This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta Hires for $ Bond; ABN Amro Prices € PNC10 AT1 at 6.375%

September 3, 2024

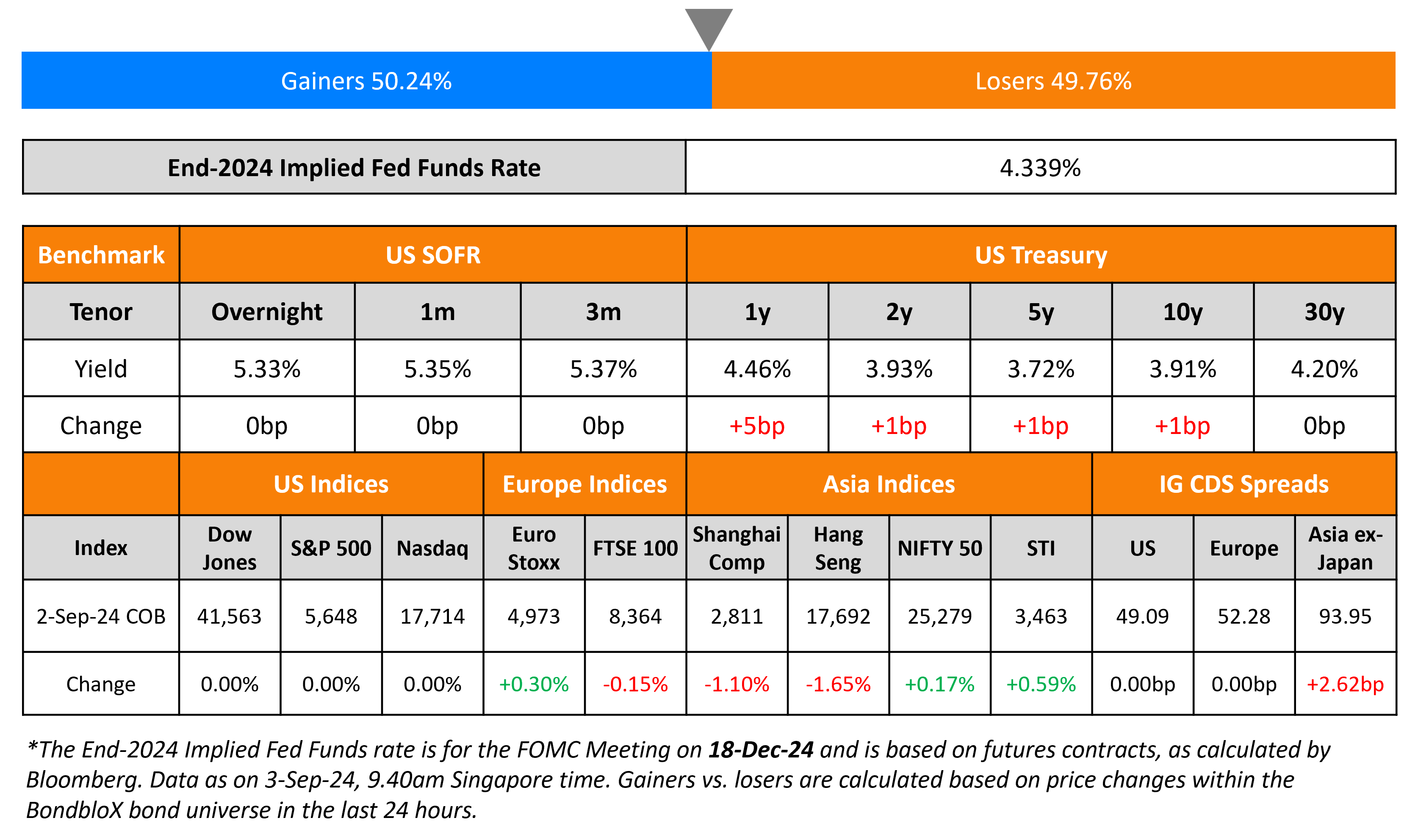

US Treasury yields were stable across the curve. US equity and CDS markets were closed on Monday on account of the Labor Day holidays. European equity markets ended mixed. Looking at Europe’s CDS spreads, the iTraxx Main spreads were flat while Crossover spreads tightened by 0.2bp. Asian equity indices have opened broadly lower this morning. China’s Caixin Manufacturing PMI came in at 50.4 in August, vs. expectations of 50 and rising modestly from 49.8 in July. Asia ex-Japan CDS spreads widened by 2.6bp.

New Bond Issues

- Power Construction $ 3Y Green at T+100bp area

- Sumitomo Mitsui Trust $ 3Y/3Y FRN/5Y at T+105/SOFR Equiv/120bp area

ABN Amro raised €750mn via a PerpNC10 AT1 bond at a yield of 6.375%, 62.5bp inside initial guidance of 7% area. The junior subordinated notes are rated BBB- (Fitch). The bond is callable on 22 September 2034 and every interest payment date thereafter. If not called on 22 September 2034, the coupon resets to EUR 5Y Swap plus 390.2bp. A trigger event would occur if the issuer’s solo CET1 ratio falls below 5.125% or it’s consolidated CET1 ratio falls below 7%. The bond offers a yield pick-up of 27.5bp over its existing EUR 6.875% Perp which is callable in September 2031 and currently yields 6.1% to call.

New Bonds Pipeline

- Vedanta hires for $ 5NC2/7NC3 bond

- Abu Dhabi Commercial hires for $ 10.5NC5.5 T2 bond

- ADNOC Murban RSC hires for $ 5Y/10Y/30Y bond

- Canara Bank hires for $ 5Y bond

- Bank of Sharjah hires for $ 5Y bond

- Nan Shan Life Insurance hires for $ 10Y T2 bond

- Wuhan Metro hires for $ bond

Rating Changes

- Azul S.A. Downgraded To ‘CCC+’ From ‘B-‘ On Weaker Results And Tighter Liquidity; Outlook Negative

- Fitch Revises Outlook on Pacific National to Negative; Affirms at ‘BBB-‘

- Outlook On Xiaomi Revised To Positive On Resilient Core Segment Performance, Clarity On EV Spend; ‘BBB-‘ Rating Affirmed

Term of the Day

Collateralized Loan Obligations (CLO)

Collateralized Loan Obligations (CLO) are securities backed by a pool of underlying loans. The loans are packaged together by a process of securitization. The loans are bundled together in tranches in an order of risk – for example, the AAA rated tranche comes with the lowest default risk while a BB tranche has a higher default risk. Investors can choose the tranche they prefer based on risk appetite. Given that the underlying loans are floating rate loans, they are also considered a hedge against inflation.

Talking Heads

On global stocks starting September in cautious mood

Aneeka Gupta, WisdomTree

“European equities have opened on a weaker footing owing to weaker economic data from China… industrials and consumer discretionary sector led the declines”

Ben Laidler, Bradesco BBI

“We are seeing some natural caution at the beginning of a critical month for markets, with the Fed set to start its interest rate cutting cycle”

Carl Hammer, SEB

“We’re always a bit cautious when we’re trading at all time highs and when earnings expectations continue to be fairly lofty in the U.S. in particular”

On CLO Managers Tempting Investors With Sweeteners as Market Revives

Walton, Sona Asset Management

“Underperforming names haven’t rallied like the rest of the market and managers will have to be cautious of the impact on the liability pricing”

Fitch analysts

“The portfolio credit quality of European collateralised loan obligations being reset in 1H24 improved compared to the original transactions”

Top Gainers & Losers-03-September-24*

Go back to Latest bond Market News

Related Posts: