This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

View Popular Defense and Aerospace Dollar Bonds Amid the Geopolitical Outlook

August 7, 2025

With a series of ongoing geopolitical conflicts – including the Russia-Ukraine war, escalating tensions in the Middle East, and the recent skirmish in South and Southeast Asia, global defense expenditures have risen. Affected nations are increasing investments in missile systems, air and missile defense platforms, unmanned aerial systems, and advanced surveillance technologies. Amid these developments, defense-sector corporate bonds have been in the limelight.

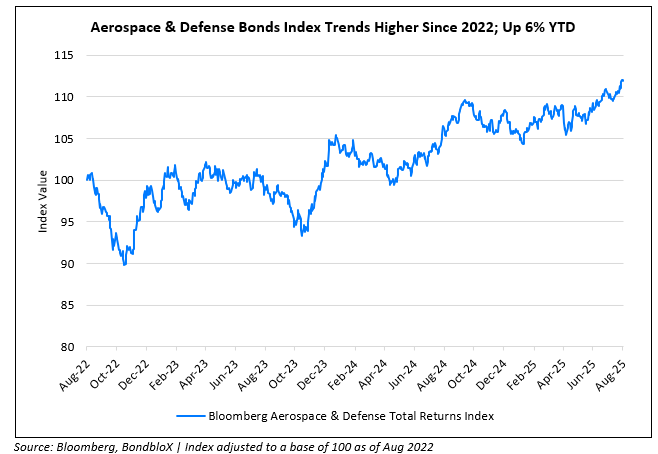

The Bloomberg Aerospace & Defense Total Returns Index of bonds has witnessed returns of 12% over the last 3 years. In 2025 alone, it has gained 6%. The credit spreads in this sector (measured by OAS) currently stands at 76bp, its tightest levels since 2018.

Given this backdrop, we have presented a selection of USD-denominated bonds issued by aerospace and defense companies, sorted by yield-to-maturity.

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024