This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

UST Curve Bear Flattens; HSBC Launches S$ Perp at 5.25% Area

March 18, 2025

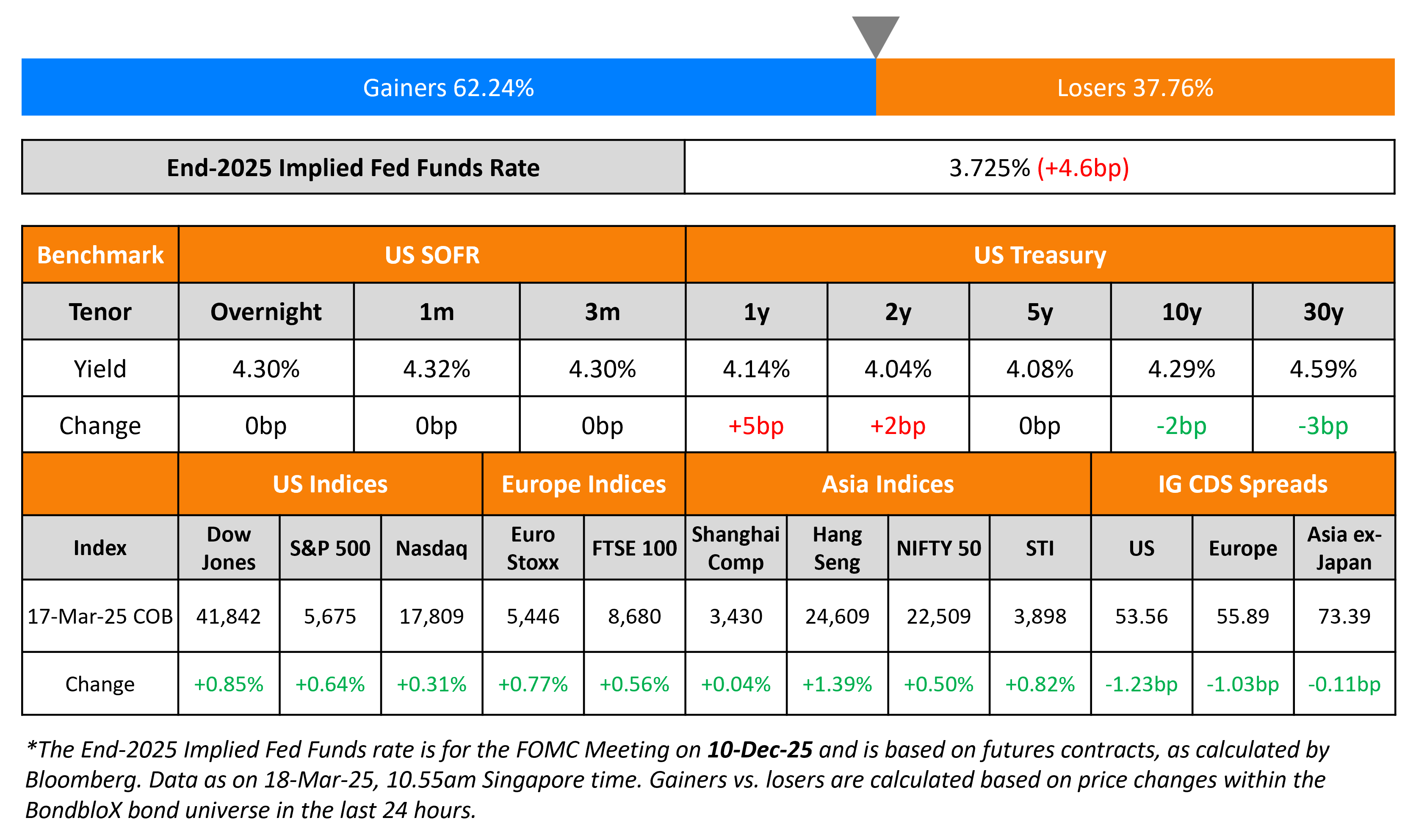

The US Treasury curve bear flattened further, with short-end yields inching higher by 2-5bp while the long-end of the curve moved 2-3bp lower. US Retail Sales for February came-in at 0.2%, improving from the prior -1.2% print, but was lower than expectations of 0.6%. Core Retail Sales came-in at 0.5%, improving from the prior -0.8% print, and was again lower than expectations of 0.4%. The Empire Manufacturing Index for March came-in at -20.0, much lower than expectations of -1.9.

US equity markets moved higher on Monday, with the S&P and Nasdaq rallying by 0.6% and 0.3% respectively. Looking at credit markets, US IG and HY spreads CDS spreads tightened 1.2bp and 3.4bp respectively. European equity markets ended higher too. The iTraxx Main and Crossover CDS spreads tightened by 1bp and 4bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 0.1bp.

New Bond Issues

- HSBC S$ PerpNC5.5 AT1 at 5.25% area

- Bangkok Bank $ 15NC10 at T+215bp area

- BTN Indonesia $ 5Y Tier 2 at 6.55% area

SingTel Optus raised S$250mn via a 7Y bond at a yield of 3.125%. The senior unsecured note is rated A3/A-. The issuer is Optus Finance Pty Ltd. Proceeds will be used to refinance existing borrowings or repay loans, finance business activities, acquisitions and for general working capital purposes.

Santander Holdings USA raised $2bn via a three-part deal. It raised:

- $850mn via a 4NC3 bond at a yield of 5.473%, 20bp inside initial guidance of T+165bp area

- $400mn via a 4NC3 FRN at SOFR+161bp vs. initial guidance of SOFR equivalent area

- $750mn via a 6NC5 at a yield of 5.741%, 20bp inside initial guidance of T+185bp area

The senior unsecured bonds are rated Baa2/BBB+/A-. Proceeds will be used for general corporate purposes.

Bank Mandiri raised $800mn via a 3Y bond at a yield of 5.124%, 32bp inside initial guidance of T+145bp area. The senior unsecured bond is rated Baa2/BBB. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- Shinhan Bank hires for $ bond

- Ahli Bank Qatar hires for $500mn WNG 5Y bond

- Greenko Wind hires for $ 3.5Y bond

Rating Changes

-

Emaar Properties Upgraded To ‘BBB+’ On Strong Business Performance; Outlook Stable

-

Fitch Upgrades Binghatti Holding Ltd.’s Ratings to ‘BB-‘; Outlook Stable

-

Moody’s Ratings revises Indika Energy’s outlook to negative; affirms Ba3 ratings

-

Moody’s Ratings changes Amazon’s outlook to positive; affirms A1 senior unsecured notes ratings

-

Fitch Revises Hellenic Bank’s Outlook to Positive; Affirms at ‘BBB-‘

Term of the Day

Debt-for-Nature Swap

Debt-for-nature swaps are a transaction wherein an amount of debt owed by a developing country government is cancelled or reduced by a creditor, and swapped with a financial commitment earmarked for environmental conservation. Once the creditor reduces or cancels the debt repayment amount, both the creditor and debtor arrive at an agreed amount that would have otherwise been used for servicing the debt, to be used for environmental projects. These swaps typically involve countries that are distressed and find it difficult to repay offshore debt. The earnings generated through swaps are often administered by local conservation or environmental trust funds.

Colombia has rejected offers to conduct a debt-for-nature swap over fears that it could impact its sovereign credit rating.

Talking Heads

On Taking Profit on Japan Bond Trade as Interest Rates Rise – Sachin Gupta, PIMCO

“Rates have gone up, but they have basically gone up in line with our expectations from a while ago. And so that’s why it makes sense to take profits and reassess… Because the selloff really began in the longer-end of the yield curve and they got higher there, so on a relative basis it makes sense to have some allocation to the longer end”

On Fed Being in Wait-and-See Mode. Investors Want Reassurance It Will Act If Needed

Dominic Konstam, Mizuho Securities

“Powell needs to give some sort of a signal that they’re watching it”

James Athey, Marlborough Investment Management

“At the margin, the Fed could make it slightly better or slightly worse”

Sarah House, Wells Fargo

“We’ll hear the message that things are still holding up, and that policy is in a good place where the Fed can react in either direction”

On Banks That Saw $3,000 Gold Coming Are Staying Bullish for Now

Marcus Garvey, Macquarie

“We do still think there are some materially bullish developments likely to come for gold. I don’t really see things that would suggest to us that this rally is in an area that’s become frenzied or overextended.”

Max Layton, Citigroup

“While there’s been a lot of central-bank buying and evidence of high-net-worth individuals buying over the last 12-18 months as a hedge against downside risks in equities and US growth, the household hasn’t really bought yet”

Top Gainers and Losers- 18-March-25*

Go back to Latest bond Market News

Related Posts: