This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Wanda Sweetens Deal for Pre-IPO Investors in its Mall Unit

December 11, 2023

Dalian Wanda Group Co. (Wanda) has sweetened the deal for the pre-IPO investors in its mall unit, Zhuhai Wanda Commercial Management Group Co., as per sources. The company is offering new shares in its shopping mall unit at a valuation of about RMB 100bn ($13.9bn), almost half of the original valuation the unit fetched in the 2021 funding round. According to sources, Wang Jianlin could sell some of his shares in the unit which could reduce his stake in Zhuhai below 50%, i.e., lose control over the unit. They added that the new proposal could make it easier to win regulatory approval for the IPO. This comes after investors had earlier turned down the proposal for the repayment delay of RMB 30bn ($4.2bn) if the company fails to list the mall unit IPO by 2023 end.

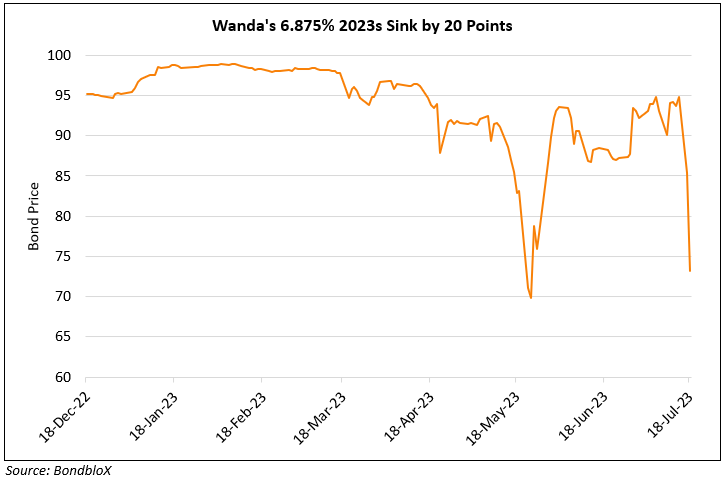

Wanda’s dollar bonds have been trading at distressed levels of 33-38 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: