This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

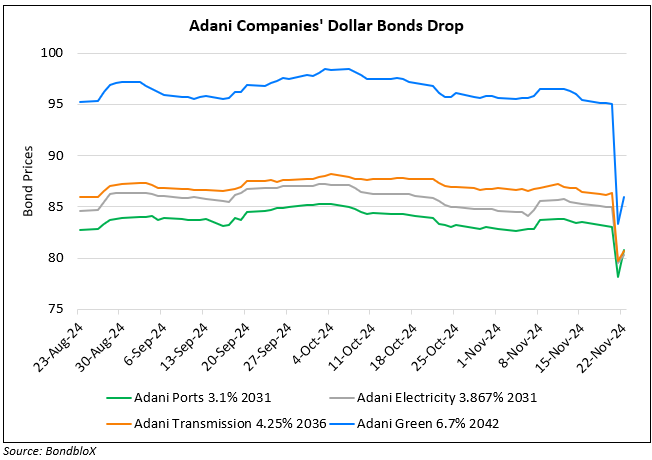

Adani Dollar Bonds Drop Sharply; Kenya Cancels 2 Deals Involving the Company

November 22, 2024

Adani companies’ dollar bonds dropped sharply yesterday across the curve after an indictment was announced against a number of senior executives by the US Attorney’s Office, Eastern District of New York. Adani Group rejected the charges made by US prosecutors stating that they were “baseless”, adding that have always upheld and stayed “committed to maintaining the highest standards of governance, transparency and regulatory compliance across all jurisdictions” of its operations.

Separately, Kenyan President William Ruto announced the cancellation of two major deals involving the Adani Group, following the indictment. The first deal, valued at nearly $2bn, involved the Adani Group upgrading Jomo Kenyatta International Airport by adding a second runway and improving the terminal in exchange for a 30Y lease. The second deal that was called-off pertained to a $736mn public-private partnership for power transmission lines. The airport deal had drawn controversy due to its bypass of competitive bidding and was temporarily blocked by a Kenyan court. While some government officials defended the agreements, they were ultimately rescinded. Legal experts suggest the Adani Group may challenge the cancellations through arbitration, though the integrity concerns could favor the state in any dispute.

Go back to Latest bond Market News

Related Posts: