This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

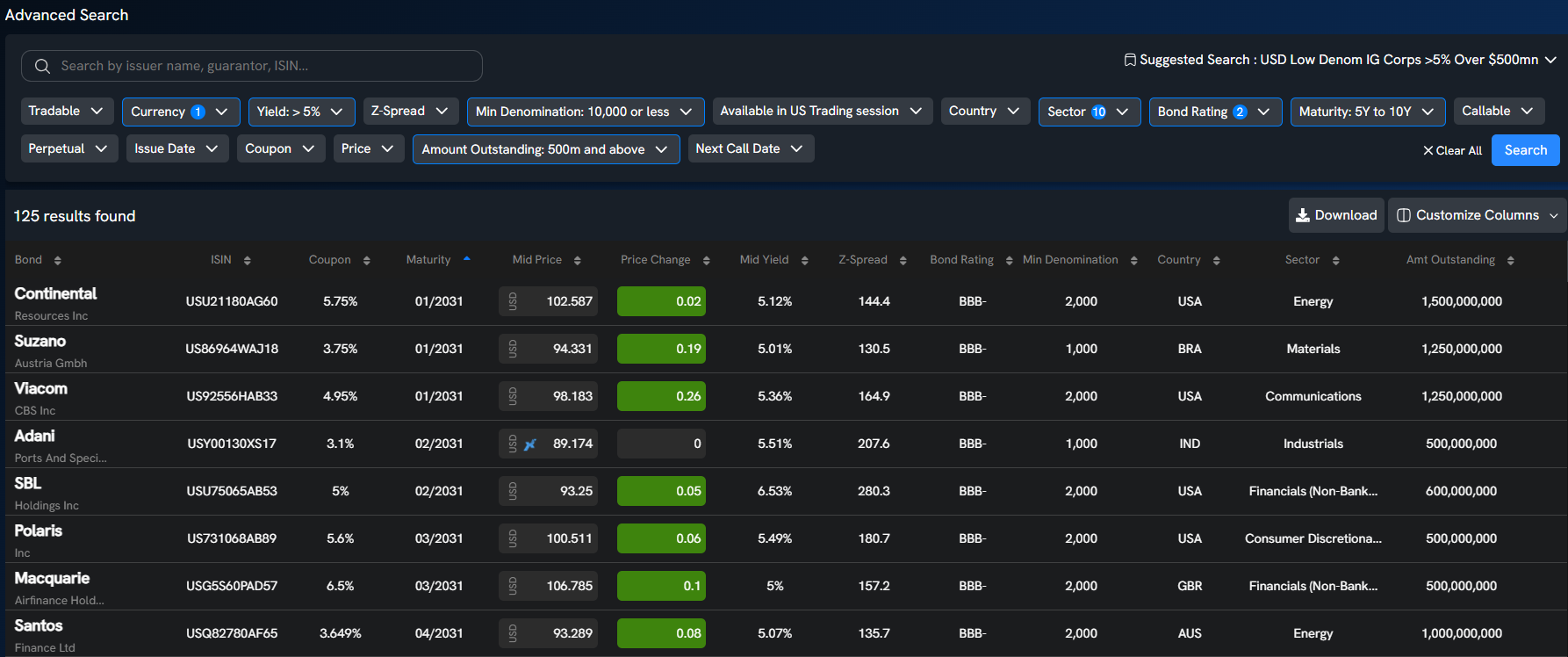

View Low Denomination IG Corporate Dollar Bonds Yielding Over 5%, Maturing in 5-10Y on BondbloX’s Upgraded Bond Screener

November 11, 2025

Several investment grade (IG) corporates have issued dollar bonds with credit spreads still near multi-year lows. Some of the recent popular largest IG deals include Meta’s $30bn six-trancher, Alphabet’s $17.5bn eight-part deal, Verizon’s $11bn five-part deal, Oracle’s $18bn eight-trancher amongst other deals. This comes on the back of steady economic data, solid corporate earnings and fundamentals, a relief in tariffs and the recent rate cuts by the Fed. IG bonds have thus performed well this year – for instance, 79%, 75% and 93% of IG dollar bonds rallied in Q1, Q2 and Q3 respectively.

In this regard, we have populated a list of IG corporate dollar bonds (non-financial) that yield over 5%, with a maturity range between 2031 and 2035. The list also has an amount outstanding of above $500mn and a minimum denomination of $10k or less. This list can also be viewed on the BondbloX App with our newly upgraded ‘Advanced Search’ bond screening tool on Desktop/PC.

Click here to explore the list under our ‘Saved Suggested Search’: USD Low Denom IG Corps >5% Over $500mn.

Go back to Latest bond Market News

Related Posts:

High-Yield Bonds Lead The July Recovery

August 6, 2018

Bond Yields – Explained

December 26, 2024

What to Look for When Buying Bonds

December 4, 2024