This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Wynn Macau Launches $ 8.5NC3 Bond; Energy Transfer, FLCT, CVS Price Bonds

August 12, 2025

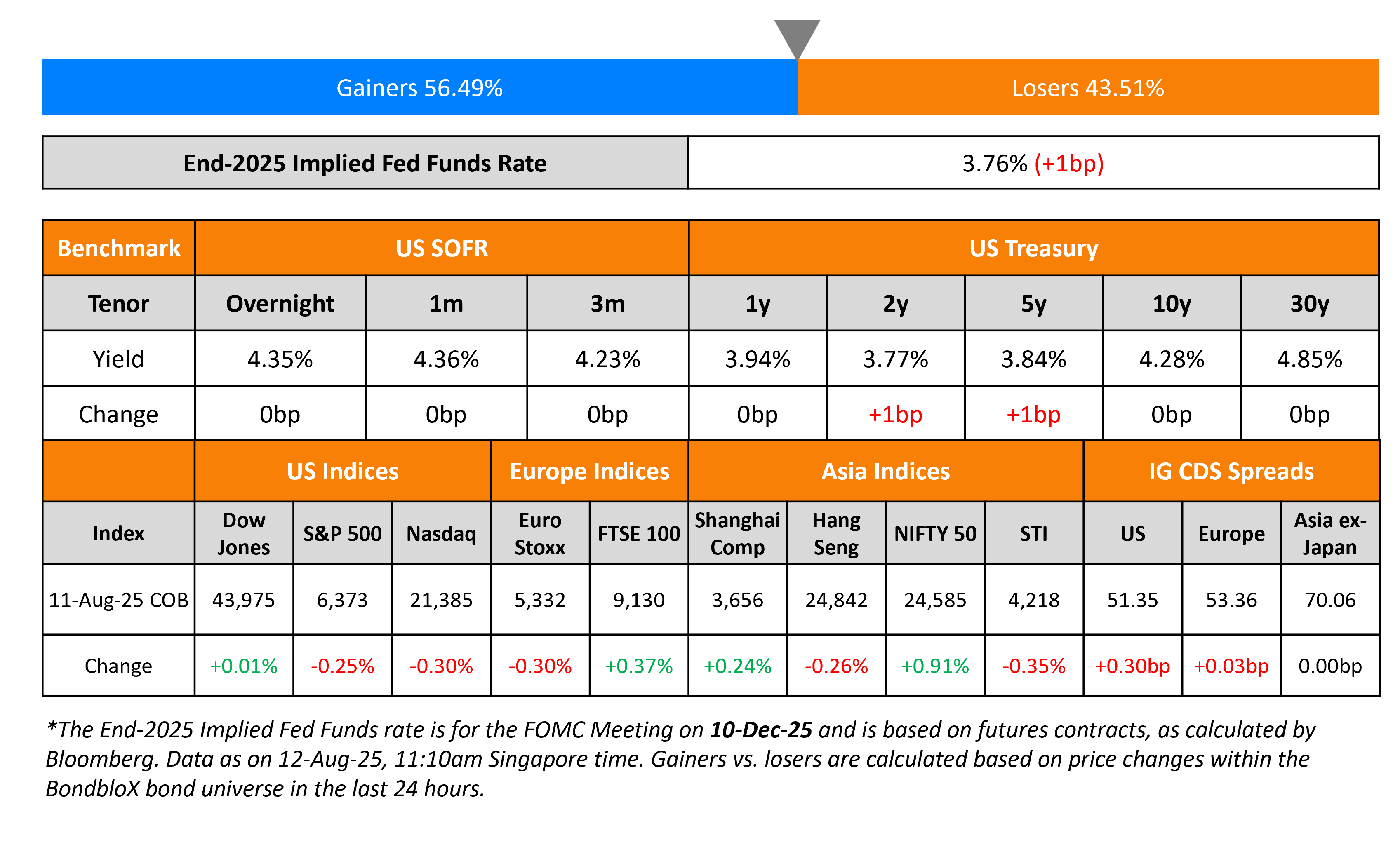

US Treasury yields were broadly unchanged on Monday with markets awaiting the Headline and Core CPI readings later today. Separately, US President Donald Trump signed an executive order to extend the tariff truce with China until November 10. The order extends the existing 30% tariffs on Chinese goods, with Chinese duties on US imports remaining at 10%.

Looking at US equity markets, the S&P and Nasdaq closed lower by ~0.3% each. US IG CDS spreads were 0.3bp wider and HY CDS spreads widened by 2.3bp. European equity markets ended mixed. The iTraxx Main CDS spreads were almost unchanged while Crossover spreads tightened by 0.6bp. Asian equity markets have opened higher today, with the Nikkei up by 2.7% at the time of writing. Asia ex-Japan CDS spreads were unchanged.

New Bond Issues

-

Wynn Macau $ 8.5NC3 at 7% area

Energy Transfer raised $2bn via a two-trancher. It raised $1.2bn via a 30NC5 bond at a yield of 6.50%, 37.5bp inside initial guidance of 6.875% area. It also raised $800mn via a 30NC10 bond at a yield of 6.75%, 37.5bp inside initial guidance of 7.125% area. The junior subordinated note is rated Baa3/BB+/BB+. Proceeds will be used to repay borrowings under their revolving credit facility and for general partnership purposes.

FLCT Treasury raised S$100mn via a 8.5Y bond at a yield of 2.45%, 25bp inside initial guidance of 2.70% area. The senior unsecured note is rated BBB+ (Fitch). Proceeds will be used to refinance existing borrowings, finance or refinance acquisitions, investments, asset enhancement works and development. Besides it may be used for working capital requirements and for general corporate purposes.

CVS raised $4bn via a four-trancher:

-2.png)

The senior unsecured notes are rated Baa3/BBB/BBB. Proceeds will be used to repay existing debt including borrowings under its commercial paper program, as well as for other general corporate purposes.

China Aircraft Leasing Group raised $160mn via a 3Y bond at a yield of 6.0%, 40bp inside initial guidance of 6.4% area. The senior unsecured guaranteed bond is unrated. The note has a change of control put at 101. Proceeds will be used for onward lending to the guarantor for aircraft acquisitions, business expansion and general corporate purposes.

Caterpillar Financial raised $1.45bn via a two-trancher. It raised $750mn via a 3Y bond at a yield of 4.105%, 22bp inside initial guidance of T+60bp area. It also raised $700mn via a 3Y FRN at SOFR+64bp vs. initial guidance of SOFR equivalent area. The senior unsecured note is rated A2/A/A+. Proceeds will be used general corporate purposes.

Rating Changes

- Simon Property Group Inc. Upgraded To ‘A’ On Strong Operating And Sector Performance, Outlook Stable

- Fitch Upgrades Kinder Morgan and Subsidiaries to ‘BBB+’; Outlook Stable

- Fitch Upgrades Leonardo to ‘BBB’; Outlook Stable

- Fitch Downgrades Reno de Medici S.p.A. to ‘B-‘; Outlook Negative

- Fitch Downgrades Stonegate to ‘CCC+’

- Fitch Downgrades TalkTalk to ‘CCC-‘ on Distressed Debt Exchange; On Rating Watch Negative

- Fitch Revises FS KKR Capital Corp.’s Outlook to Negative; Affirms IDR at ‘BBB-‘

Term of the Day: Eurobond

A Eurobond is a bond denominated in any currency other than the home currency of the country or market in which it is issued. Eurobonds are a way for companies to raise funds by issuing bonds in a foreign currency and generally come with the issuing currency suffixed. For example, a Chinese company raising money in USD will issue a euro-dollar bond and if it raises money in Yen, it would be called a euro-yen bond.

Euro-dollar bonds should not be confused with euro denominated bonds since the former is denominated in USD. The word ‘Euro’ here implies any currency other than the issuer’s home currency. These bonds are issued to entice investors to the currency in which the bond is issued but from a foreign market.

For instance, Angola is planning to launch a eurobond offering in the near future.

Talking Heads

On Lowering US Rates Outlook on Weak Data, Fed Risks – Bank of America Strategists

Mark Cabana

“Recent US data has meaningfully shifted market Fed pricing and our view on US rates…Fed independence erosion risk could see higher inflation tolerance and more low-rate champions…The appointment of Stephen Miran, an ally of President Donald Trump, as a Fed governor will likely further tilt the balance in favor of lower rates”

On Favoring Asian High-Grade Debt Again as Growth Risks Rise – Goldman Sachs

Kenneth Ho and Sandra Yeung

“As US growth concerns have re-emerged and valuation at even more elevated levels compared with end-2024, we believe now is the time to switch back to an overweight Asia IG over HY positioning”

On Wall Street Looking Ahead to September Liquidity Pinchpoints

Lou Crandall, Wrightson ICAP

“The supply of reserves is about to enter a zone where day-to-day shifts in overnight market conditions will warrant heightened attention – especially from Labor Day onward…We suspect that the decline in reserve availability won’t start to affect the overnight market visibly until aggregate Fed balances fall somewhat below $2.8 trillion on a sustained basis.”

Top Gainers and Losers- 12-Aug-25*

Go back to Latest bond Market News

Related Posts: