This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

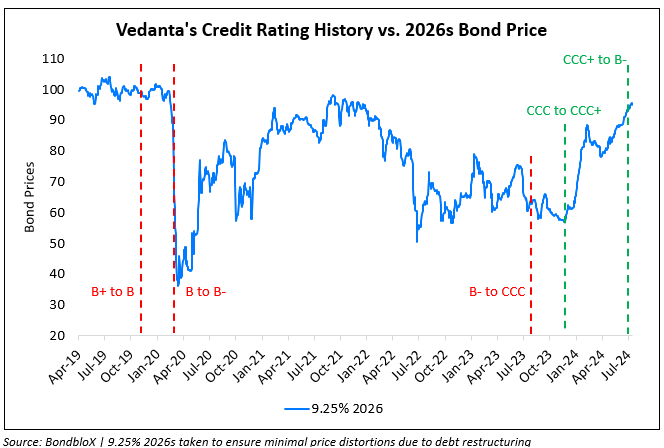

Vedanta Upgraded to B- by S&P; Dollar Bonds Among Top Performers YTD

July 26, 2024

Vedanta Resources was upgraded to B- from CCC+ by S&P, citing improving capital structure and liquidity. Following the recent funds raised and improved dividend capacity at its subsidiaries, S&P believes that Vedanta has “sufficient internal resources to meet debt maturities until December 2025”. With a $600mn 9.25% bond due in 2026, S&P believes Vedanta will proactively look to refinance the note to avoid any liquidity pressure later on. The rating agency also notes that Vedanta’s debt reduction efforts have seen its capital structure turn more sustainable. They expect a further debt reduction of $1bn to about $4.5bn over the next year, with regular brand fees and dividends collected also helping them deleverage.

Having endured financial strains over the past year, followed by a timely restructuring of its debt, the company’s bonds have been among the top performers this year with price returns of over 30%. In particular, its 9.25% 2026s have rallied by over 55% YTD.

Go back to Latest bond Market News

Related Posts:

Vedanta Reduces Debt by Another $1bn

April 25, 2023