This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

China Cinda HK Launches $ Bond

May 20, 2024

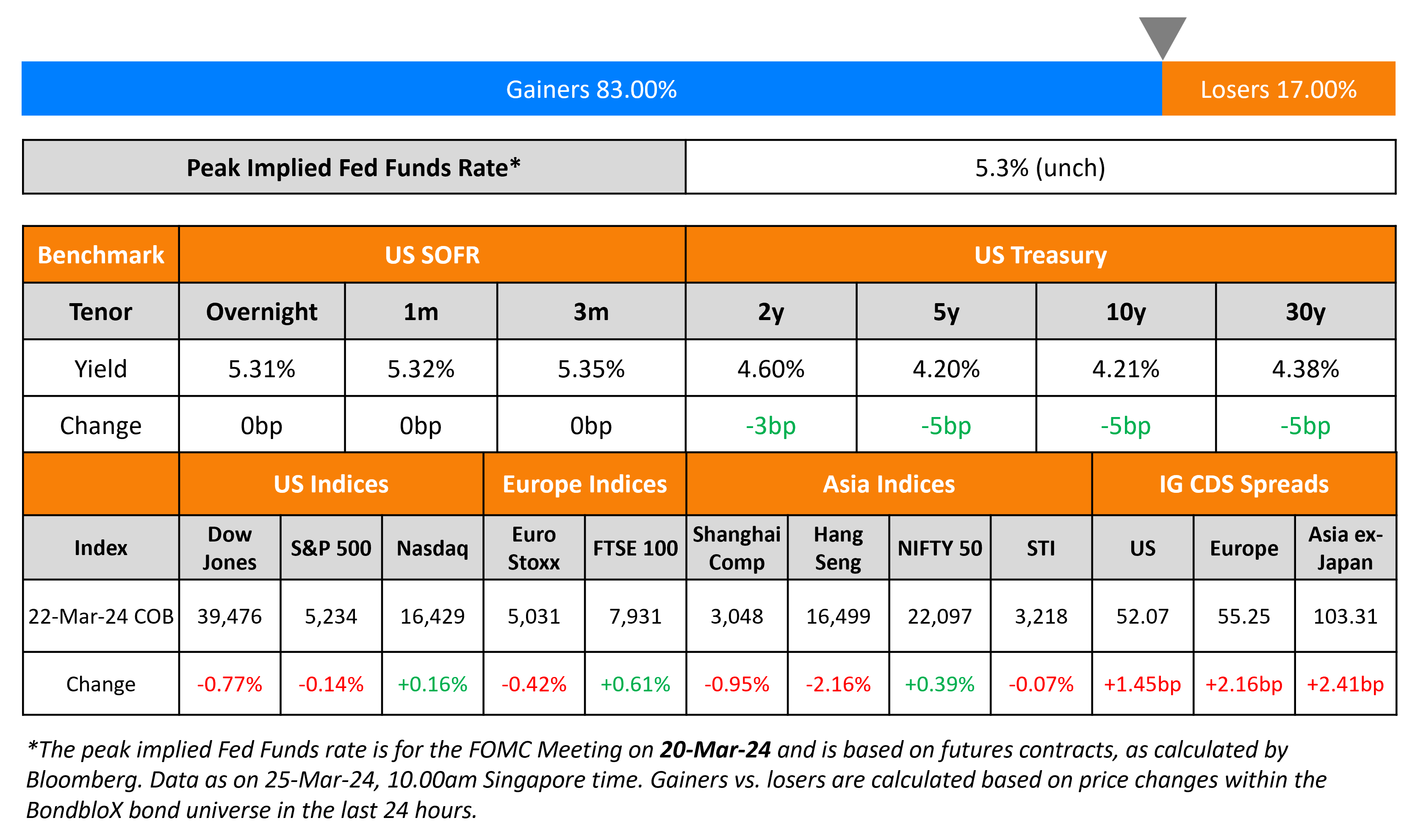

US Treasury yields ticked higher by 4-6bp on Friday. The Leading Index fell by 0.4%, worse than expectations of a 0.3% drop. S&P ended 0.1% higher while Nasdaq was 0.1% lower on Friday. US IG CDS spreads tightened 0.5bp and HY spreads were 3bp tighter.

European equity markets ended lower. Europe’s iTraxx main CDS spreads were 0.2bp wider while crossover spreads were 0.2bp tighter. Asian equity indices have opened higher this morning. Asia ex-Japan CDS spreads were 1.1bp tighter.

New Bond Issues

-

China Cinda HK Holdings $ 5Y at T+175bp area

Rating Changes

- Fitch Downgrades Petrofac and Debt to ‘C’ on Missed Interest Payment

- Moody’s Ratings downgrades Fibra UNO’s senior unsecured rating to Baa3; stable outlook

- Petrofac Ltd. Downgraded To ‘SD’ On Missed Coupon Payment

- Moody’s Ratings downgrades CSC Holdings’ CFR to Caa2 from B3, outlook negative

New Bonds Pipeline

- Uzbekistan hires for $ 7Y bond

- Amcor hires for $ 5Y bond

Term of the Day

Covered Bonds

Covered bonds are senior secured debt instruments that are typically issued by banks. These bonds are secured (i.e. covered) by a pool of assets referred to as the “cover pool”, which typically consists of mortgages or loans. In an event that the bank defaults, holders of covered bonds have a preferential claim to the cover pool, which ensures interest payments and repayment of principal. This makes covered bonds relatively more secure vs. other debt and therefore results in a higher credit rating. While they have similarities with Mortgage-Backed Securities (MBS) in terms of the pool of assets there is a difference – the transfer of mortgages to an Special Purpose Entity (SPE) in a MBS issue means that the issuing bank no longer bears the risk of the loans and the mortgage pool is static. This is in contrast to Covered Bonds where, because the mortgage pool is constantly adjusted to maintain the pool size, the issuing bank bears the credit risk of the mortgages.

Talking Heads

On Big Funds That Bet the ‘Anything But Bonds’ Trade Is Poised to End

Gershon Distenfeld at AllianceBernstein

“History shows pretty consistently that yields rally hard starting three to four months before the Fed actually starts cutting”

Luca Bottiglione, head of European credit research at Zurich Insurance

“Companies are taking advantage of the low prevailing credit spreads in the market and locking in that risk premium “

On Open to Possibilities After ‘Reasonable’ June Cut – ECB’s Vasle

“Unless we’ll get a big surprise, June is a reasonable, realistic moment to cut interest rates, but I can’t say what will happen after that… I’m really attentive to what’s happening in the US”

On Fed’s Higher-for-Longer Rates U-Turn Is at Odds With Market – El-Erian

“The Fed pivoted on the basis of data. It was the opposite of the pivot that they did in December — now they have to do a U-turn… Fed is going to have to pivot — not on the basis of inflation numbers, but the basis of the real economy”

Top Gainers & Losers- 20-May-24*

Go back to Latest bond Market News

Related Posts:

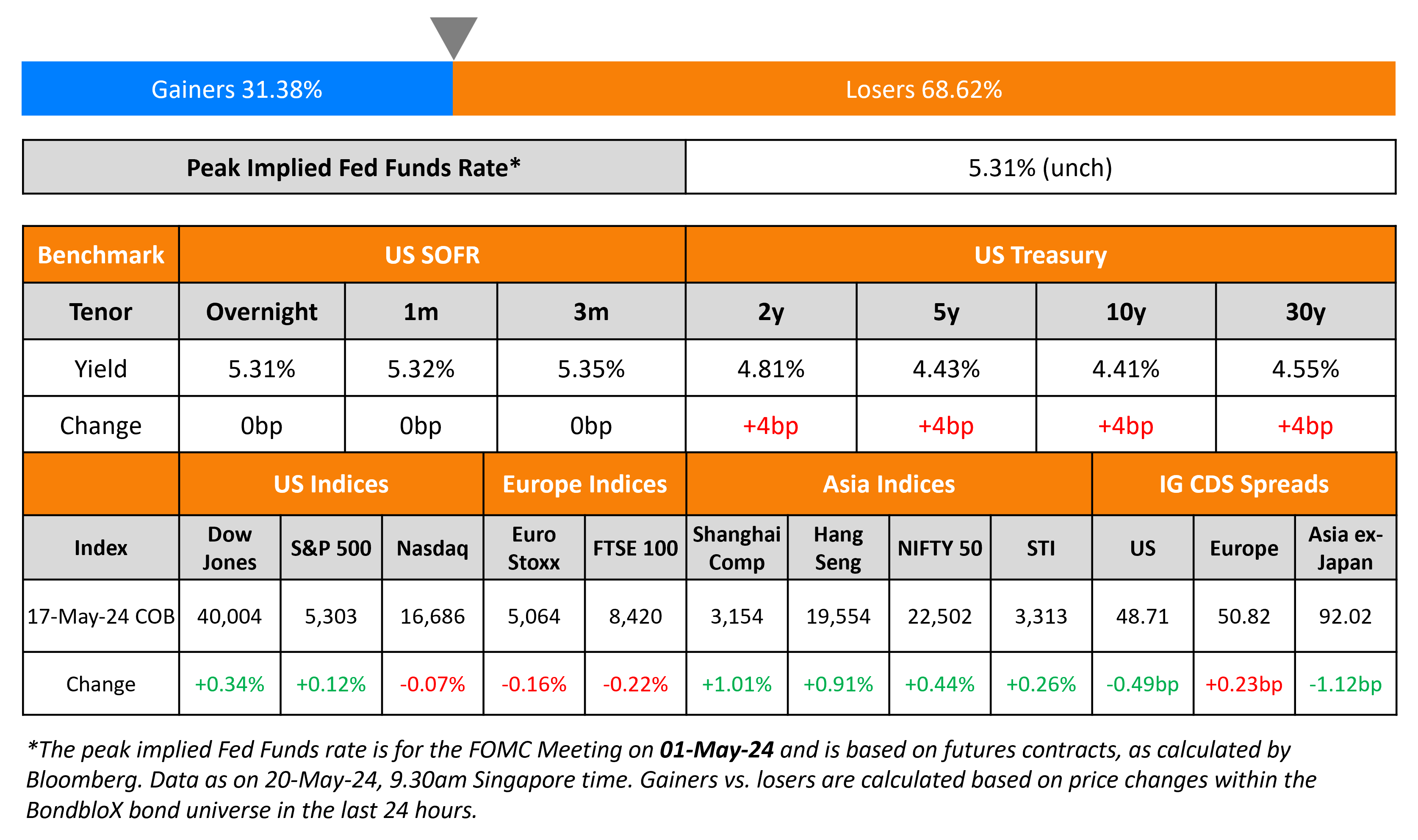

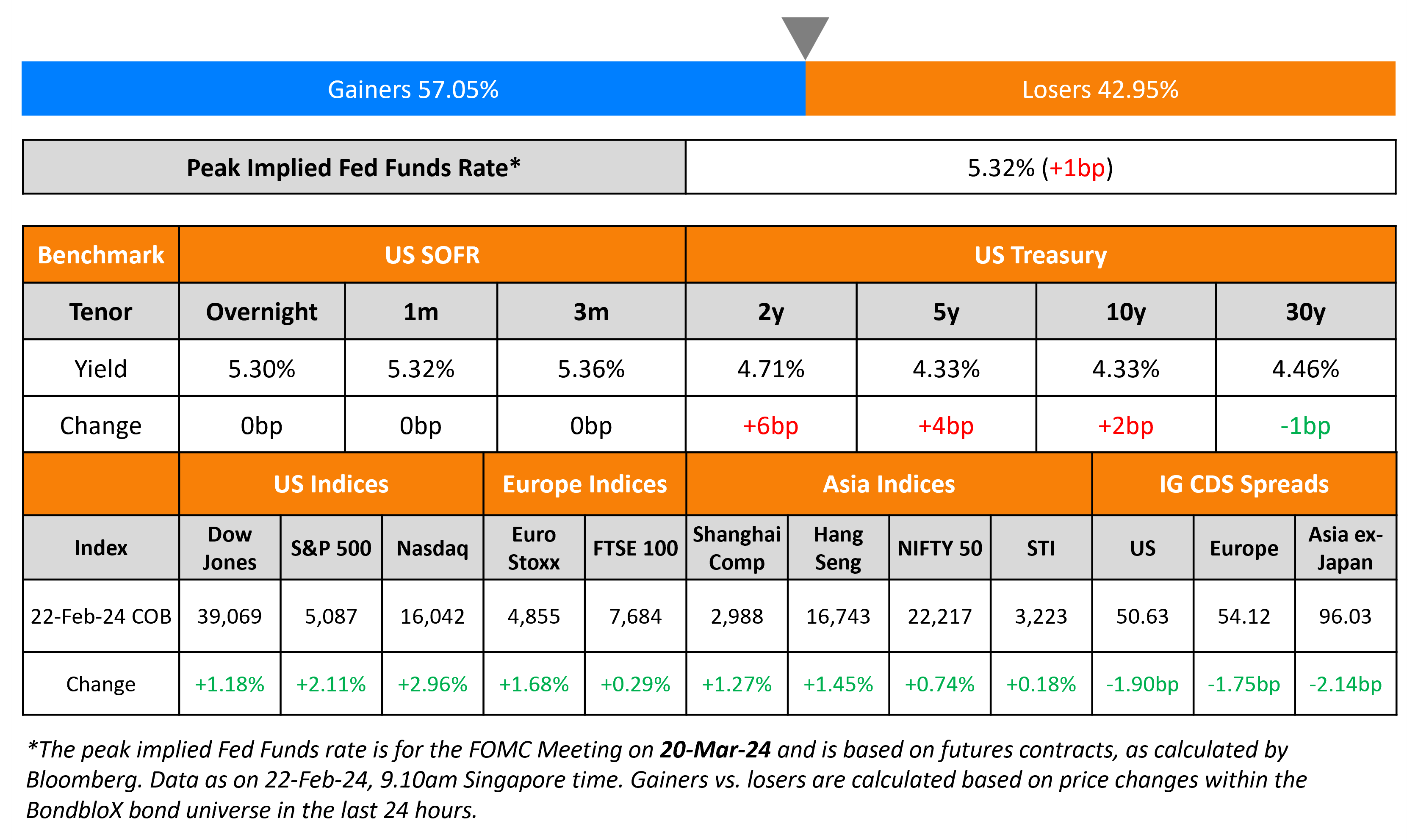

Garanti, Royal Caribbean Price $ Bonds

February 23, 2024