This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta, Egypt, Kuwait, Transocean, Carnival Price $ Bonds

October 1, 2025

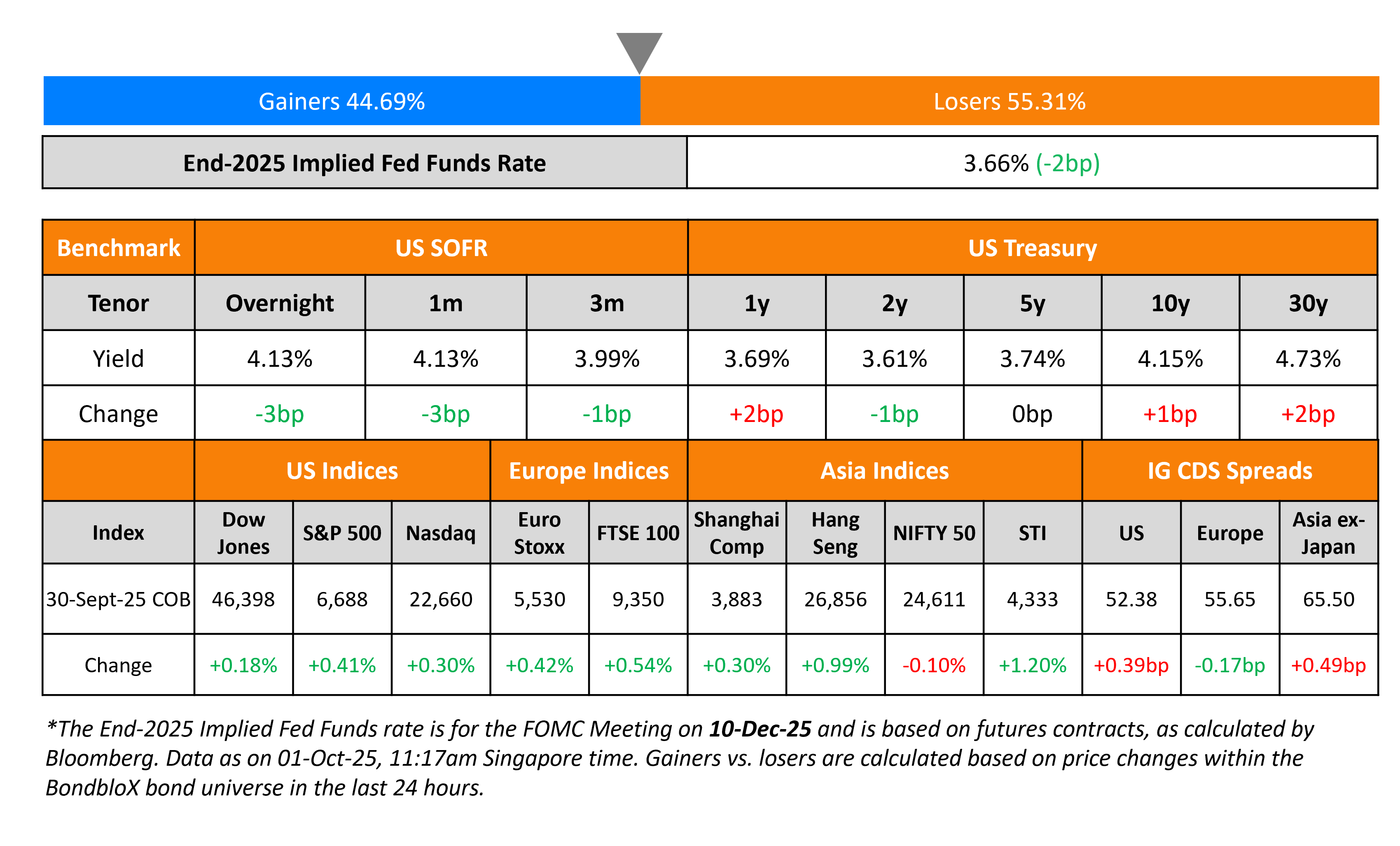

US Treasury yields were steady on Tuesday. The US government shutdown took effect as senators failed to agree on a last-minute spending bill. It is therefore likely that Friday’s NFP release by the Bureau of Labor Statistics (BLS) may not happen as scheduled. Separately, Boston Fed President Susan Collins said that more easing may be appropriate in 2025, albeit still “moderately restrictive” due to the weaker labor market. However, she cautioned that the Fed must still be wary of the persistent inflation.

Looking at equity markets, both the S&P and Nasdaq ended 0.4% and 0.3% higher respectively. US IG CDS spreads were wider by 0.4bp while HY CDS spreads were flat. European equity markets ended higher too. The iTraxx Main CDS and Crossover CDS spreads tightened by 0.2bp each. Asian equity markets have broadly opened mixed today. Asia ex-Japan CDS spreads were 0.5bp wider.

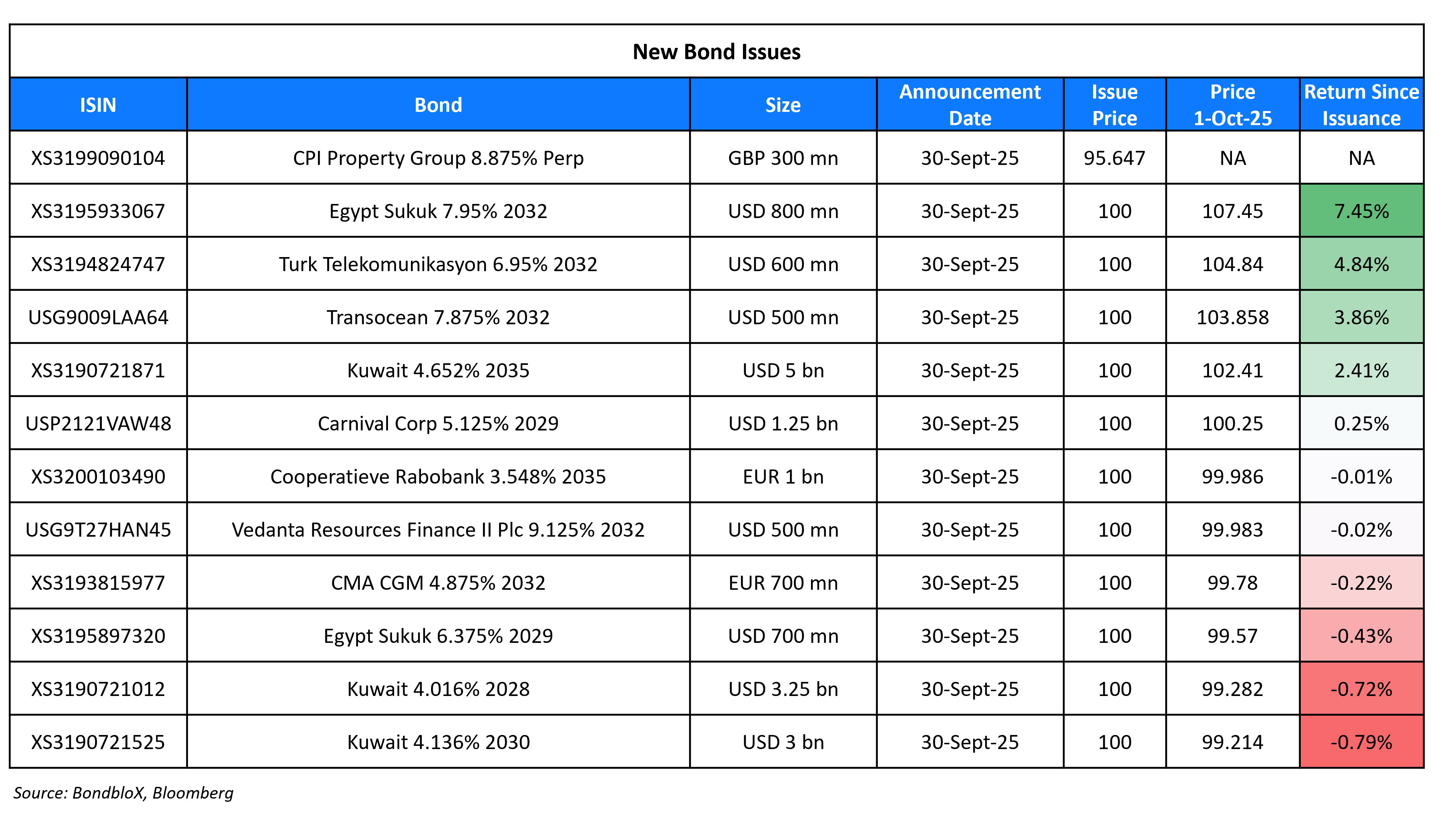

New Bond Issues

- Starhill Global REIT S$ PerpNC5 at 3.5% area

Vedanta Resources Finance raised $500mn via a 7NC2 bond at a yield of 9.125%, 37.5bp inside initial guidance of 9.50% area. The senior unsecured note is rated B2/B+ (Moody’s/Fitch), and received orders of over $2.2bn, 4.4x issue size. Proceeds from the offering together with proceeds from existing bank loans will be used to repay its private credit facility. The note has a parent guarantee from Vedanta Resources Limited and a subsidiary guarantee from each of Twin Star Holdings Ltd., Welter Trading Ltd. and Vedanta Holdings Mauritius II Ltd. Separately, short seller Viceroy Research questioned the latest bond issuance, claiming Vedanta had already taken out a loan to fund the debt refinancing. However, Vedanta clarified that part of the earlier loan was used for a different debt repayment.

Egypt raised $1.5bn via a two-part sukuk deal. It raised $700mn via a long 3Y sukuk at a yield of 6.375%, 50bp inside initial guidance of 6.875% area. It also raised $750mn via a 7Y note at a yield of 7.95%, 55bp inside initial guidance of 8.50% area. The senior unsecured notes are rated B-/B, and received orders of over $8.5bn, 5.7x issue size. Proceeds will be used for general corporate purposes. The new 3Y sukuk is priced inline with its existing 7.6% 2029s that currently yield 6.38%. The new 7Y sukuk is priced ~8bp tighter to its existing 7.625% 2032s that currently yield 8.03%.

Kuwait raised $11.25bn via a three-trancher. It raised:

- $3.25bn via a 3Y bond at a yield of 4.016%, 30bp inside initial guidance of T+70bp area

- $3bn via a 5Y bond at a yield of 4.136%, 35bp inside initial guidance of T+75bp area

- $5bn via a 10Y bond at a yield of 4.652%, 35bp inside initial guidance of T+85bp area

The senior unsecured notes are rated A+/AA-, and received orders of over $23.7bn, 2.1x issue size.

Carnival raised $1.25bn via a 3.5Y bond at a yield of 5.125%, 12.5bp inside initial guidance of 5.25% area. The senior unsecured note’s ratings are yet to be determined. Proceeds, along with cash on hand will be used to fully redeem its $2bn 6% 2029s.

Transocean International raised $500mn via a 7NC3 bond at a yield of 7.875%, 12.5bp inside initial guidance of 8% area. The senior priority notes are rated B3 /B-. Proceeds, together with the release of certain restricted cash amounts relating to its 6.875% 2027s will be used to (a) refinance, repay or redeem its 8% 2027s and 6.875% 2027s (b) fund the cash tender offer for its 7.35% 2041s.

CMA CGM raised €700mn via a 6.3NC2 bond at a yield of 4.875%, 37.5bp inside initial guidance of 5.25% area. The senior unsecured note is rated Ba1/BB+. Proceeds will be used for general corporate purposes.

Turk Telekom raised $600mn via a 7Y green bond at a yield of 6.95%, 42.5bp inside initial guidance of 7.375% area. The senior unsecured note is rated BB/BB- (S&P/Fitch). Proceeds will be used to finance and/or refinance eligible businesses and projects in accordance with its sustainable finance framework.

CPI Property raised £300mn via a PerpNC5.25 hybrid bond at a yield of 10%, ~50bp inside initial guidance of mid-10% area. The subordinated bond is rated Ba3/B+. If not called by 7 January 2031, the coupon will reset to 5Y Mid-Swap plus 564.8bp and any relevant step-up. The notes have a step-up of 25bp and 75bp if not called by 7 January 2036 and 7 January 2046 respectively. The notes will be mandatorily exchanged for fully-paid Conversion Beneficiary Units if the ratings of issuer are lowered to Caa1 by Moody’s. Proceeds will be used for general corporate purposes, including repurchase of the minority equity stake in CPI Project Invest and Finance, A.S. held by funds managed by Sona Asset Management.

New Bond Pipeline

- Bahrain $ long 8Y sukuk/12Y bond

Rating Changes

- Fitch Upgrades Dell Technologies to ‘BBB+’; Outlook Stable

- Moody’s Ratings upgrades Carpenter Technology’s CFR to Ba2; outlook remains positive

- Moody’s Ratings downgrades Braskem’s rating to Caa3; outlook remains negative

- Fitch Places Carnival Corp. on Rating Watch Positive

- Transocean Ltd. Outlook Revised To Stable From Negative On Improved Liquidity, Ratings Affirmed; Proposed Notes Rated

- Carnival Corp. Outlook Revised To Positive, Ratings Affirmed; Proposed $1.25 Billion Notes Rated ‘BB+’ (Recovery: ‘3’)

- easyJet Upgraded To ‘BBB+’ On Robust Operating Performance And Balance Sheet; Outlook Stable

- Yuexiu REIT Outlook Revised To Stable On Debt Reduction Following Asset Sale; Ratings Affirmed

Term of the Day: Hybrid Bonds

Hybrid bonds are called “hybrids” because they combine characteristics of both bonds and equities. These instruments may be issued by both banks and non-financial corporates. A common example of hybrid bonds would be perpetual bonds, which are fixed income securities without a maturity date (similar to equities) that pay a fixed coupon to holders (similar to bonds). Perpetuals typically have a call option, which allows the bond issuer to redeem the bonds at a fixed date. It is important to note that the option to redeem lies with the bond issuer, not the holder.

Talking Heads

On Bond Traders Boosting Bets on 10Y Rally as Shutdown Approaches

Ian Lyngen and Vail Hartman, BMO Capital Markets

“Investors appear to be interpreting any potential shutdown uncertainty as support for a lower fed funds rate”

On Wall Street Strategists Split Over Potential Fed Policy Rate

Morgan Stanley

SOFR is a “more viable target” if the Fed decides to clear repo transactions

Wrightson ICAP

If the Fed chooses to adopt a single rate as its new operating target, TGCR is the strongest candidate

Wells Fargo

TGCR better represents the marginal cost of funds and return on investment in short-term funding markets… “In a TGCR target rate world, we suspect the Fed would be modestly comfortable with a small, temporary move above the upper end of the target range on a quarter-end date”

Goldman Sachs

Making the TGCR the official target would reinforce the Fed’s commitment to ensuring that rates remain within the band

Citigroup

targeting TGCR “would mean the Fed controls the rate cash borrowers receive for UST repo, while SOFR also includes the cost of intermediation”

On Inflation Risks ‘Quite Contained’ in Each Direction – ECB President, Christine Lagarde

“The risks to inflation appear quite contained in both directions… With policy rates now at 2%, we are well placed to respond if the risks to inflation shift, or if new shocks emerge that threaten our target… We are in a good place today, but that place is not fixed”

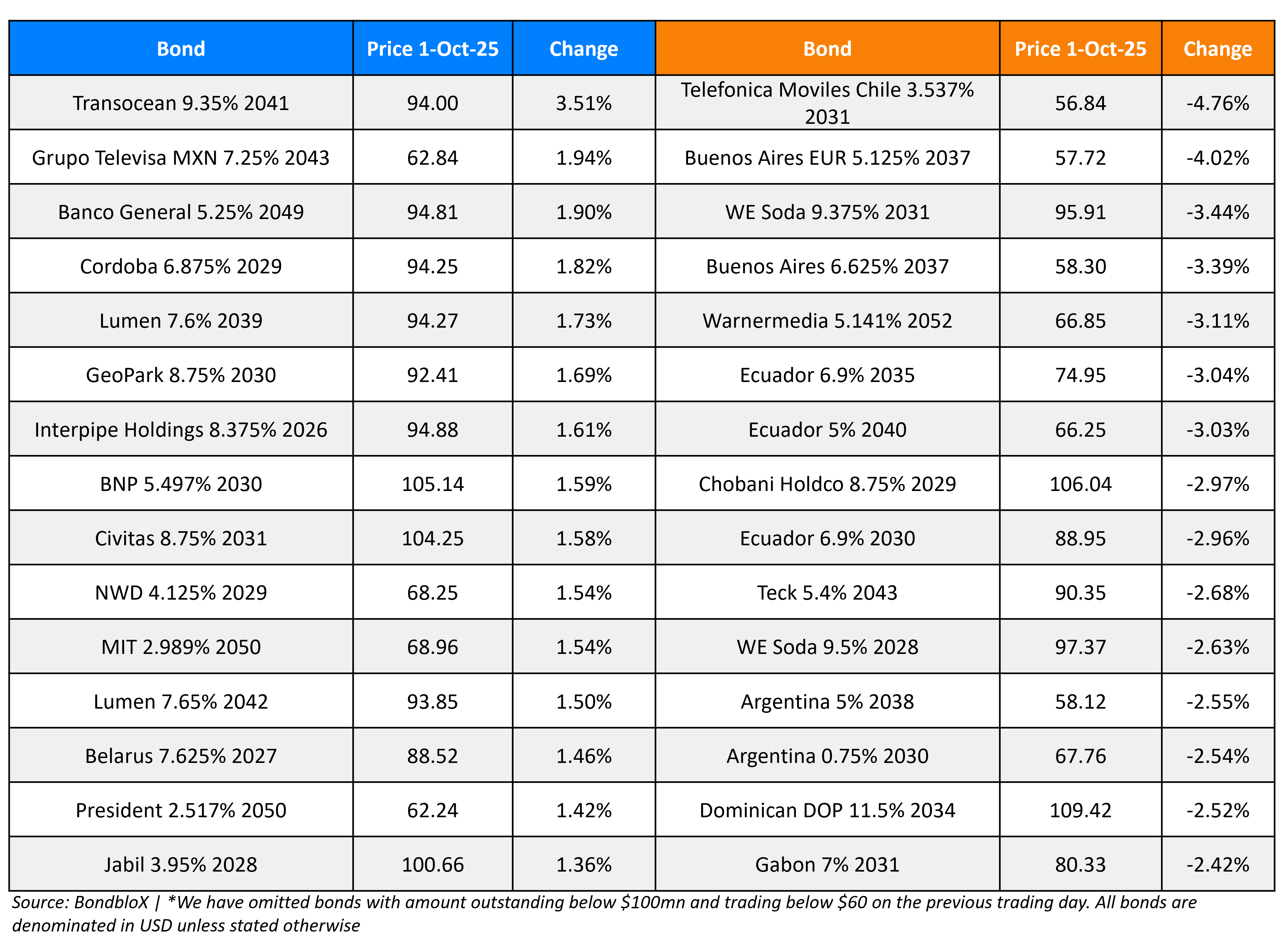

Top Gainers and Losers- 01-Oct-25*

Go back to Latest bond Market News

Related Posts: