This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

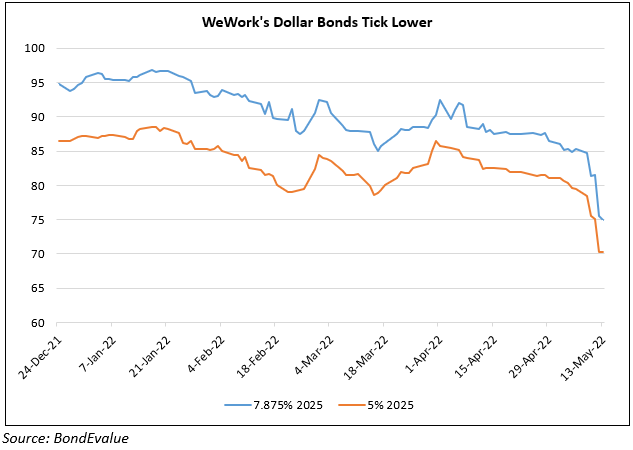

WeWork’s Bonds Jump on Receiving Support for Debt Restructuring

March 21, 2023

WeWork’s dollar bonds jumped following the release of the co-working company’s extensive restructuring plan. After finalizing the terms last week, WeWork said that it will reduce total debt by ~$1.5bn through:

- Equitization of $1.04bn in its 5% unsecured notes held by SoftBank at a discounted value of 90% of par

- Conversion of the remaining $609.5mn of its 5% unsecured notes into new debt and equity at a discount to par

Additionally, public bondholders of WeWork’s 5% 2025s and 7.875% 2025s will be exchanged for equity or a mix of debt and equity, at a discount. With the new arrangements, WeWork managed to extend its significant maturity wall of $1.9bn from 2025 to 2027. WeWork also secured more than $1bn of fresh funding from bondholders such as BlackRock, King Street Capital Management and Brigade Capital Management. The debt restructuring plan is well-received at launch, including the support of SoftBank and ~60% of public bondholders. The improved balance sheet post-transaction will “allow the company to pursue value-additive growth opportunities, providing further upside potential” as per WeWork.

WeWork’s 5% 2025s were up 11.75 points to 52.73 cents on the dollar.

For more details on the restructuring, click here

Go back to Latest bond Market News

Related Posts:

WeWork Explores Fresh Equity Raise

March 7, 2022

WeWork Guides for at least 30% Jump in 2022 Revenues

March 14, 2022