This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Where Can Bond Investors Find Bond Prices?

December 9, 2024

Before we get into details about where investors can find bond prices, it is important to understand how bonds are traded and how the trading process is different from stocks.

Trading Process for Stocks vs. Bonds

Stocks are traded on an exchange where the buyer and seller trade with the exchange rather than with each other, at a price that is openly published on the exchange based on buy/sell orders received. Investors can access stock prices in real-time by visiting the exchange website or third-party websites or apps, which get their data from the exchange.

In contrast, bonds are traded over-the-counter or OTC. Put simply, this means that bonds are traded between two parties who negotiate directly with each other (usually over the phone) before closing a trade. Since the buyer and seller of a bond negotiate the bond price directly, there is no universal source of bond prices like there is for stocks (exchanges). Thus, it is not unusual for bond investors to receive different prices for the same bond at the same time, from different banks or brokers. This leads to information asymmetry in the bond markets, especially at the individual bond investor level.

App for Bond Prices

We at BondbloX are working towards fixing this information asymmetry in the bond markets with the help of technology. We have designed and developed a platform where bond investors can track their bond investments conveniently via our Mobile & Web App.

The key features of the BondbloX platform are:

- Transparent two-way bond prices

- New bond issue alerts

- Bond screener to filter for bonds based on 9 different criteria

- AI-powered news on bond issuers

- Portfolio analytics

- On Mobile, Web & API

Our bond coverage universe consists primarily of US dollar denominated corporate and sovereign bonds from Asia, Europe, Middle East, Latin America and the US. We also have full coverage of Singapore dollar denominated bonds and select local currency bonds from the UK, Europe, India, Indonesia, Malaysia, Hong Kong, China, Australia.

Bond investors can try out the BondbloX platform by registering for a free trial by clicking on the link below:

How Do We Calculate Bond Prices?

Our proprietary bond pricing algorithm uses bond price data from various reputed market sources as an input and calculates bond prices that are most representative of the current market price. It is important to note that our bond prices are indicative bond prices and may be different from tradable bond prices.

Most of our subscribers use our bond prices to value their bond portfolio and track daily price movement of their bonds. Since we provide two-way bond prices, our subscribers use it as a reference price before they trade with their banks or brokers.

Go back to Latest bond Market News

Related Posts:

What to Look for When Buying Bonds

December 4, 2024

Masala Bonds – Everything You Need to Know

December 17, 2024

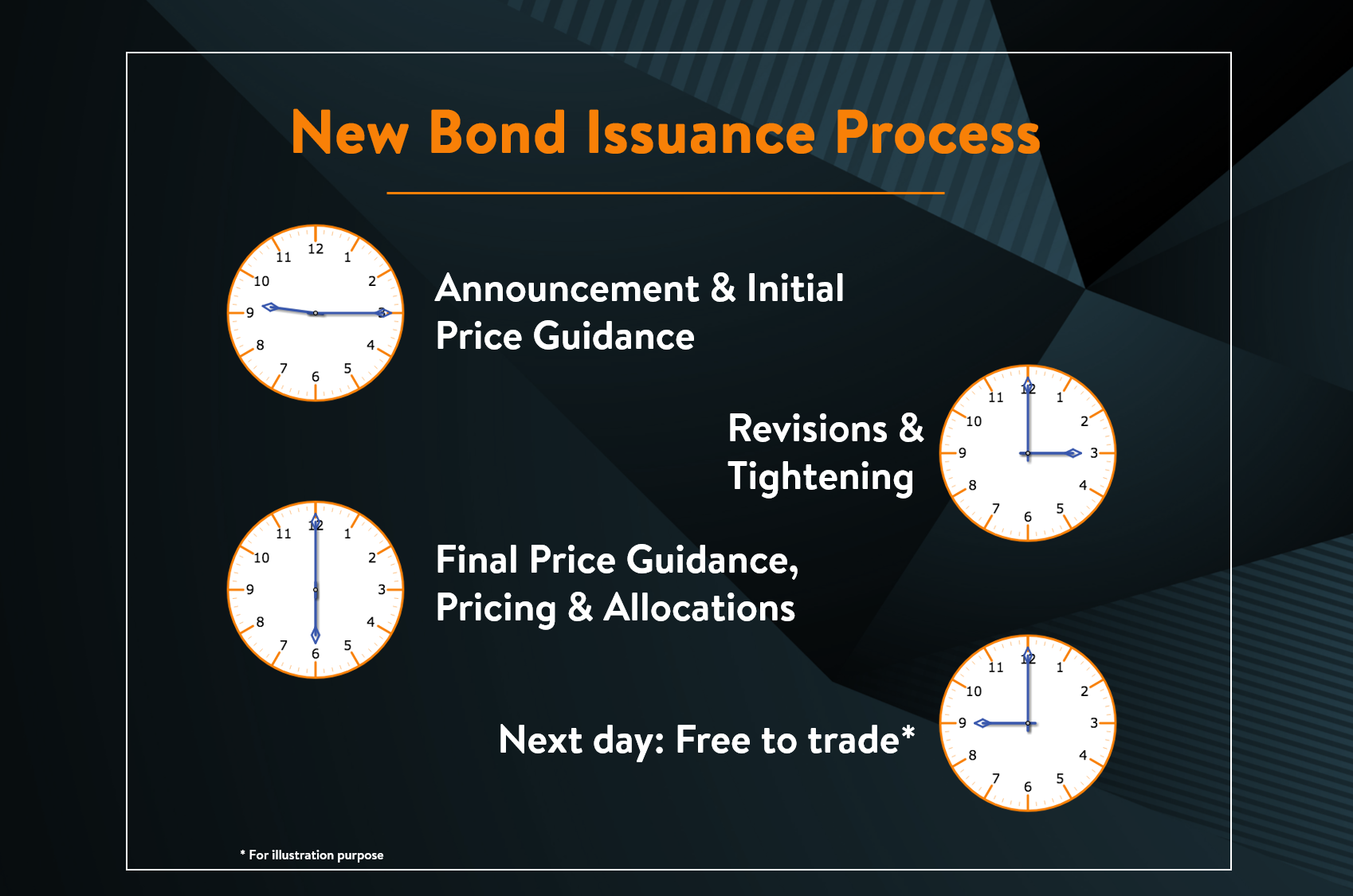

New Bond Issue Process – Explained

December 13, 2024