This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

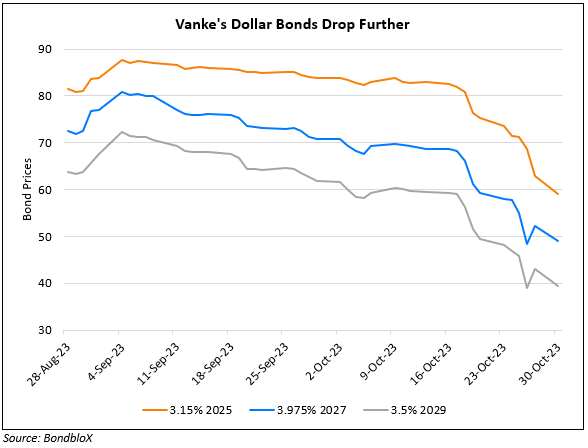

Vanke Downgraded Two Notches to Baa3 by Moody’s

November 27, 2023

China Vanke has been downgraded by two notches to Baa3 from Baa1 by Moody’s. Moody’s also downgraded the ratings on its senior unsecured bonds of Vanke from Baa2 to Ba1. The rating action reflects Vanke’s weakening contracted sales, which underperformed the broader market in the first ten months of 2023. Moody’s expects that Vanke’s credit metrics and liquidity buffer will weaken over next 12-18 months. In addition, Vanke’s access to long-term funding remains uncertain which could constrain the financial flexibility of the company. Moody’s has a negative outlook on Vanke, reflecting high uncertainty over the company’s ability to improve its operating performance amid challenging industry prospects.

However, Vanke’s dollar bonds were positive on the back of support from Chinese government news last week. Vanke’s 5.35% 2024s were at 97.3 cents on the dollar, yielding 15%.

Go back to Latest bond Market News

Related Posts:

China Vanke Plans $2.2bn Share Issuance to Boost Capital

February 14, 2023

Vanke’s Dollar Bonds Dip Amid Drop in Earnings and Sales

October 30, 2023