This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Weekly Jobless Claims Drops to 214k; Markets Trade Rangebound

December 26, 2025

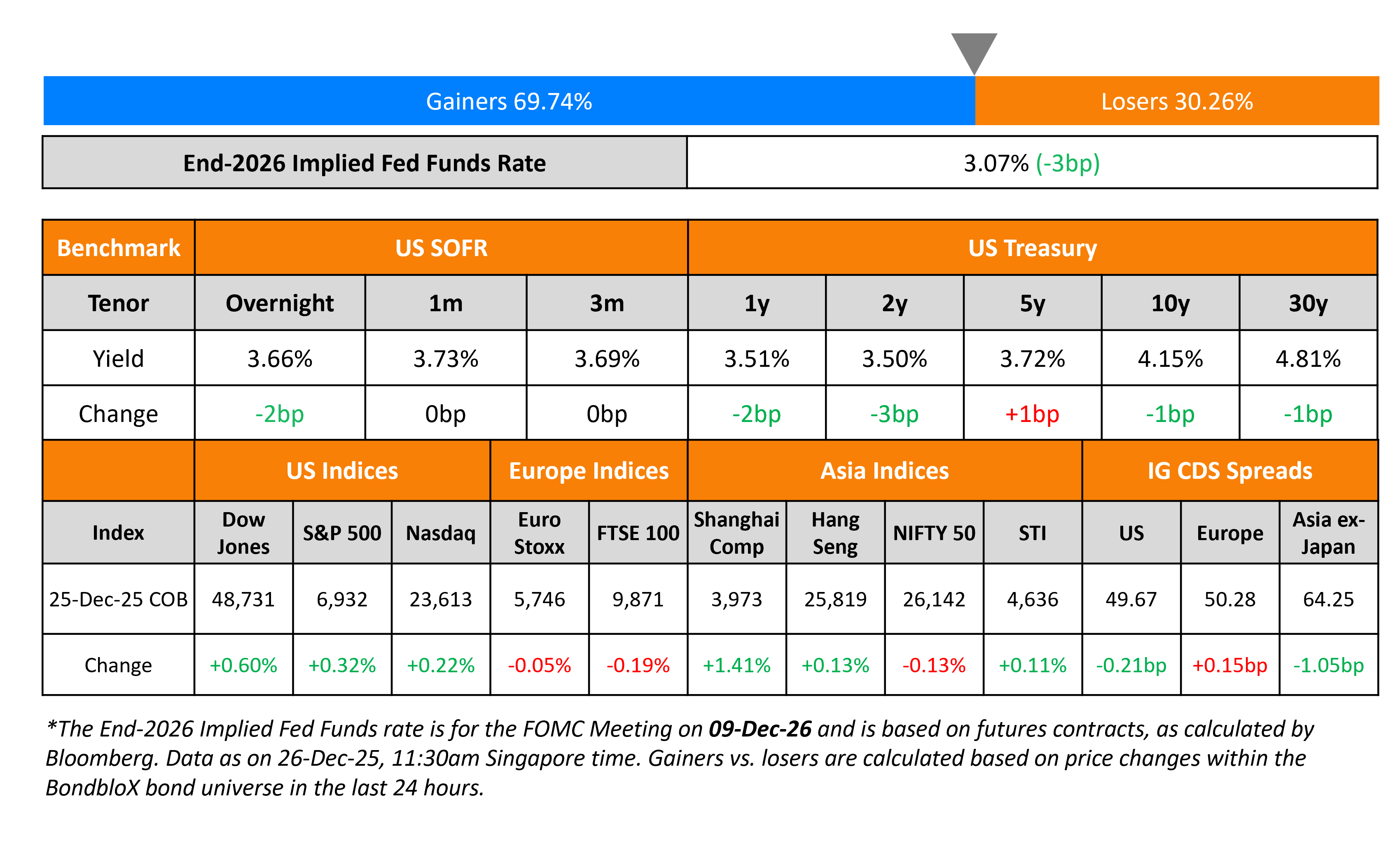

US Treasury yields were broadly stable across the curve. The prior week’s initial jobless claims reading came in at 214k, much better than expectations of 224k. However, some analysts have noted that the unemployment rate likely remained high in December amid sluggish hiring trends.

Looking at US equity markets, the S&P and Nasdaq ended 0.3% and 0.2% higher respectively on Wednesday. US IG CDS spreads tightened by 0.2bp while HY CDS spreads were tighter by 2.2bp. European equity indices ended lower. The iTraxx Main CDS spreads widened by 0.2bp while the Crossover CDS spreads were 0.2bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads tightened 1.1bp.

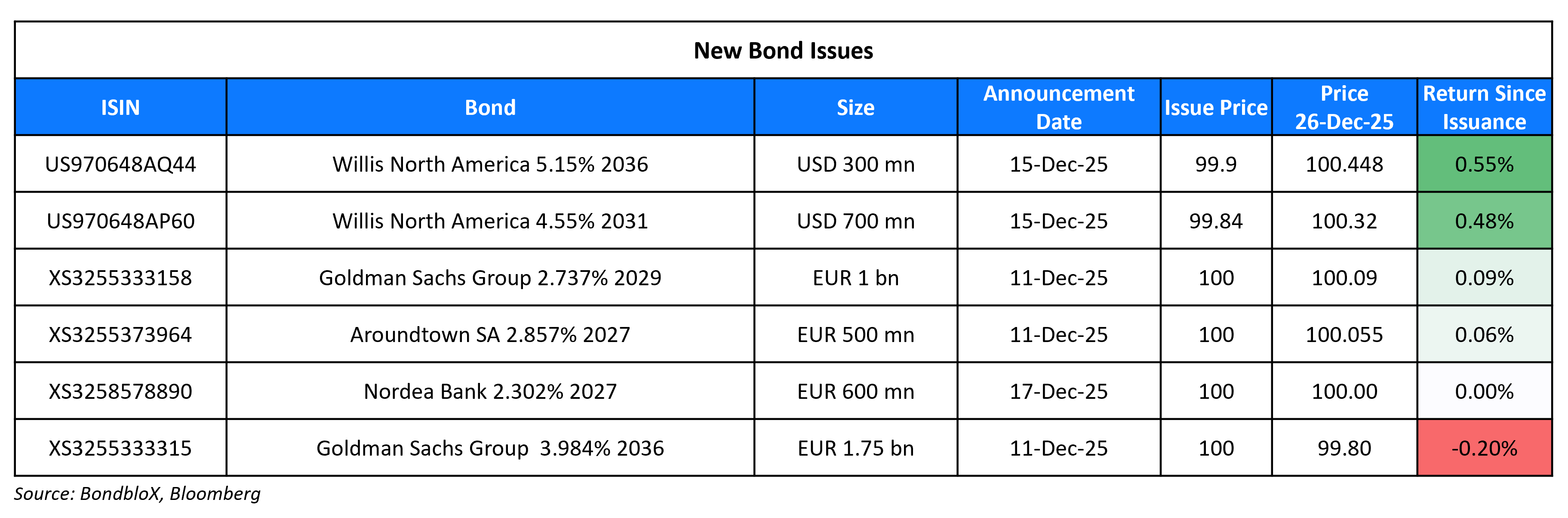

New Bond Issues

Rating Changes

- Fitch Downgrades China Vanke to ‘RD’

- Fitch Downgrades Oriflame to ‘RD’ on DDE; Upgrades to ‘CCC’

- Fitch Downgrades Wanda Commercial and Wanda HK to ‘C’

- China Tourism Group ‘A-‘ Rating Withdrawn At The Company’s Request

Term of the Day: Distressed Debt Exchange (DDE)

Distressed Debt Exchange (DDE) is an offer made by a company to its bondholders to avoid bankruptcy, improve liquidity, reduce debt, manage its maturity dates (by exchanging debt securities that are coming due for debt securities with an extended maturity) and to reduce or eliminate onerous covenants.

Talking Heads

On Ueda Signalling Further Hikes With More Confidence Over Price Goal

Kazuo Ueda, BOJ Governor

“The achievement of the 2% price stability target, accompanied by wage increases, is steadily approaching. Amid tightening labor market conditions, business behavior has shifted significantly on setting wages and prices in recent years… appears that the likelihood of realizing the bank’s baseline scenario has been rising”

On Gold Steadying as Traders Book Profits After Record Rally

John Feeney, Guardian Vaults

“The dominant drivers for both gold and silver right now are the combination of sustained physical demand and renewed sensitivity to macro risk… seeing momentum reinforced rather than capped… Unlike previous silver rallies driven primarily by leverage, this move is being underwritten by real demand”

On Fed Should Lower Rates If the Market Does Well – US President Donald Trump

“I want my new Fed Chairman to lower Interest Rates if the Market is doing well, not destroy the Market for no reason whatsoever. Anybody that disagrees with me will never be the Fed Chairman!”

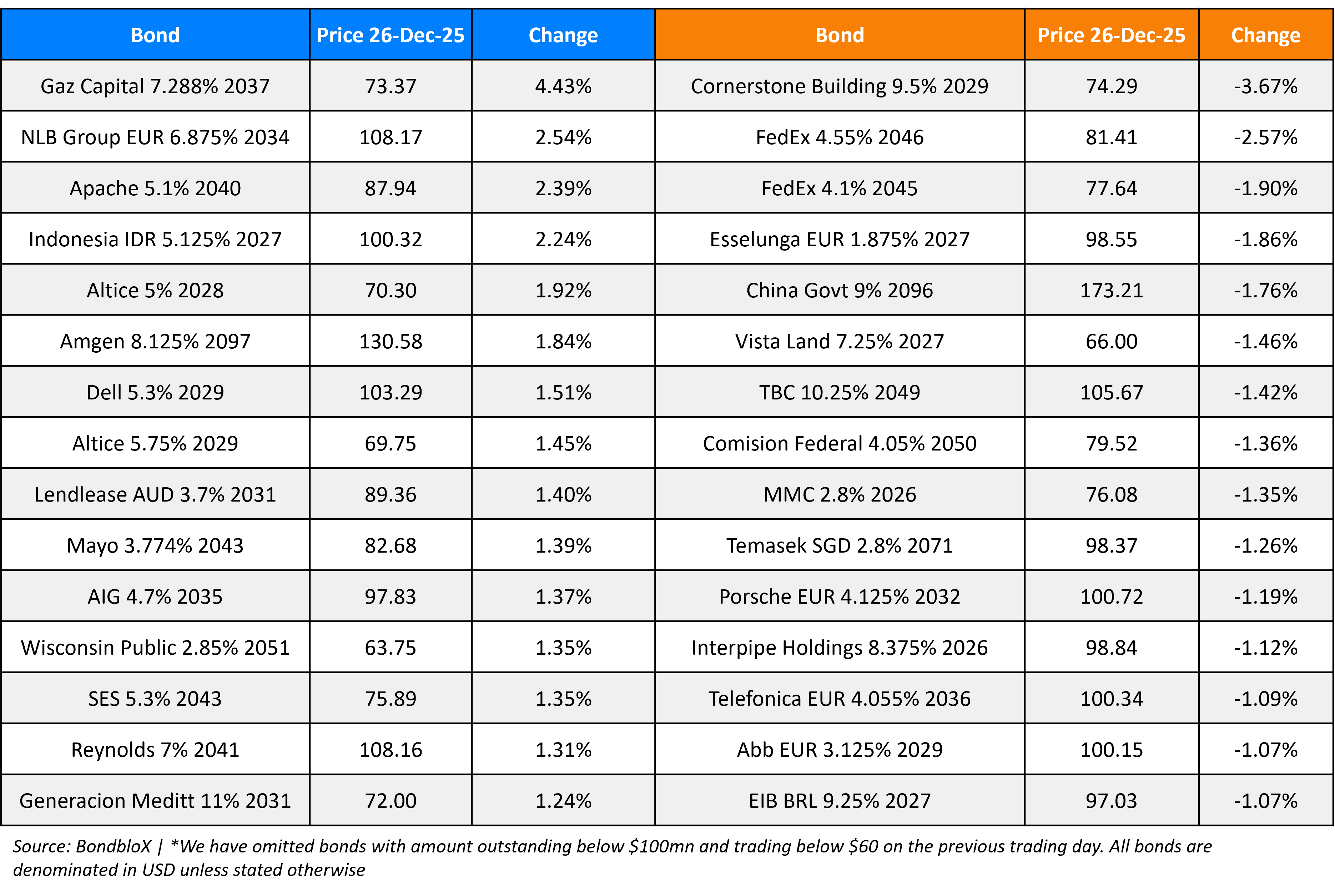

Top Gainers and Losers- 26-Dec-25*

Go back to Latest bond Market News

Related Posts: