This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Weekly Initial Jobless Claims Jump to 236k; Goldman, Aroundtown Price € Bonds

December 12, 2025

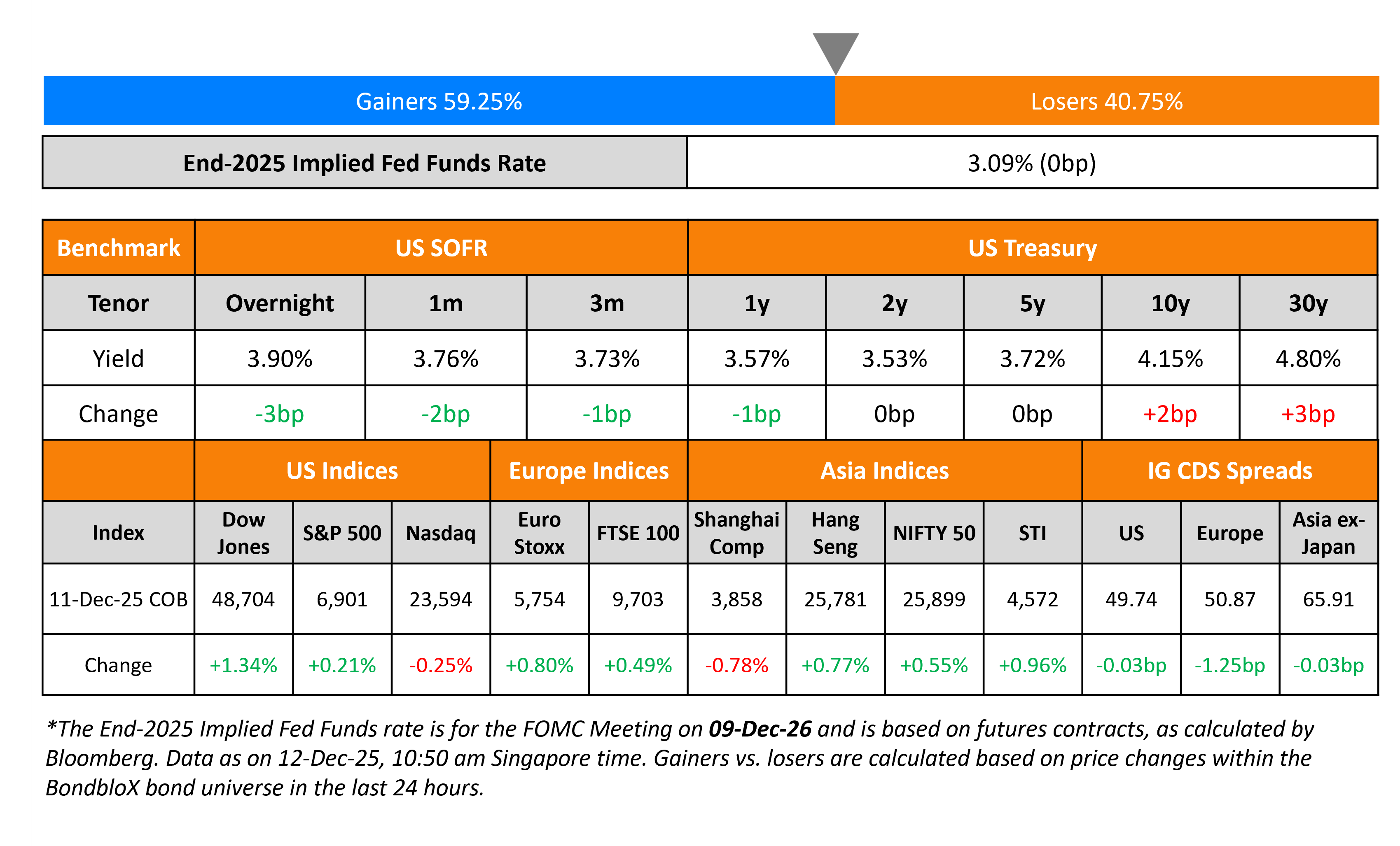

US Treasury yields bear steepened with longer term yields rising by 2-3bp while short term yields held broadly stable. On the data front, the initial jobless claims for the week increased to 236k, vs. expectations of 220k and the previous reading of 192k. While this was the biggest jump since March 2020, it followed the lowest level of applications in over three years in the week prior (Thanksgiving). The four-week moving average of new applications, which helps adjust for weekly volatility, ticked up to ~217k last week. In other news, a US official warned that July’s trade deal with Indonesia was in jeopardy after Jakarta backtracked on key commitments, though Indonesia said it was aiming for a mutually beneficial agreement.

Looking at US equity markets, the S&P ended 0.2% higher and Nasdaq ended 0.3% lower. US IG CDS spreads were were broadly stable while HY spreads tightened by 0.3bp. European equity indices ended higher. The iTraxx Main CDS spreads tightened by 1.3bp while the Crossover CDS spreads were 6.1bp tighter. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were stable. Chinese policymakers vowed to step up housing-market stabilization efforts, including promoting the purchase of existing homes for affordable housing, at the Central Economic Work Conference.

New Bond Issues

Goldman Sachs raised €2.75bn via a two part deal. It raised €1bn via a 4NC3 FRN at a yield of 3mnth Euribor+68bp, 22bp inside initial guidance of 3mnth Euribor+90bp. It also raised €1.75bn via a 11NC10 bond at a yield of 3.984%, 25bp inside initial guidance of MS+135bp. The senior unsecured bonds are rated A2/BBB+/A. Proceeds will be used for general corporate purposes.

Aroundtown raised €500mn via a 2NC1 FRN at a yield of 3mnth Euribor+80bp. The senior unsecured bond is rated BBB (S&P). Proceeds will be used to refinance and/or repay the Issuer’s existing debt and for general corporate purposes.

Rating Changes

- Fitch Upgrades Bank Dhofar to ‘BB+’; Stable Outlook

- Fitch Upgrades National Bank of Oman to ‘BB+’; Stable Outlook

- Fitch Upgrades Bank Muscat’s IDR to ‘BBB-‘; Stable Outlook

- Fitch Upgrades Ahli Bank SAOG to ‘BB+’; Stable Outlook

- Spirit AeroSystems Inc. Upgraded To ‘BBB-‘ Following Acquisition By Boeing, Outlook Stable; Ratings Off Watch Positive

- Fitch Upgrades Toll Brothers’ IDR to ‘BBB+’; Outlook Stable

- Precision Drilling Corp. Upgraded To ‘BB-‘ On Improved Financial Measures; Outlook Stable

- Fitch Downgrades Bukit Makmur Mandiri Utama to ‘B+’/’A(idn)’, Rupiah Notes to ‘A-(idn)’

- Fitch Downgrades Sappi Limited to ‘BB’; Outlook Stable

- Fitch Affirms Freedom Mortgage Holdings at ‘BB-‘; Upgrades Unsecured Notes to ‘BB-‘; Outlook Stable

- Moody’s Ratings affirms The Boeing Company’s Baa3 senior unsecured rating; outlook changed to stable from negative

Term of the Day

Bear Steepening

Bear Steepening refers to a move in the yield curve where the longer-dated bond yields move higher than the shorter-dated bond yield (far maturity bonds sell-off more than near maturity ones). A bear steepening move can occur due to different reasons some of them being long term expectations of inflation picking up, higher supply of longer-dated bonds, central bank tapering purchases with a focus on the long-end bonds etc.

Talking Heads

Rick Rieder – BlackRock

“Dollar-based investors can use currency hedges to earn as much as 6% on high-quality European corporate bonds. I’ve never bought more European fixed income in my life.”

On Foreign Outflows Challenging Indonesian Bond Market

Ze Yi Ang – Allianz Global Investor

“Indonesia is undergoing a ‘credibility repricing’ from investor concerns over governance and fiscal sustainability. We don’t know how they will react when the growth really slows down or when things get tough. We have to be a bit more cautious because the range of outcome is a bit more uncertain.”

On Asian EM Bonds Set For Revival in 2026

Belinda Liao – Fidelity International

“Emerging Asia local-currency bonds will perform strongly in 2026 due to currency appreciation and re-normalization of carry.”

Abhay Gupta – BofA Securities

“Indonesia, Philippines and India offer the best real yields in the region, and we remain bullish on the five-year bonds in these countries on scope for further monetary easing.”

On Seeing Little Merit in Further Fed Rate Cuts – Howard Marks

“I believe that the Fed should be passive most of the time and only come to the rescue if the economy is seriously overheated and tending toward hyperinflation or seriously underactive and not creating jobs. I don’t think that’s the case right now.”

Top Gainers and Losers- 12-Dec-25*

Go back to Latest bond Market News

Related Posts: