This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

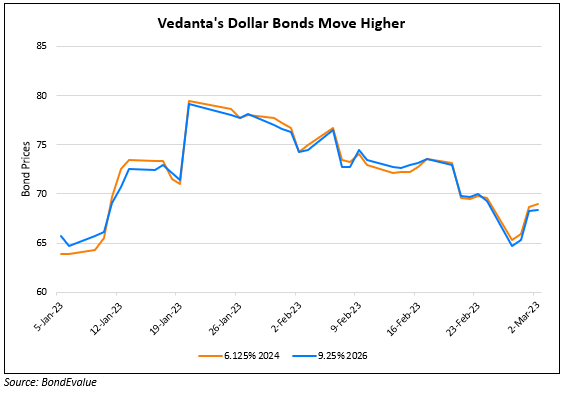

Vedanta Open to Revising Debt Repayment Terms

October 9, 2023

Vedanta Resources’ bondholders have pushed back on the initial debt restructuring proposal by the company. As per our update published last week,, the initial debt restructuring plan would have allowed the company to pay 50% of the January 2024s and a smaller portion of the 2025s in cash, with the rest of the principal being deferred for three years. As per the latest news, some bondholders are demanding a higher upfront cash payment while other investors are requesting changes to collateral for some debt. The company mentioned that it was open to revising the debt restructuring proposal and added that the discussions are ongoing and no conclusion has been reached yet.

Vedanta’s dollar bonds remained steady with its 13.875% bonds due January 2024 trading at 88.7 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: