This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

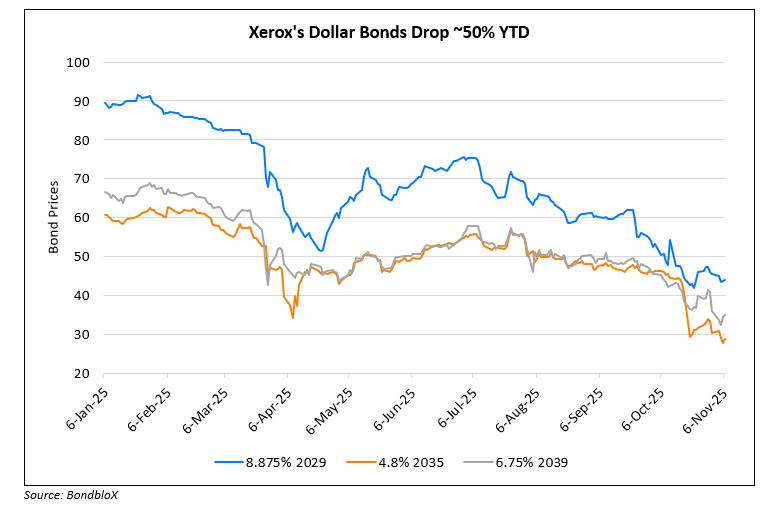

Xerox Downgraded to CCC+ by S&P; Bonds Lose Half Their Value in 2025

November 6, 2025

Xerox was downgraded by a notch to CCC+ from B- by S&P. Its first lien notes, second lien and senior unsecured notes were downgraded by the same measure to B, CCC+ and CCC respectively. The downgrade follows Xerox’s second downward revision of its 2025 guidance — this reflects steep revenue declines of 7–8%, a lower EBITDA margin of ~8%, leading to negative core free operating cash flow (FOCF) of $170–200mn. Besides, it also could lead to a higher leverage above 7.5x debt-to-EBITDA. S&P noted that despite Lexmark-related cost synergies and reduced dividends, its weak operating performance, higher tariff-related costs, and reduced receivables after 2026 heighten refinancing risks for its 2028–2029 debt maturities. While the company retains adequate liquidity to meet near-term debt servicing needs, S&P views Xerox’s path to restoring organic revenue growth and positive cash generation as uncertain. More broadly, S&P highlighted elevated global uncertainty tied to US policy direction, tariffs, and geopolitical tensions, which continue to weigh on Xerox’s credit conditions and economic forecasts.

Go back to Latest bond Market News

Related Posts: