This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Vedanta Bondholders Said to Demand Higher Coupons on Potential Restructured Bonds

October 27, 2023

Vedanta Resources’ dollar bondholders are said to be demanding higher coupons on the potential restructured bonds that it may issue to rollover its maturity profile, as per sources. They noted that bondholders believe the new bonds may offer a coupon of 14% which is low, as compared to their recent debt borrowings from Standard Chartered and JPMorgan at 17%. Besides, one bondholder added that its restructured bonds may come with significant capex restrictions and may limit Vedanta’s growth and expansion plans. They are also said to have been concerned about raising new loans at high rates and its plans to prepay existing bonds amongst other issues that could lead to negative credit rating actions and long-term financial challenges.

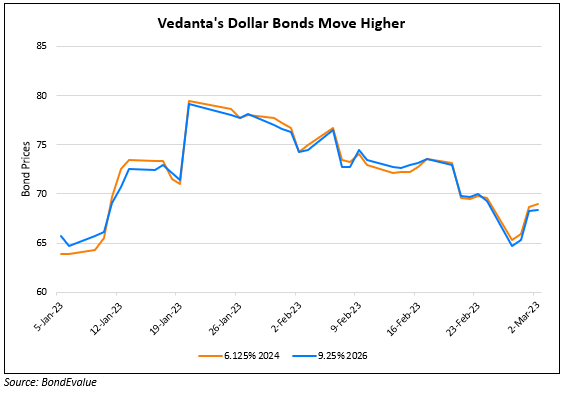

Vedanta’s dollar bonds were trading stable with its 8.95% 2025s at 73.17 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts: