This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Weekly Jobless Claims Drops to 3Y Low; Yapi Kredi, DB Price Bonds

December 5, 2025

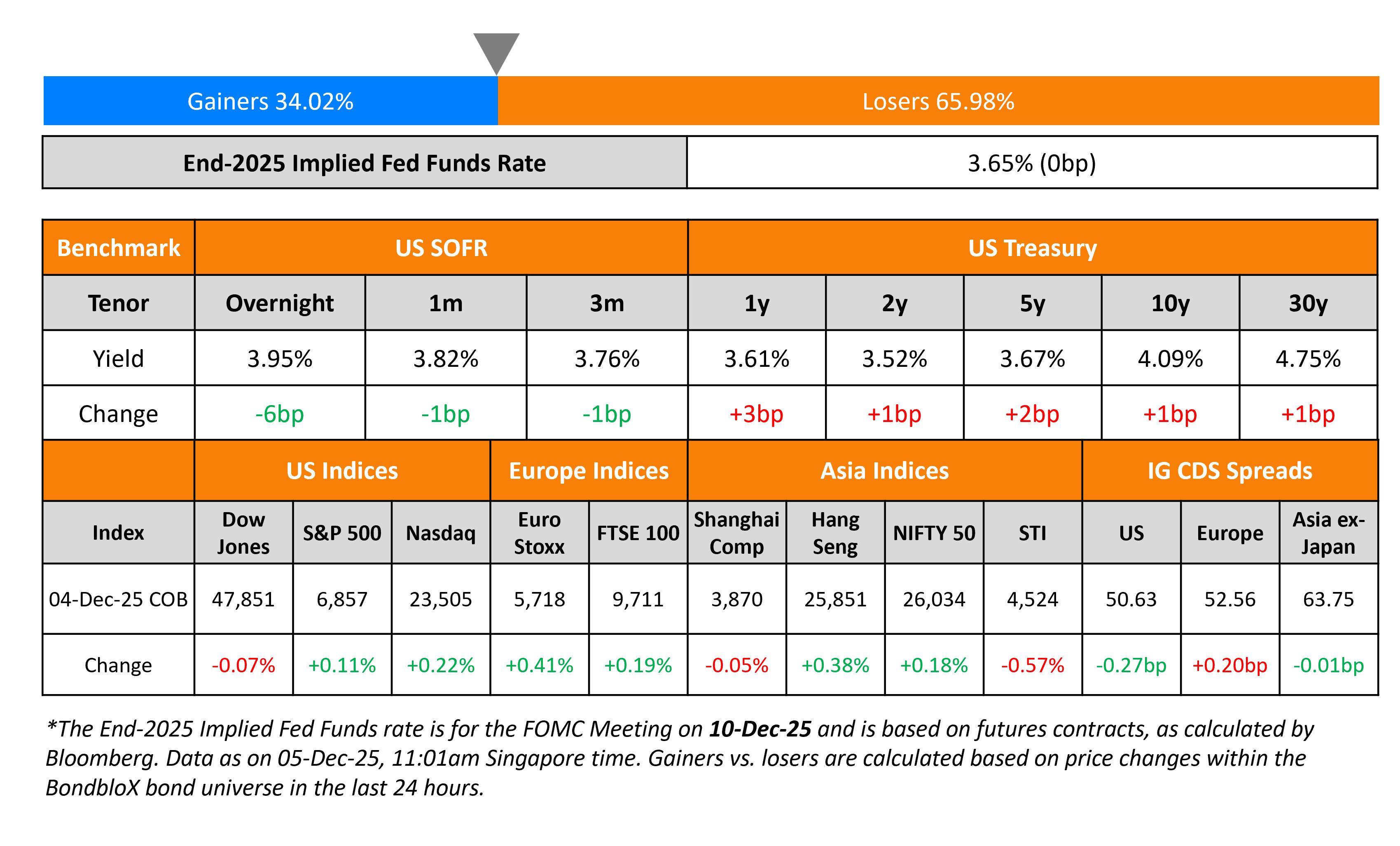

US Treasury yields rose by 1-2bp across the curve on Thursday. On the data front, the prior week’s initial jobless claims fell to 191k, the best reading in more than three years, allaying fears about a sharp slowdown in the labor market. Separately, US National Economic Council Director Kevin Hassett said that the Fed should cut rates next week and predicted a 25bp reduction.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.1% and 0.2% respectively. US IG CDS spreads were 0.3bp tighter and HY spreads tightened by 2bp. European equity indices ended higher too. The iTraxx Main CDS spreads widened by 0.2bp while the Crossover CDS spreads were 0.3bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were nearly unchanged.

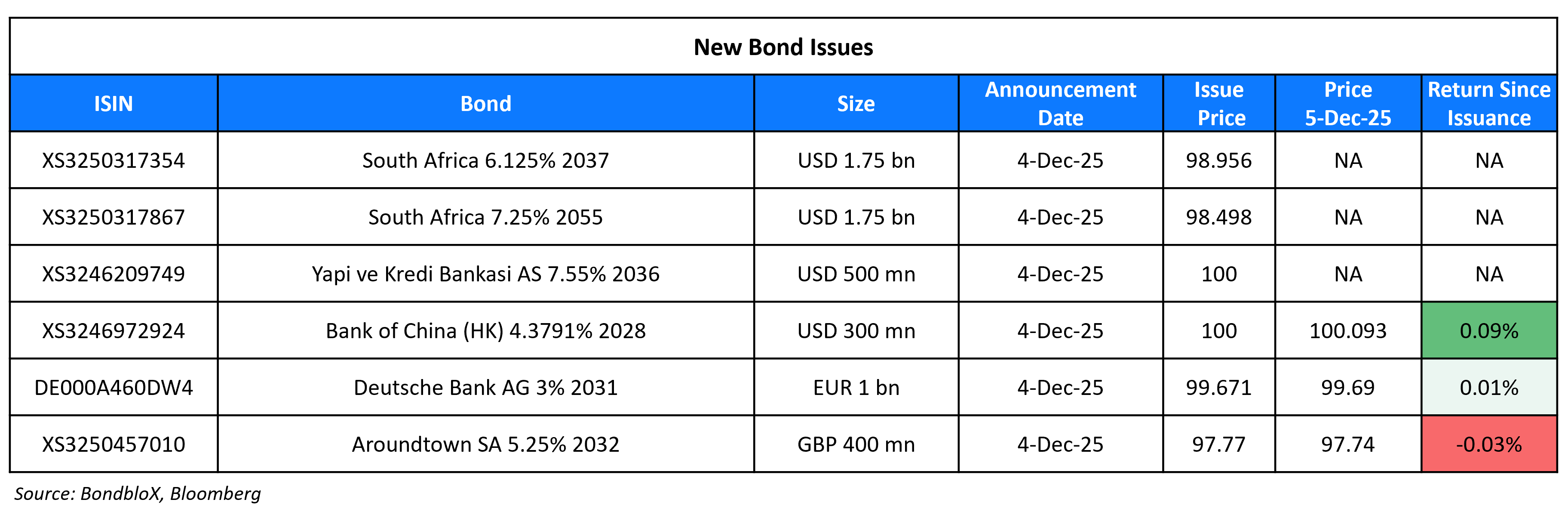

New Bond Issues

Yapi Kredi raised $500mn via a 10.5NC5.5 Tier-2 bond at a yield of 7.55%, 45bp inside initial guidance of 8% area. The subordinated note is rated B by Fitch, and received orders of over $1.5bn, 3x issue size. Proceeds will be used for general corporate purposes which may include the redemption of its outstanding $500m 7.875% Tier-2 dollar bond due 2031.

Deutsche Bank raised €1bn via a long 5NC4 bond at a yield of 3.087%, 25bp inside initial guidance of MS+95bp area. The senior preferred note is rated A1/A/A, and received orders of over €3.6bn, 3.6x issue size. Proceeds will be used for general corporate purposes.

Bank of China (Hong Kong) raised $300mn via a 3Y FRN at SOFR+41bp, 59bp inside initial guidance of SOFR+100bp area. The senior unsecured note is rated A1/A/A. Proceeds will be used for general corporate purposes.

New Bonds Pipeline

- China Minmetals $ guaranteed Subordinated Perp

Rating Changes

- Reliance Industries Ltd. Rating Raised To ‘A-‘ On Improving Cash Flow Stability; Outlook Stable

- Moody’s Ratings upgrades ArcelorMittal to Baa2; stable outlook

- AIA’s Core Subsidiaries Upgraded To ‘AA’ On Sustained Capital Buffer, Parent AIA Group Ltd. To ‘AA-‘; Outlook Stable

- Prudential PLC Core Entities Upgraded To ‘AA’ On Enhanced Capital Buffer; Parent Upgraded To ‘A+’; Outlooks Stable

- Fitch Upgrades Cinemark’s IDR to ‘BB-‘; Outlook Stable

- Moody’s Ratings downgrades Under Armour’s CFR to B1

- Moody’s Ratings changes Vedanta’s outlook to positive; ratings affirmed

- Deutsche Bank Outlook Revised To Positive On Improving Earnings And Focused Strategy; ‘A/A-1’ Ratings Affirmed

- Commerzbank Outlook Revised To Positive On Credible Progress Toward Its Ambitious 2025-2027 Targets; ‘A/A-1’ Affirmed

Term of the Day: Bridge Financing

Bridge financing is a temporary form of financing used to cover the borrower’s short-term costs until the moment when regular long-term financing is secured. This form of financing ‘bridges’ the gap between when the borrower’s funds are set to dry up and its next long-term funding option.

Netflix is said to have made a mostly-cash offer for WBD and is working on a bridge loan that totals “tens of billions of dollars” as per Bloomberg sources.

Talking Heads

On Traders Underpricing Risk of Higher Japan Yields – Roger Hallam, Vanguard

“The market underestimates how high the neutral rate will need to go in Japan to relieve inflation pressures, so being underweight Japanese government bonds is the right one… still think that the Bank of Japan will continue to normalize and that it will hike in December

On IMF talks expected to move smoothly – Mostafa Madbouly, Egypt Prime Minister

The IMF mission arrived two days ago… indicators are developing in line with the government’s plans and that several indicators have performed better than the targets set with the IMF… reiterated the government’s focus on tax incentives as part of ongoing efforts to support investment and strengthen the role of the private sector.

On Market Doubts Hassett Can Deliver at Fed – Greg Peters, PGIM

“Does he have the credibility within the committee to drive consensus? We don’t know that answer. I don’t think he has that credibility. I think that’s what the bond market is telling you”

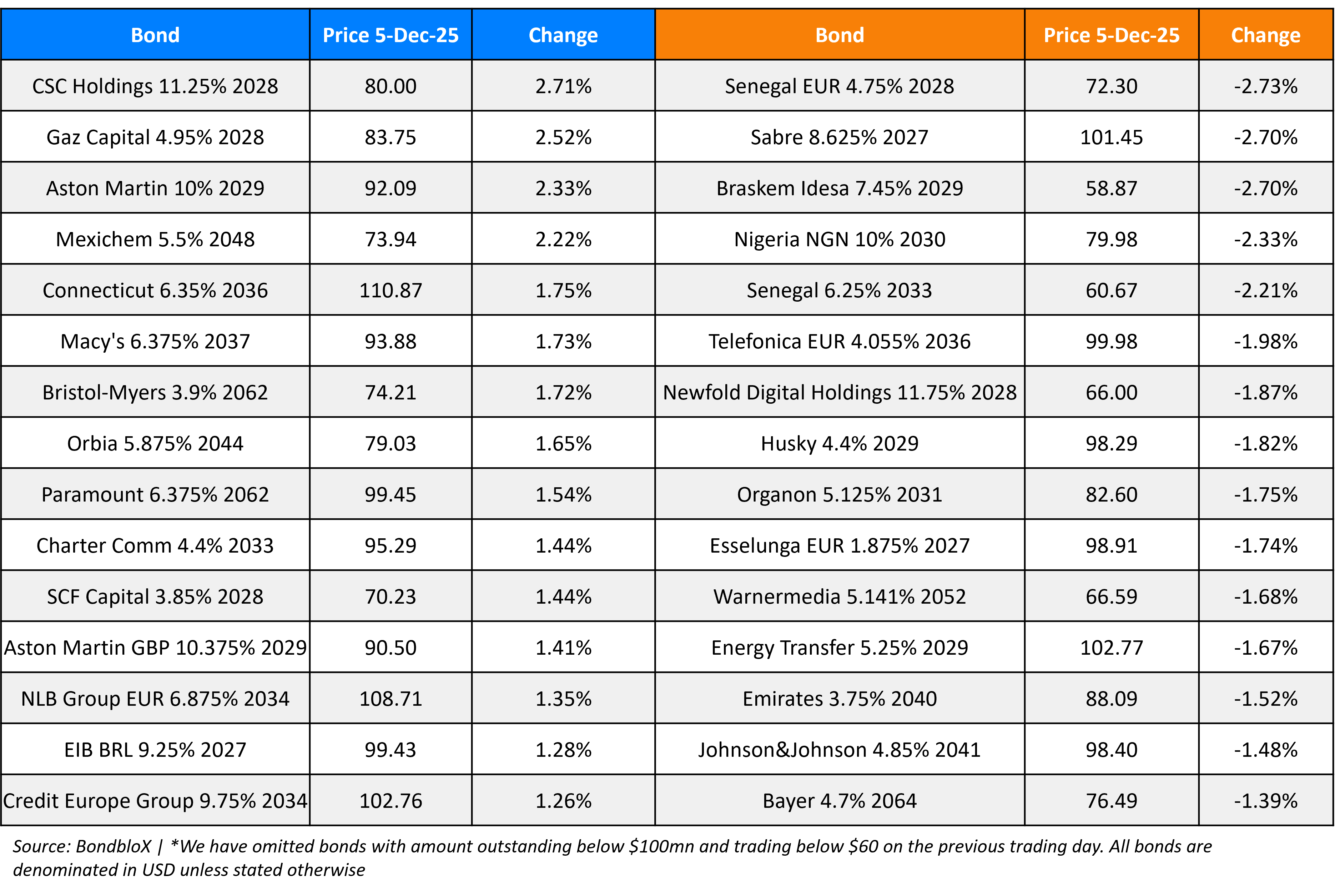

Top Gainers and Losers- 05-Dec-25*

Go back to Latest bond Market News

Related Posts: