This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vodafone Launches Tender Offer to Buy Back Dollar and Sterling Bonds

July 1, 2025

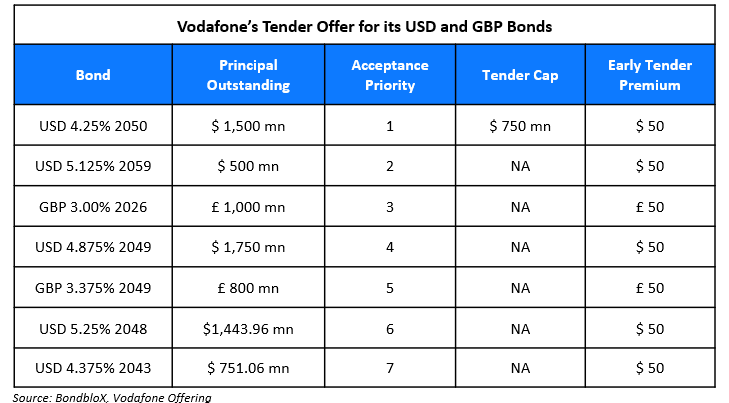

Vodafone launched a tender offer to buy back its dollar and sterling denominated bonds, funded by the latest issuance of its EUR and GBP-denominated notes. Details of the tender offer are given below.

The maximum tender amount is up to €2bn equivalent based on the above acceptance priority. Vodafone reserves the right to increase or decrease either or both, the maximum tender amount and the cap for the USD 4.25% 2050s. The early tender deadline is on July 14 with the tender offer expected to conclude on July 29. The company plans to pro-actively manage its outstanding debt portfolio following the tender offer.

For more details, click here

Go back to Latest bond Market News

Related Posts: