This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

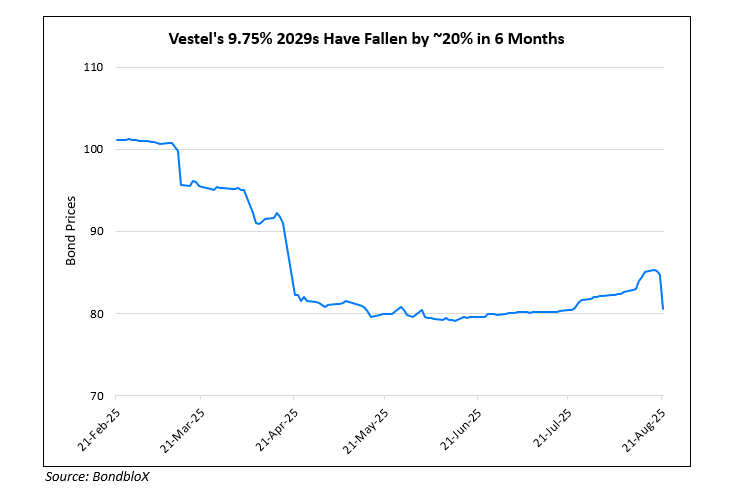

Vestel’s Dollar Bond Falls by 4 Points After Second Quarterly Loss

August 21, 2025

Vestel Electronik, one of Europe’s leading home appliance manufacturers, posted a second consecutive quarterly loss amounting to TRL 7.26bn ($177mn). Vestel’s sales are down 18% YoY and resulted in a net 1H2025 loss of TRL 12.6bn ($307.8mn). Fitch had earlier downgraded Vestel by two notches to B- in June this year on the back of softer demand and lower-than-expected sales volumes. Zorlu Holding, Vestel’s parent company, is itself facing cost cuts and debt reduction pressure. To tackle this, Vestel and Zorlu are reducing staff with expectations of improvement in performance.

Vestel’s stock has plummeted 46% this year, making it the worst performer in Turkey’s BIST-100 benchmark index. Vestel’s $500mn 9.75% 2029s fell by about 4 points yesterday. A fixed income broker said that high leverage, combined with operational losses, triggered a fresh wave of selling. The bonds are now trading at 80.6, yielding 16.97%.

Go back to Latest bond Market News

Related Posts: