This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

VW, Meta, Chinalco Price $ Bonds; ReNew Power Taps 2026s

August 8, 2024

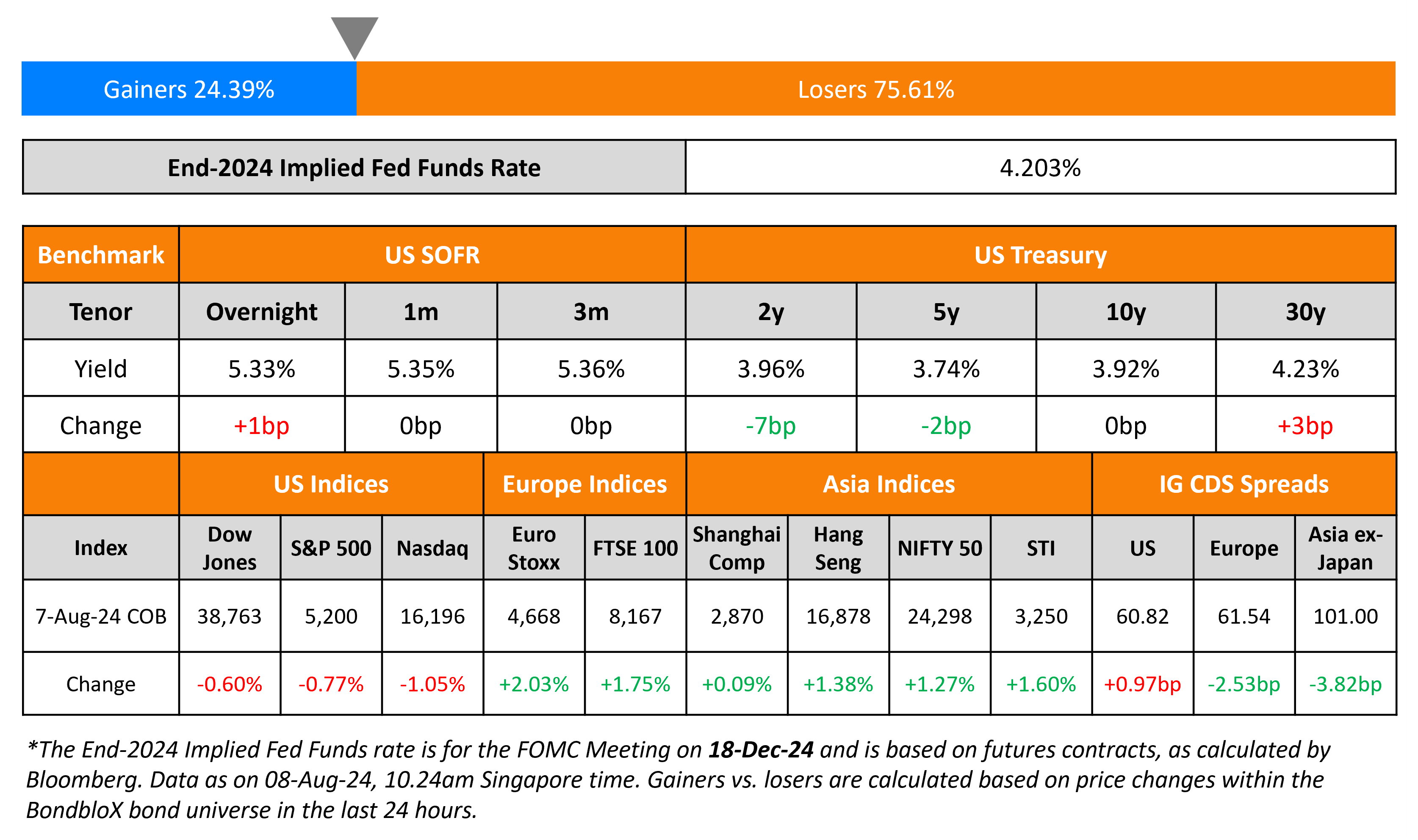

US Treasury yields were stable across the curve. The US Treasury’s $42bn 10Y bond auction saw weak demand, with a bid-to-cover ratio of 2.32x (vs. 2.58x in July) and an indirect bid acceptance rate of 66.2% (vs. 67.6% in July). The auction saw a final yield of 3.96%. US equities ended lower, with the S&P and Nasdaq down by 0.8% and 1.1% each. US IG and HY CDS spreads widened by 1bp each.

European equity markets jumped higher. Looking at Europe’s CDS spreads, the iTraxx Main spreads were 2.5bp tighter and Crossover spreads tightened by 12bp. Most Asian equity indices have opened broadly in the green today. Asia ex-Japan CDS spreads were tighter by 3.6bp.

New Bond Issues

.png)

VW Group of America raised $2bn via a four-trancher.

The senior unsecured notes are rated A3/BBB+/A-. Proceeds will be used for general corporate purposes. The new 3Y bond was priced 15.7bp tighter to its existing 4.35% 2027s that yield 4.70%. The new 5Y bond was priced 16.3bp tighter to its existing 5.25% 2029s that yield 4.86%.

ReNew Energy raised $120mn via a tap of its 7.95% 2026s at a price of 101. The senior secured notes are rated Ba3/BB- with a guarantee by ReNew Energy Global PLC.

Chinalco raised $650mn via a 3Y bond at a yield of 4.75%, 52bp inside initial guidance of T+145bp area. The senior guaranteed bonds are rated A-. Proceeds will be used to refinance offshore existing debt.

Meta raised $10.5bn via a 5-part deal.

Rating Changes

- Moody’s Ratings upgrades Tata Motors to Ba1; outlook remains positive

- Moody’s Ratings upgrades JLR’s ratings to Ba2 from Ba3 on consistently strong earnings; outlook remains positive

- Commerzbank AG Ratings Raised To ‘A/A-1’ On Strengthened Performance And Capitalization; Outlook Stable

- SK hynix Upgraded To ‘BBB’ From ‘BBB-‘ On Strong Rebound In High-Bandwidth Memory Sales, Lower Leverage; Outlook Stable

- Moody’s Ratings downgrades UPL to Ba2, places ratings under review for further downgrade

- Community Health Systems Inc. Downgraded To ‘SD’ From ‘CCC+’ On Senior Note Repurchase

Term of the Day

Sahm Rule

Named after economist Claudia Sahm, the rule states that when the three-month moving average of the unemployment rate rises by 0.5% or more from its lowest level over the past 12 months, it marks the beginning of a recession in the US economy. For instance, recently, the July unemployment rate rose to 4.3% with the 3-month moving average at 4.1%. The lowest level over the past 12-months stood at 3.5% in July 2023. This is among several indicators to look at whilst not necessarily making a strong prediction of the future.

Talking Heads

On Time to Kill the New Treasury Bond He Created

Fmr. US Treasury Secy, Steven Mnuchin

“I would not keep issuing them. It’s just costly to the taxpayer… We wanted to issue as much long-term debt as possible to extend our maturities and lock in the very low rates that existed at the time”

Brian Sack, Balyasny Asset

“Having another maturity point… gives them some additional flexibility”

On Recent Market Swings an Overreaction – ECB’s Olli Rehn

“My own understanding is that it was an overreaction of market forces in the conditions of uncertainty and thin market liquidity… not so much due to issues arising from the fundamentals”

Top Gainers & Losers- 08-August-24*

Go back to Latest bond Market News

Related Posts:

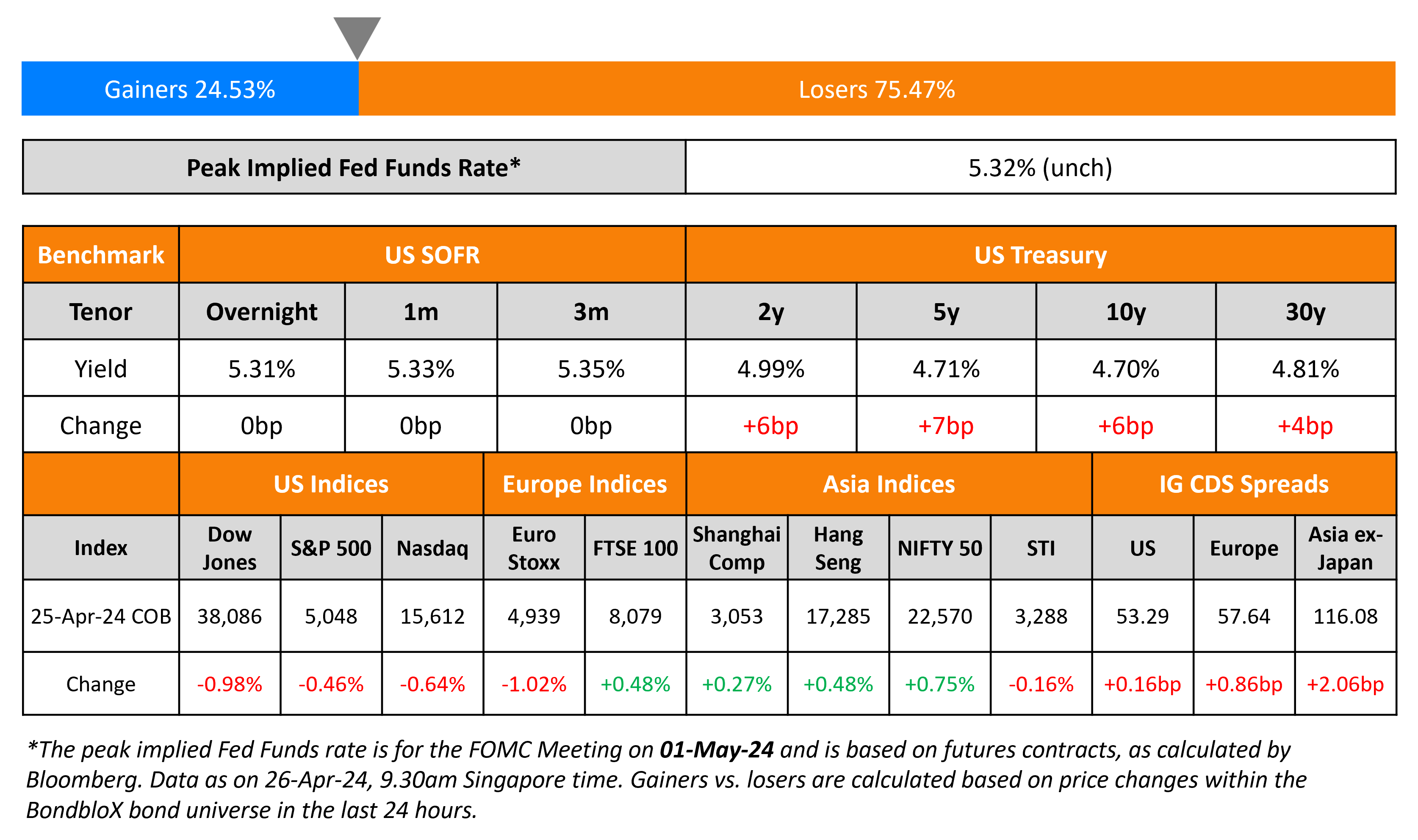

US GDP Softens; KIB Prices $ AT1

April 26, 2024

Turkey, FAB, Astrea Price Bonds; Muthoot Taps 2028s

July 10, 2024