This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta Rolls Over Debt Repayment to Group Company; Analysts Cautious on Subsidiary Dividends

July 24, 2023

Vedanta Resources has rolled over its debt repayment to group company Twin Star Holding with a new interest that is more than twice the figure previously. A $956mn loan, which has $449mn outstanding and made by Vedanta’s subsidiary Cairn India Holdings in FY21, had its repayment date extended to end-2024, with the interest rate increased to 17% from 7% previously. The extension of inter-company loans will allow the company to meet its external debt repayments, which amounts to about $2.2bn outstanding for FY24, of which $1bn is from a 13.875% bond due in January 2024. S&P has earlier warned Vedanta Resources of a potential rating action in the absence of a credible refinancing plan by end-July. Separately, banks have expressed concern over the large dividend payouts Vedanta Ltd. made to Vedanta Resources, its parent company, in an attempt to help the latter deleverage. This is because such payouts could put stresses on Vedanta Ltd., thus making banks more cautious over their exposure to the Indian subsidiary.

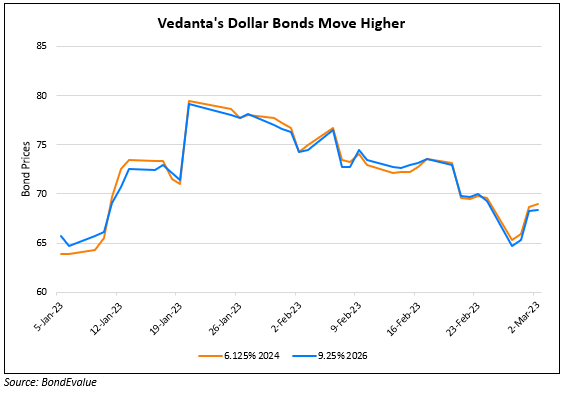

Vedanta’s dollar bond prices have fallen 1-2% over the past week. In particular, its 6.125% 2024s have fallen 1.9% and are currently trading at 65.4 cents on the dollar.

Go back to Latest bond Market News

Related Posts: