This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

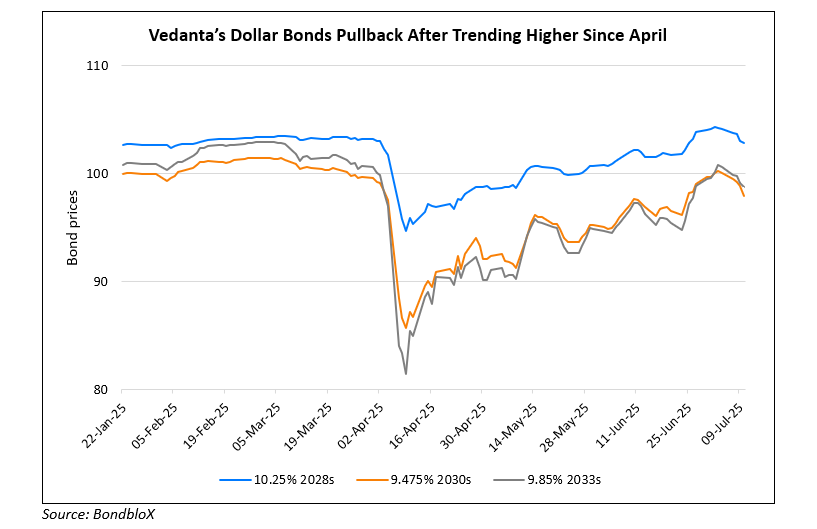

Vedanta Bonds Drop After Viceroy Research Issues Short Sale Report

July 10, 2025

Vedanta’s dollar bonds fell by nearly one point after Viceroy Research released a report and announced that it is shorting the debt of Vedanta Resources Limited (VRL). It cited that “the entire group structure is financially unsustainable, operationally compromised, and poses a severe, under-appreciated risk to creditors.” The report criticized VRL of systematically draining its Indian subsidiary Vedanta Ltd, “forcing the operating company to take on ever-increasing leverage and deplete its cash reserves.” It added that VRL’s actions to meet short-term obligations has “pushed the entire group to the brink of insolvency”.

A Vedanta spokesperson responded by dismissing the report as “a malicious combination of selective misinformation and baseless allegations”. Meanwhile, a market participant noted that the group’s layered structure continues to obscure transparency in finances and governance, raising potential re-rating risks especially if intra-group transactions and refinancing plans remain unclear. Vedanta Limited’s net debt has increased by $6.7bn since FY2022. However analysts do note that Vedanta has met all debt obligations without any delays over the past year.

Vedanta shares were down by as much as 7.8% intraday immediately after the announcement. All five of Vedanta’s dollar bonds were also down – its 11.25% 2031s fell by 0.9 points to 103.14, yielding 10.34%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: