This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

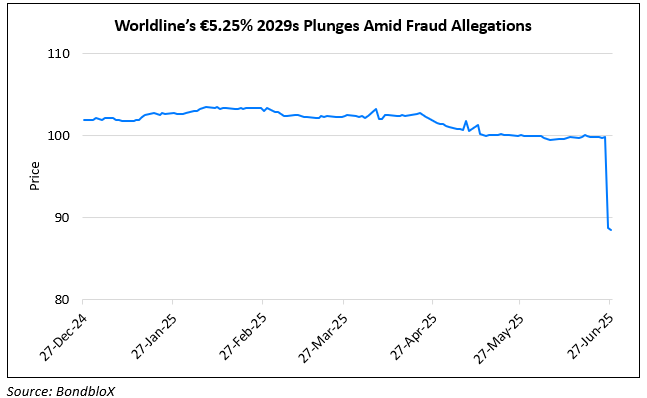

Worldline’s Bonds Slump on Customer Fraud Cover-up Reports

June 27, 2025

Bonds of Worldline SA, a French payments processor slumped by ~11 points after a series of news reports emerged alleging that the company had covered up fraud by some of its customers. The controversy has reignited concerns over Worldline’s credibility, despite reassurances from CEO Pierre-Antoine Vacheron and upcoming plans for a strategic turnaround. The company issued a €550mn ($643mn) bond due 2030 earlier this month, which has plunged to as low as 87 cents on the euro currently, as per Bloomberg. The sharp drop has caused investors to lose about €55mn ($64.3mn), with the bonds now trading at levels consistent with junk-rated (single B) credit, despite their investment-grade (BBB-) rating. Some investors are trying to exit positions, and a few are even considering legal action. Other Worldline bonds also fell, including convertible debt maturing next month, which is trading below par due to the stock’s collapse (now at €3.408, far below the €119.44 conversion price). Despite the turmoil, the company has significant liquidity, with €1.8bn ($2.1bn) in cash and €201mn ($235.1mn) in free cash flow as of end-2024, according to its annual report. Its €5.25% 2029s lost almost 11 points in a single day as shown in the chart above.

For more details, click here

Go back to Latest bond Market News

Related Posts: