This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta, San Miguel, ABN AMRO Price $ Bonds

November 26, 2024

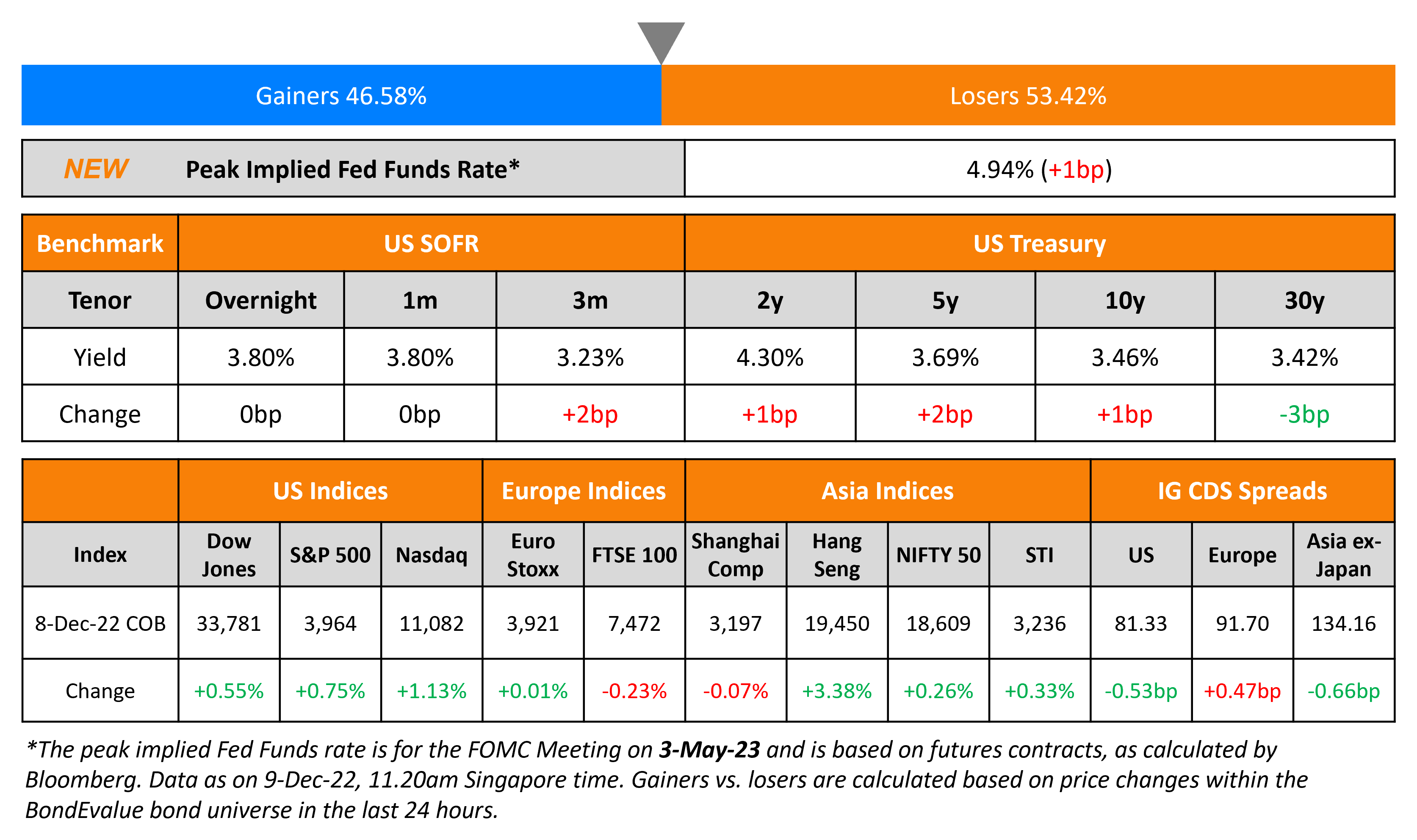

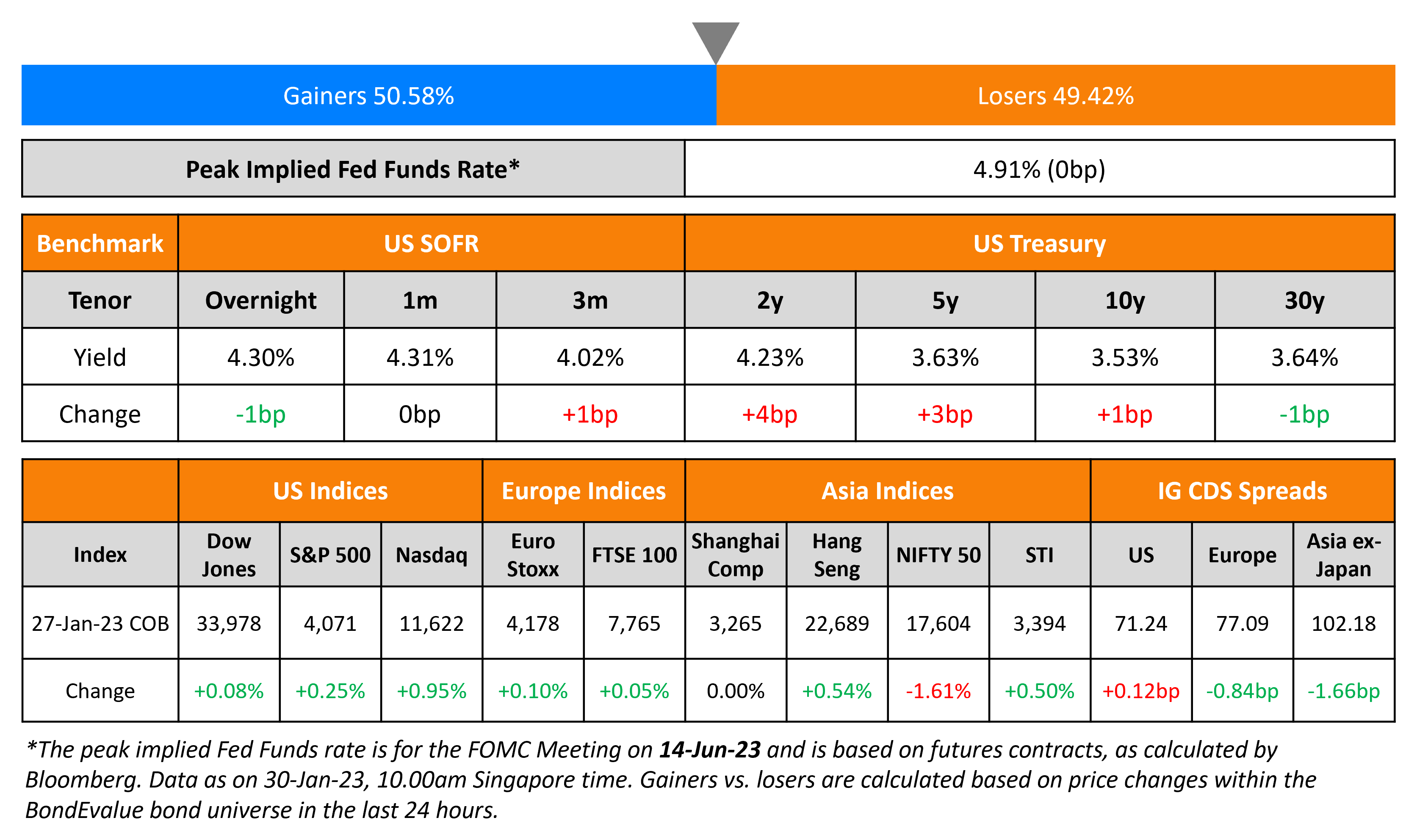

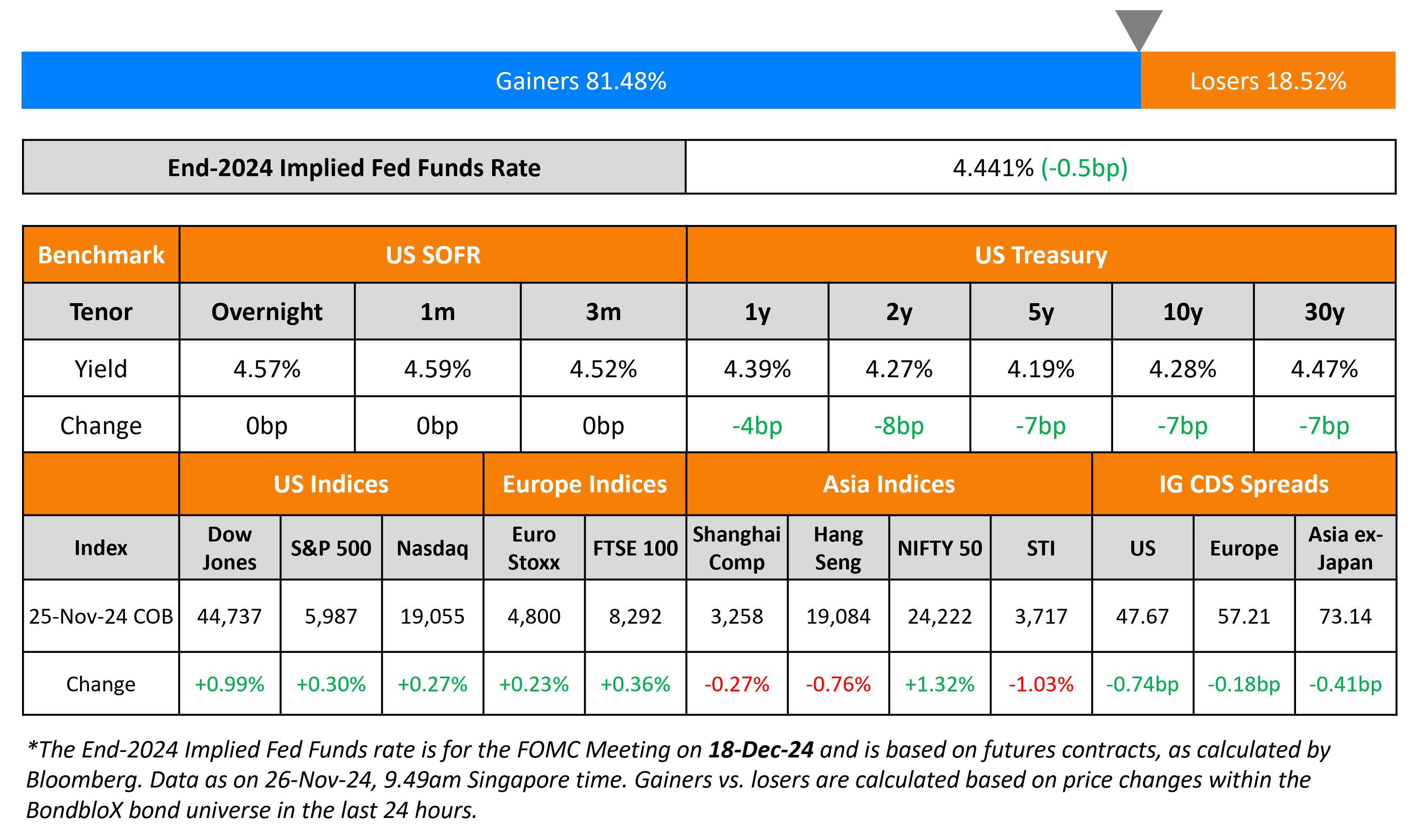

US Treasury yields dropped across the curve, with the long-end being impacted the most, falling by ~7bp on Monday. Minneapolis Fed President Neel Kashkari said that a December 25bp cut was “still a reasonable consideration”. Chicago Fed President Austan Goolsbee also said that “barring some convincing evidence of overheating”, he did not see the case for not having the fed funds rate ease. Separately, charges against Donald Trump regarding obstruction of justice and classified records regarding the 2020 election were dropped by the US Justice Department.

US IG and HY CDS spreads tightened by 0.7bp and 3.9bp respectively. In terms of the US equity markets, the S&P and Nasdaq closed 0.3% higher each. European equities followed suit and closed higher across the board too. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 0.2bp each. Asian equities have opened broadly mixed this morning. Asia ex-Japan CDS spreads tightened by 0.4bp.

New Bond Issues

Vedanta Resources raised $800mn via a two-part offering. It raised $300mn via a 3.5NC1.5 bond at a yield of 10.25%, 12.5bp inside initial guidance of 10.375% area. It also raised $500mn via a 7NC3 bond at a yield of 11.25%, 12.5bp inside initial guidance of 11.375% area. The senior unsecured notes are rated B-/B- by S&P/Fitch. Vedanta Resources Finance II PLC is the issuer of the notes. Proceeds will be used first to refinance its 2028s. The new notes have the following covenants:

- Negative Lien on brand fee receivables, other than the charge already created

- Cap on Incurred Debt:

- For parent guarantors and subsidiaries, the Fixed Charge Coverage Ratio (FCCR) has to stay at or exceed, 1.75x until March 2025, 2x until March 2026, 2.25x until March 2027 and 2.5x thereafter.

- For subsidiary guarantors:

- Attributable debt-to-EBITDA cannot exceed 6x currently and 5.5x after 30 Sep 2025

- A debt cap of $4bn excluding intercompany loans (against a 40.99% stake held by subsidiary guarantors) or consolidated FCCR of parent guarantor and subsidiaries at 3.5x

- Restricted Payments: A builder basket at 50% of net income, which increases to 100% of net income, if consolidated FCCR>3.5x

- Other Covenants include a limitation of distribution of net proceeds from asset sales and a change of control (CoC) event

The 3.5NC1.5 bond is callable after 1.5 years at par plus 25% of coupon and after 2.5 years at par. The 7NC3 bond is callable after 3 years at par plus 50% coupon, after 4 years at par plus 25% of coupon and at par after 5 years.

San Miguel Global Power raised $226.1mn via a PerpNC5.25 bond at a yield of 8.125%, 25bp inside initial guidance of 8.375% area. The coupons are fixed until 2 March 2030 and if not called by then, reset to the US 5Y Treasury yield plus the initial spread of 390.1bp. The notes also have a 250bp coupon-step up if not called or upon the occurrence of any CoC or reference indebtedness default event. If the CoC or reference indebtedness default event is cured or remedied, the coupon will decrease by 250bp from next distribution date. The notes also have a dividend pusher and dividend stopper. The total deal size is to the tune of $500mn, which includes $273.9mn of debt that is part of an exchange offer.

ABN AMRO raised $2bn via a three-tranche deal. It raised:

- $750mn via a 4NC3 bond at a yield of 4.988%, 32bp inside initial guidance of T+110bp area

- $500mn via a 4NC3 FRN at SOFR+100bp vs. inside initial guidance of SOFR equivalent area

- $750mn via a 11NC10 bond at a yield of 5.515%, 25bp inside initial guidance of T+150bp area

The senior non-preferred notes are rated Baa1/BBB/A. Proceeds will be used for general corporate purposes.

Citigroup raised $1.5bn via a PerpNC5 preference share at a yield of 6.75%, 37.5bp inside initial guidance of 7.125% area. The notes are rated Ba1/BB+/BBB- (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes including partial/full redemption of outstanding shares of Citigroup preferreds and related depositary shares, and repurchases/redemptions of other outstanding securities of Citigroup and its subsidiaries.

Rating Changes

-

Moody’s Ratings downgrades Whirlpool’s senior unsecured ratings to Baa3; outlook remains negative

-

Fitch Takes Negative Rating Actions on Adani Group’s Infrastructure Entities and Restricted Groups

-

Fitch Places Ratings on Adani Energy and Adani Electricity Mumbai on Watch Negative

-

Health And Happiness Outlook Revised To Negative On Revenue Weakness; ‘BB’ Ratings Affirmed

Term of the Day: Cross Default

Cross default is a covenant included in bond and loan documents that puts an issuer in default if it has defaulted on another debt instrument. Cross defaults tend to have a domino effect, which puts the issuer under further pressure of making accelerated repayments and reduces its ability to refinance.

Talking Heads

On Trump Trade Muddling Inflation Outlook in Fed’s Favorite Gauge

Skanda Amarnath, Employ America

“Either stocks have to correct or the Fed’s going to be in a position where they’re forced to slow down their cuts and be a little hawkish”

Veronica Clark, Citigroup

“It’s not necessarily something you ignore. But strength from that component isn’t really something that would be so concerning to Fed officials.”

On Risk of US Credit Cycle Overheating Underpriced – Deutsche Bank

“Simply put, a hawkish Fed pivot is near… risk of an over-heating US cycle is underpriced… For IG investors, the big surprise in 2025 could be much lower inflows than predicted… for speculative grade investors, next year may provide a dawning realization that leveraged issuers will be unable to refinance their existing debt more cheaply”

On Fed Should Pause, Opposing Its Economists – Citi Strategists

“We believe that the Fed should put easing on hold, barring weak payrolls data in December… can be argued that other labor market data such as jobless claims are indicating a resilient labor market.”

Top Gainers and Losers- 26-November-24*

Go back to Latest bond Market News

Related Posts: