This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Zhangzhou Yuanshan Launches $ Bond; CIMB Upgraded to AA; Road King Downgraded to Ca

August 18, 2025

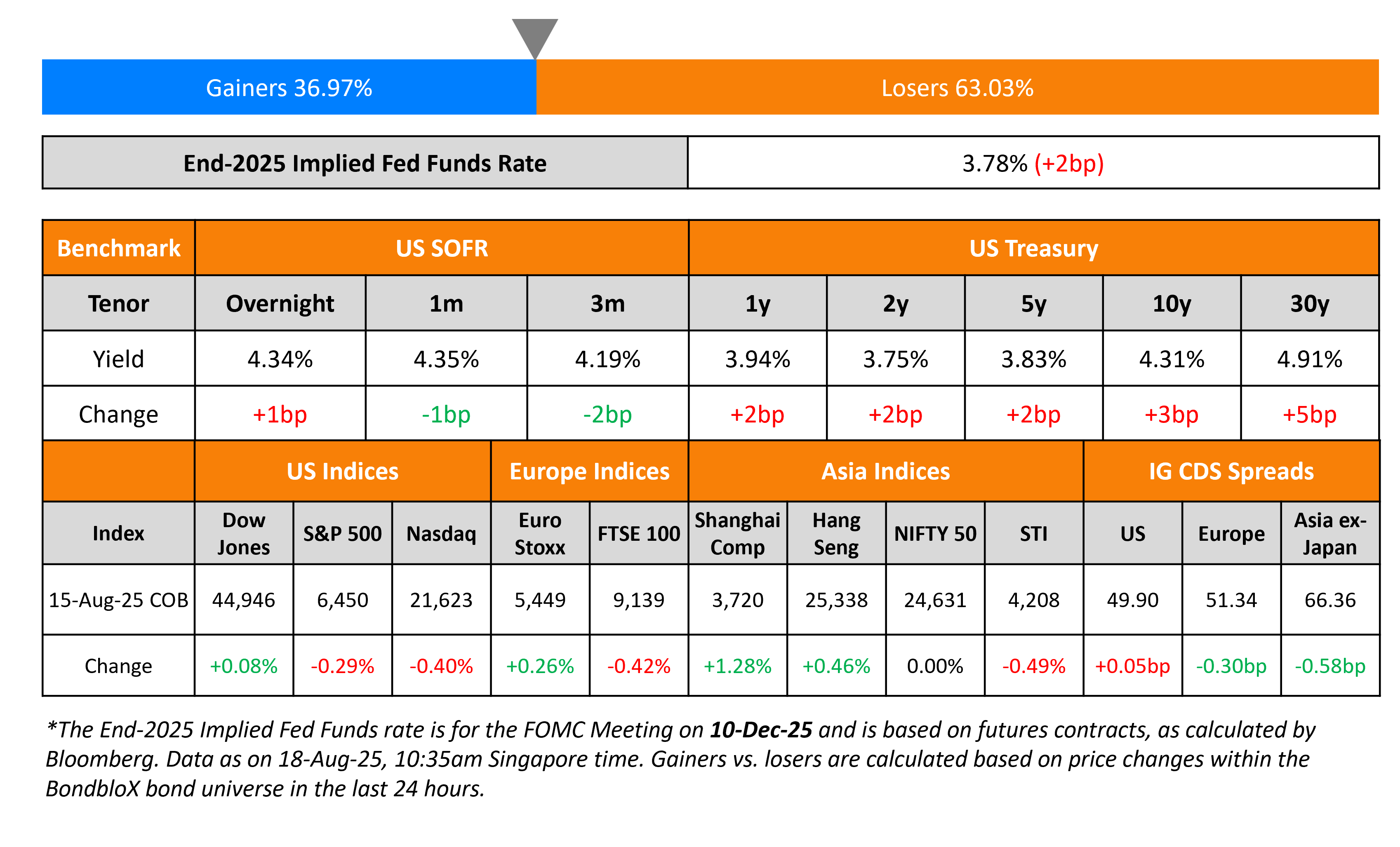

US Treasury yields rose by 2-3bp across the board on Friday. US Retail Sales rose by 0.5% MoM in July, slightly softer than the surveyed 0.6%. Similarly, Core Retail Sales rose by 0.2%, again softer than expectations of 0.3%. Markets are now pricing-in an 85% probability of a 25bp FOMC rate cut in September vs. the 94% seen earlier last week.

Looking at US equity markets, the S&P and Nasdaq ended 0.3-0.4% lower on Friday. US IG CDS spreads were 0.1bp wider and HY CDS spreads widened by 1.1bp. European equity markets ended mixed. The iTraxx Main CDS spreads were 0.3bp tighter and Crossover spreads tightened by 1bp. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 0.6bp tighter.

New Bond Issues

-

Zhangzhou Yuanshan $ 3Y at 7.5% Area

New Bond Pipeline

- CMB International Capital USD FRN

Rating Changes

-

Moody’s Ratings downgrades Road King’s ratings to Ca/C; outlook remains negative

- Fitch Downgrades Spirit Airlines to ‘CCC-‘; Affirms EETC Ratings

- Fitch Downgrades BlackRock TCP to ‘BB+’; Outlook Stable

- Fitch Revises Outlook on HDFC Bank to Negative; Affirms National Rating at ‘BB+(lka)’

Term of the Day: Cross Default

Cross default is a covenant included in bond and loan documents that puts an issuer in default if it has defaulted on another debt instrument. Cross defaults tend to have a domino effect, which puts the issuer under further pressure of making accelerated repayments and reduces its ability to refinance.

In a filing with the US SEC, Spirit Aviation Holdings said that if can not keep enough cash in the bank, creditors could jeopardize the company’s survival by demanding accelerated debt repayments.

Talking Heads

On Bond Market’s Rate-Cut Bets Entering Decisive Stretch With Powell

Kelsey Berro, JPMorgan Asset Management

“He has the capacity to do something that’s market-moving, but I’m not necessarily sure that he’s going to”

Scott DiMaggio, AllianceBernstein

“The Fed’s under a tremendous amount of pressure…They’re a little bit behind, but they’ve been waiting to see the impact of tariffs and what it’s doing to the economy and to inflation.”

On Wall Street Wrestling With Hedging Conundrum as Valuations Swell

Nathan Thooft, Manulife Investment

“Markets are getting overly complacent…Valuations are stretched in many markets. Risk indicators have fallen to the lows of the year.”

Garrett Melson, Natixis Investment

“The direction of travel is that things continue to cool off here and eventually the consensus gets a little too bullish,”

On US Corporate Bond Spreads Sinking to 27-Year Low as ‘FOMO’ Sets In

Matt Brill, Invesco

“There’s a little bit of some FOMO kicking in…These are yields people wanted for years.”

Eric Beinstein and Nathaniel Rosenbaum, JPMorgan

“These trends suggest that we may be entering a period of strong fund inflows with Fed cuts now mostly priced in for the upcoming three FOMC meetings in 2025,”

Nicholas Elfner, Breckinridge Capital

“Investment-grade spreads have retraced all the widening in April as worst-case tariff risks receded.”

Top Gainers and Losers- 18-Aug-25*

Go back to Latest bond Market News

Related Posts: