This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Downgraded to AA+ from AAA by Fitch

August 2, 2023

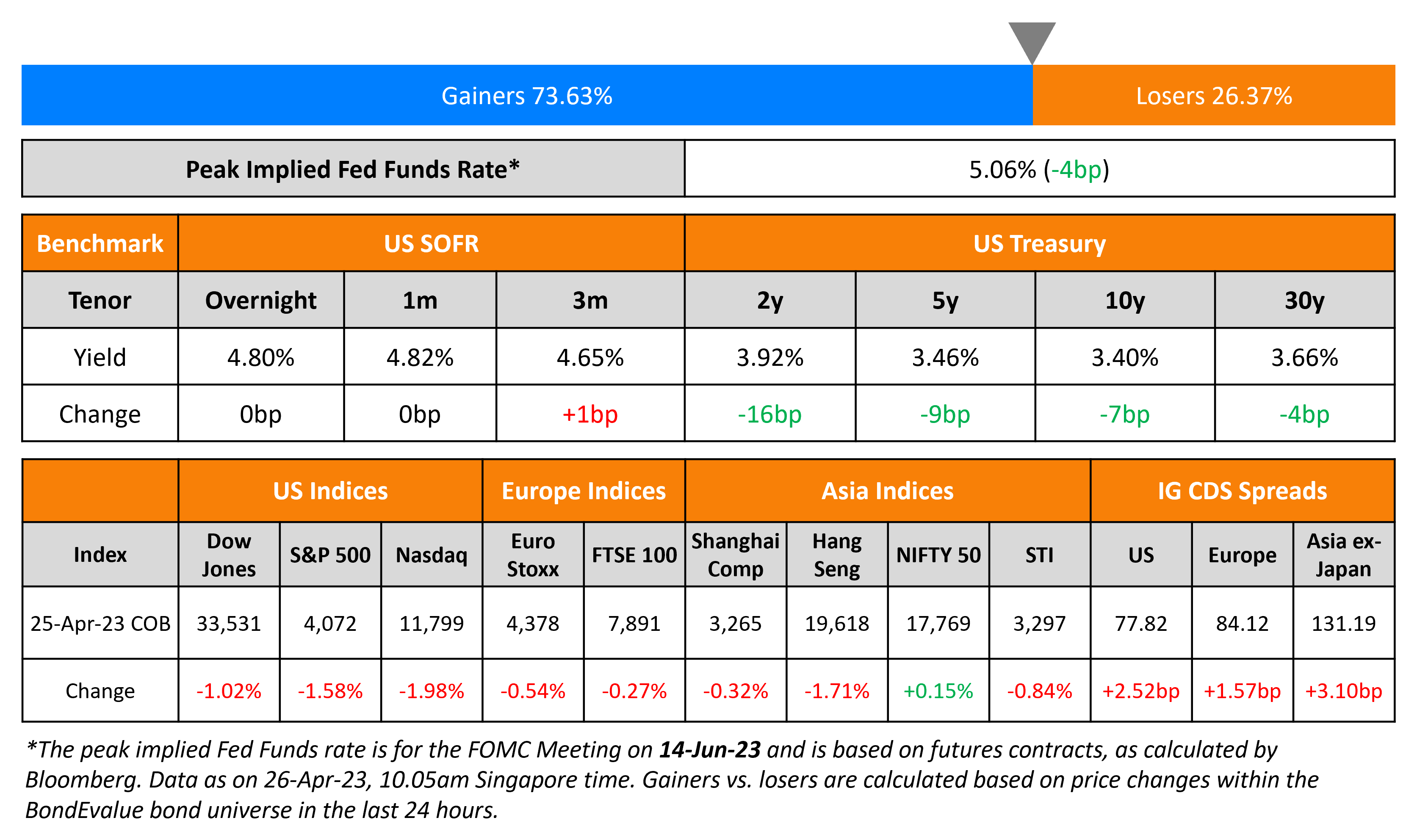

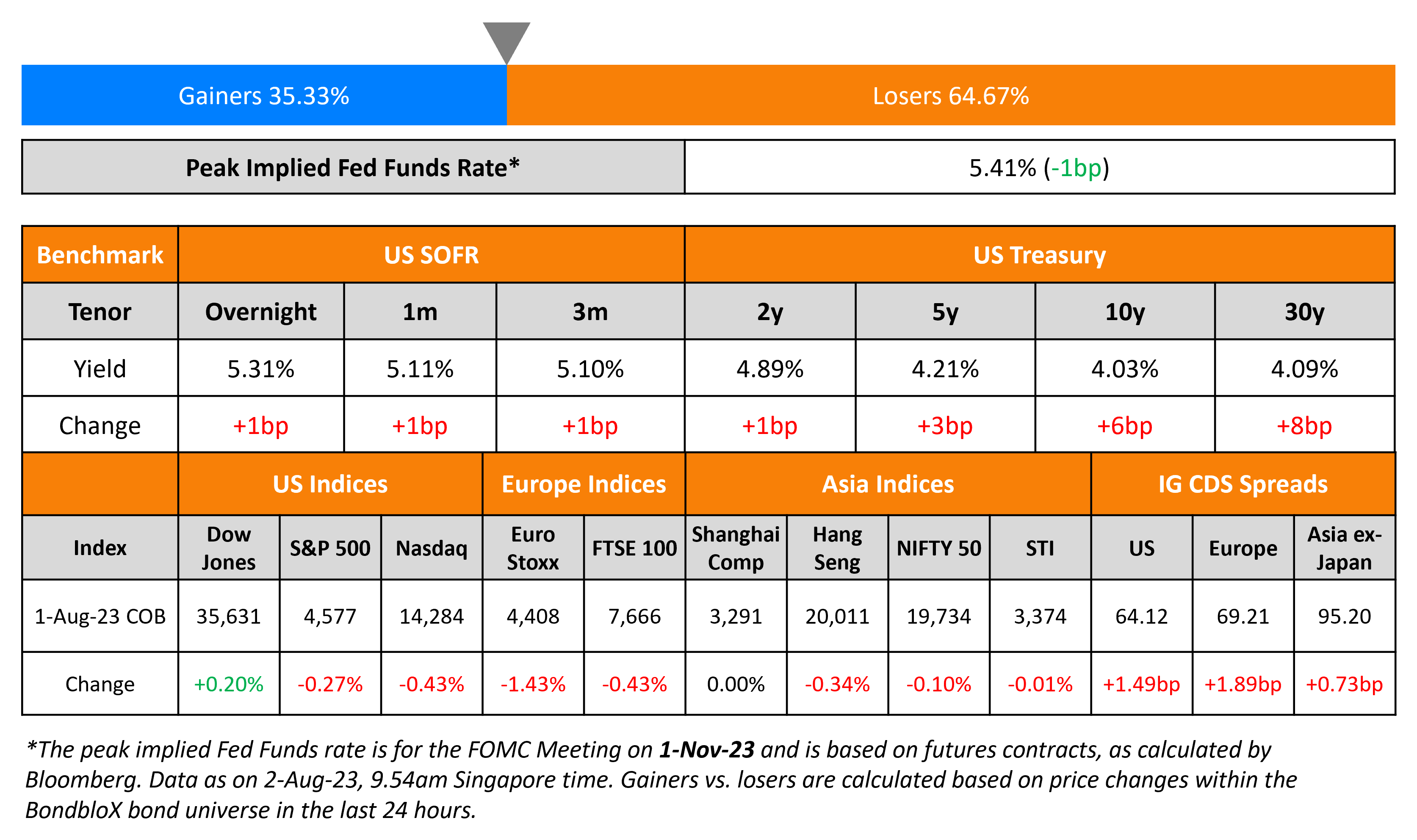

Treasury yields inched higher as the curve bear steepened – 2Y yields rose 1bp while the 10Y and 30Yyields were up 6-8bp. The 2s10s curve is now at -86bp, retracing from the lows of -109bp seen in the beginning of July. Fitch downgraded the US’ long-term rating to AA+ from AAA and placed it on negative watch. They cited the “repeated debt-limit political standoffs and last-minute resolutions” that have “eroded confidence in fiscal management”. The US ISM Manufacturing PMI for July rose to 46.3 from 46.0 in June, slightly missing forecasts of 46.8. This is the ninth straight month that the figure has stayed below 50, indicating a continued contraction in the manufacturing sector and marking the longest stretch of contraction since the 2008 crisis. Separately, two Fed officials commented on the Fed’s rate decisions on Monday. Austan Goolsbee noted that the focus would be on inflation to make the upcoming decision in September while Raphael Bostic said that he reluctantly agreed to support July’s rate hike. The peak Fed Funds rate eased 1bp to 5.41%. US IG credit spreads widened 1.5bp while HY CDS spreads were wider by 8.5bp. The S&P and Nasdaq ended lower by 0.3-0.4% each.

European equity markets were lower too. In credit markets, European main CDS spreads were 1.9bp wider and Crossover CDS widened 6.7bp. Asia ex-Japan CDS spreads, while widening by 0.7bp on Monday, are at its tightest since over a year a 95.2bp. Asian equity markets have opened lower this morning following global bourses.

.png)

New Bond Issues

- Huatai Securities $ 3Y at T+105bp area

Carnival raised $500mn via a 6NC3 bond at a yield of 7%, 25bp inside initial guidance of 7.25% area. The senior secured first lien bonds are rated Ba2/ BB-. Proceeds will be used to repay its dollar-denominated term loan due 2025. The new notes are priced 25bp wider to its existing 4% first lien bonds due 2028 that yield 6.75% and 125bp tighter compared to its existing 5.75% senior unsecured 2027s (callable in 2026), currently yielding 8.25%. The lien includes “pledges on the capital stock of each subsidiary guarantor, mortgages on a substantial majority of the vessels and related vessel collateral, material intellectual property and pledges over other vessel-related assets including inventory, trade receivables, computer software and casino equipment.”

Barclays raised €1.25bn via a 7NC6 bond at a yield of 4.918%, 25bp inside initial guidance of MS+200bp area. The senior unsecured bonds have expected ratings of Baa1/BBB+/A, and received orders over €5.3bn, 4.2x issue size. If uncalled after 6 years, the coupon will be reset at 1Y EUR swap rate plus 175bps. Proceeds will be used for general corporate purposes and may be used to further strengthen the capital base of the issuer and its subsidiaries.

Rating Actions

- Fitch Downgrades the United States’ Long-Term Ratings to ‘AA+’ from ‘AAA’; Outlook Stable

New Bonds Pipeline

- Erajaya Digital hires for S$ 3Y or 5Y bond

Term of the Day

Bear Steepening

Bear Steepening refers to a move in the yield curve where the longer-dated bond yields move higher than the shorter-dated bond yield (far maturity bonds sell-off more than near maturity ones). In yesterday’s move, the US 2s10s curve primarily bear steepened – the 10Y yield jumped 6bp while the 2Y yield was 1bp higher. Thus, the 10Y yield contributed to the bulk of the move, the net effect being a bear steepening of 5bp.

Talking Heads

On the US Fed Interest Rate Decision in September

Douglas Porter, chief economist at Bank of Montreal

“I suspect the data will be mild enough to meet with the Fed’s approval…Our core view is that the Fed has done enough, with short-term rates now solidly in positive real terrain, core inflation beginning to come down, and the labor market softening around the edges.”

Anna Wong, chief US economist at Bloomberg

“Softer wage growth — the one aspect of the economy that had been slow to cool so far — assures Fed officials that the labor market is easing, and was something Fed Chair Jerome Powell described as a necessary condition for continued progress on disinflation. This print — along with a separate report that showed core PCE inflation growing at a pace consistent with the Fed’s 2% target — strengthens our view that the FOMC will hold rates steady at the September meeting.”

Rubeela Farooqi, chief US economist at High Frequency Economics

“The Fed is not basing their actions on forecasts, given they have been wrong before…They want confirmation from the data.”

On More Stimulus in China Benefitting EM Markets – portfolio manager at Brandywine Jack McIntyre

“The US dollar will come under pressure this year as relative growth shifts in favor of China versus the US slowing down…(this may be) a little bit of a tailwind for emerging markets…Improving growth in China is also expected to stabilize commodities demand, benefiting exporters in Latin America…China is still a dominant theme in emerging markets.”

On Investors’ Optimism About a ‘Soft Landing’ in the US

Steven Oh, global head of credit and fixed income at PineBridge Investments

“It’s greater confidence in the US economic outlook and the probability of a soft landing — and a reduction in recession probabilities…You see it across risk markets, whether in equities or high-yield spreads, as well as investment-grade spreads.”

Travis King, head of US IG corporates at Voya Investment Management

“Concerns around credit deterioration are falling…Investors are more comfortable adding investment-grade risk.”

Joseph Kalish, chief global macro strategist at Ned Davis Research

There’s still a sense of uncertainty beneath the surface. Credit conditions still face the impact of higher-for-longer interest rates. Plus, lower risk premiums mean that traders would be in for a shock if data unexpectedly worsens, causing US policymakers to take an even-more aggressive policy path.

On the Sahm Rule Pointing Towards a US Recession – Sahm Consulting founder Claudia Sahm

“If (the Sahm Rule) was ever going to break it would be now, and I would be so happy to see it break… I would love it to trigger and there not to be a recession…I absolutely disagree with the statement that we need a recession to get inflation down…We may end up with a recession because the Fed is really going at it, and a recession probably would bring down inflation, but I don’t see a sufficiently good argument about why we should just expect a recession versus, you know, we might get through this.”

Top Gainers & Losers –02-August-23*

Other News

Go back to Latest bond Market News

Related Posts: