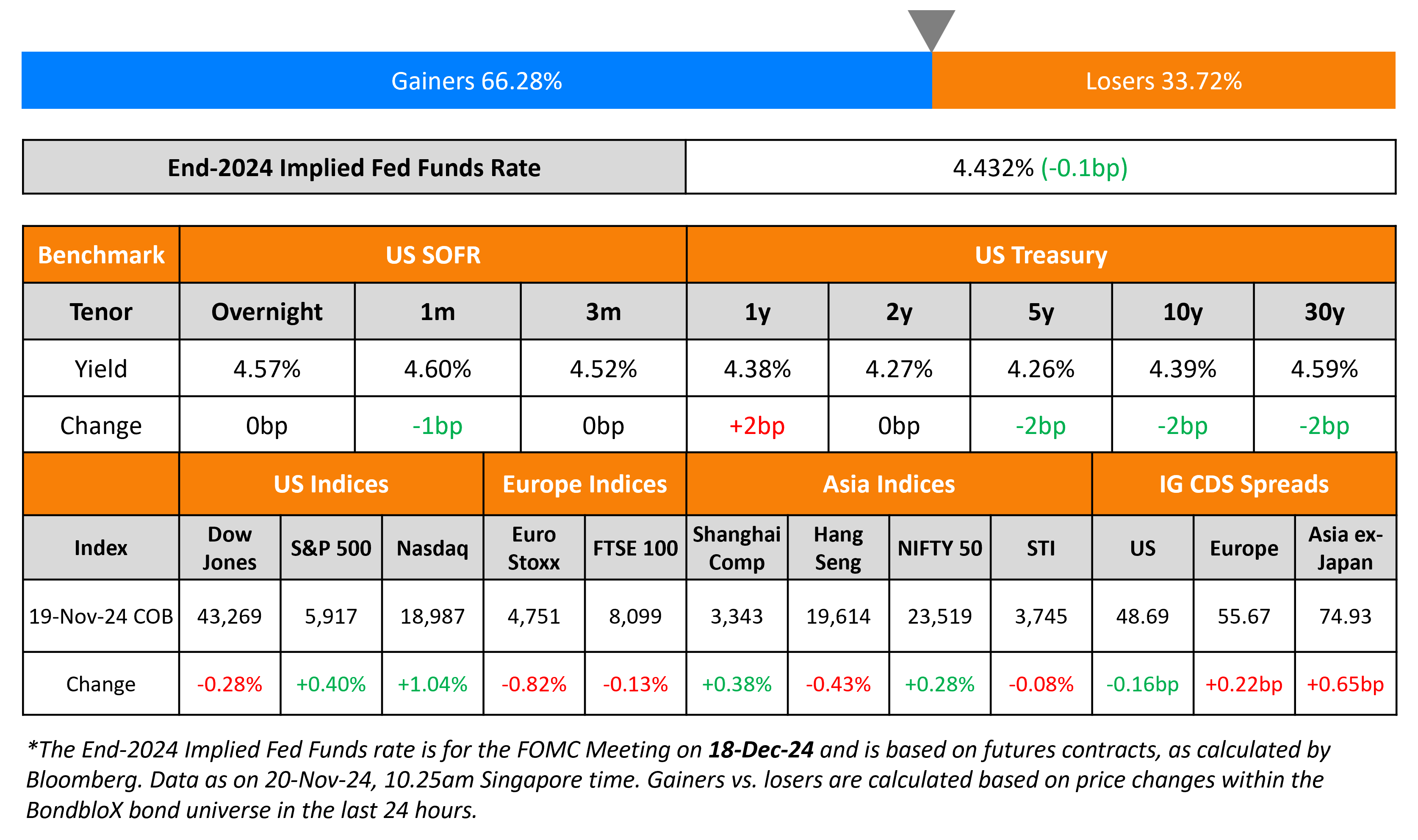

US Treasury yields fell by 8bp upon a risk-off move earlier yesterday, post which they broadly recovered and closed ~2bp lower. The risk-off sentiment came on the back of demand for haven assets following the escalation in the Russia-Ukraine conflict, where Ukraine launched an airstrike on Russia using Western-supplied missiles. Post this, Russian President Vladimir Putin approved a nuclear doctrine that allowed it to fire back in response to attacks on its soil. Other haven investments like gold also rallied following this escalation.

US IG and HY CDS spreads tightened by 0.2bp and 2bp respectively. Looking at US equity markets, S&P and Nasdaq closed higher by 0.4% and 1% respectively. European equities on the other hand closed lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads widened by 0.2bp and 1.1bp respectively. Asian equities opened broadly mixed this morning. Asia ex-Japan CDS spreads widened by 0.7bp.

New Bond Issues

-

Housing and Development Board S$ 7Y at 3.092% area

-

Adani Renewable Units $ 20Y Green at 7.75% area

The Republic of Turkiye raised $2.5bn via a long 5Y sukuk at a yield of 6.55%, 32.5bp inside initial guidance of 6.875% area. The bonds are unrated and received orders of over $3.5bn, 1.4x issue size. Hazine Mustesarligi Varlik Kiralama is the issuer. The new bonds were priced 8bp wider to its existing 5.25% 2030s that yield 6.47%.

Lloyds raised $3bn via a three-part deal. It raised:

- $1.25bn via a 4NC3 bond at a yield of 5.087%, 25bp inside initial guidance of T+110bp area. The new bonds were priced inline with its existing 5.871% 2030s (callable in March 2028) that yield 5.08%.

- $750mn via a 4NC3 FRN at SOFR+106bp vs. initial guidance of SOFR equivalent area.

- $1bn via a 11NC10 bond at a yield of 5.59%, 25bp inside initial guidance of T+145bp area

The senior unsecured notes are rated A3/BBB+/A. Proceeds will be used for general corporate purposes.

NAB raised $1.75bn via a two-part deal. It raised $1bn via a 3Y bond at a yield of 4.609%, 22bp inside initial guidance of T+60bp area. It also raised $750mn via a 3Y FRN at SOFR+60bp vs. initial guidance of SOFR equivalent area. The senior bank notes are rated Aa2/AA-. Proceeds will be used for general corporate purposes.

Alibaba raised $2.65bn via a three-part deal. It raised:

- $1bn via a 5.5Y bond at a yield of 4.909%, 25bp inside initial guidance of T+90bp area.

- $1.15bn via a 10.5Y bond at a yield of 5.294%, 25bp inside initial guidance of T+115bp area. The new bonds were priced ~6bp wider to its existing 4.5% 2034s that yield 5.23%.

- $500mn via a 30Y bond at a yield of 5.645%, 25bp inside initial guidance of T+130bp area

The senior unsecured notes are rated A1/A+/A+. The notes have a put option at 101 upon the occurrence of a triggering event. Proceeds will be used for general corporate purposes including repayment of offshore debt and share repurchases.

Emirates NBD raised $500mn via a 5Y sustainability-linked bond at a yield of 5.141%, 35bp inside initial guidance of T+125bp area. The senior unsecured bonds are rated A2/A+ (Moody’s/Fitch). Net proceeds will be used to finance/refinance a portfolio of general corporate purpose sustainability-linked loans in accordance with its framework.

Term of the Day: Risk-Off

Risk-off is an indication of global market sentiment wherein investors switch out from risky assets (i.e. risk-off) into safer assets on the back of increased uncertainty. This can be due to geopolitical risk, poor economic data or a crisis. Most typically, during a risk-off environment, US Treasuries and gold tend to perform better as they are considered safe haven assets. On the other hand, risk-on indicates positive investor sentiment wherein investors switch into risky assets (i.e. risk-on) from safer assets on improved prospects of economic growth. This can be due to improved political environment, strong economic data, strong corporate earnings, or a recovery from a crisis.

Talking Heads

On Fed Rate Cuts to Spur $2tn Money-Fund Exit – Torsten Slok, Apollo Global

“Where will the $2tn added to money market accounts go now that the Fed is cutting… most likely scenario is that money will leave money market accounts and flow into higher-yielding assets such as credit, including investment grade private credit”

On Powell’s Wait-and-See on Trump Policies Is a Switch From 2016

Randall Kroszner, University of Chicago’s Booth School of Business

“The job’s not quite done (on inflation)… They are going to be on a shallower path”

Former Fed Governor Laurence Meyer

“They should be running alternative simulations. They shouldn’t be basing their policy on something where they don’t know what is going to happen.”

Sarah Binder, Brookings

“The patterns we have here for unified Republican control has not been a model of restraint… could see why central bankers might want to duck out of the wind and get a better sense of what’s coming”

On ECB Must Move to Neutral Rates to Aid Growth

ECB GC member, Fabio Panetta

“Restrictive monetary conditions are no longer necessary. We need to normalize our monetary-policy stance and move to neutral – or even expansionary territory, if necessary”

Estonia, central bank Governor Madis Muller

“I wouldn’t ever want to say anything is a done deal… analysis, discussion and fresh forecast still lie ahead. But I think it is likely that we can again reduce interest rates in December”

Top Gainers and Losers- 20-November-24*

Go back to Latest bond Market News

Related Posts:

1, 2, 3, 4th Fed Hike!

June 14, 2017

Unifin Downgraded to BB- by Fitch

April 7, 2022