This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

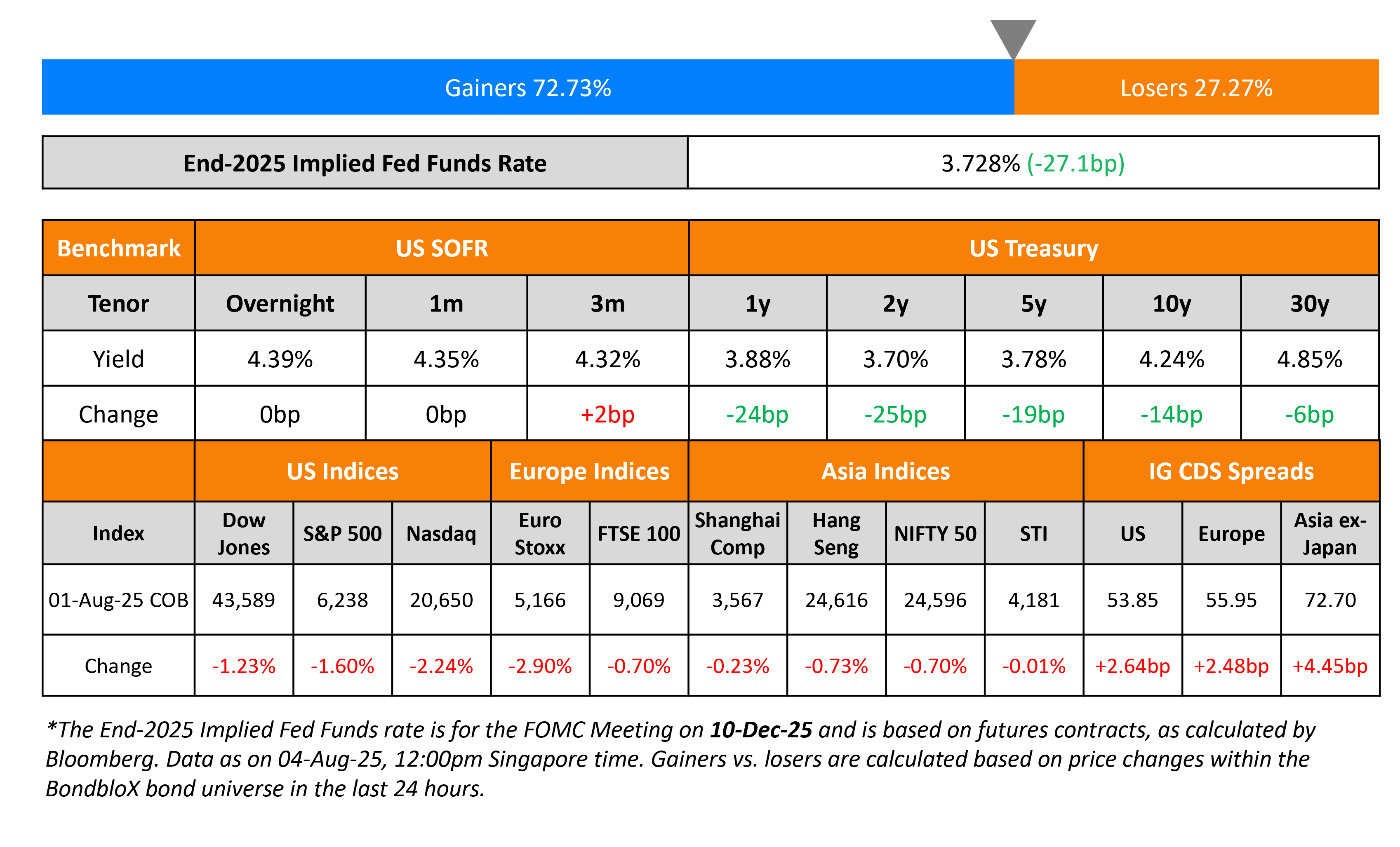

US Treasury Yields Tumble, Markets Price-in ~60bp in Rate Cuts After NFP

August 4, 2025

The US Treasury curve bull steepened with yields tumbling across the curve. The 2Y yield dropped by 25bp while the 10Y was down 14bp. This came after a poor jobs report on Friday that indicated signs of a weaking in the US economy. US NFP for July saw job additions of 73k, softer than expectations of 104k. Moreover, the prior month’s reading for June was revised significantly lower to just 14k, the lowest in nearly five years, after rising by a previously reported 147k. The average payrolls for the past three months stands only at 35k, the lowest since the pandemic. Average Hourly Earnings (AHE) YoY rose by 3.9%, higher than expectations of 3.8% while the Unemployment Rate rose to 4.2%, in-line with expectations. Separately, the ISM Manufacturing Index declined to 48.0 in July from the prior month’s 49.0 print, also coming-in softer than expectations of 49.5. The manufacturing index has now remained in contraction territory for five consecutive months. Markets are now pricing-in nearly 60bp in rate cuts by the end of the year vs. 40bp prior to the data release on Friday. A 25bp rate cut in September is now being priced-in with an 82% probability.

Looking at US equity markets, the S&P and Nasdaq closed lower by 1.6% and 2.2% respectively. US IG CDS spreads were 2.6bp wider and HY CDS spreads widened by 13.2bp. European equity markets ended lower too. The iTraxx Main and Crossover CDS spreads widened by 2.5bp and 11.5bp respectively. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 4.5bp wider.

New Bond Issues

New Bonds Pipeline

- China Aircraft Leasing hires for $ bonds

Rating Changes

-

Moody’s Ratings upgrades Dominican Republic’s ratings to Ba2, changes outlook to stable

-

San Marino Upgraded To ‘BBB+/A-2’ On Improved External And Net Debt Data And Metrics; Outlook Stable

-

Moody’s Ratings downgrades Brunswick Corporation’s notes to Baa3; outlook remains negative

-

Moody’s Ratings downgrades Shandong Energy’s and Yankuang Energy’s ratings to Ba2; outlook stable

-

BMW Outlook Revised To Negative On Turbulent Market Conditions; ‘A/A-1’ Ratings Affirmed

-

Mercedes-Benz AG Outlook Revised To Negative; ‘A/A-1’ Ratings Affirmed

Term of the Day: Bull Steepening

Bull Steepening refers to a change in the yield curve where short-end rates move down faster than long-end rates. This not only has a steepening effect on the entire yield curve but also has a net effect of interest rates moving lower and bond prices moving higher.

Similar terms include Bear Steepening, Bull Flattening and Bear Flattening. If the yield curve moved lower and bond prices moved higher, it is considered a bull move, while the opposite is a bear move. If the effect of the move is to steepen the curve, it would either be a Bear Steepening or a Bull Steepening. If the effect was to flatten the curve, it would be a Bear Flattening or Bull Flattening.

Talking Heads

On EM Funds Adjusting Bets As ‘Sell the Dollar’ Trade Loses Appeal

Leonard Kwan, T. Rowe Price

“I’m weighted towards” dollar-denominated emerging-market bonds for now, given their attractive coupons…There’s likely to be a consolidative period for the dollar over the next three-to-six months”

Lemon Zhang, Barclays

“We remain reluctant to jump into outright trades betting the dollar will weaken against Asian currencies…we have recommended going long the US dollar against some low yielders in the region with stretched valuations and idiosyncratic risks, such as the Thai baht and Hong Kong dollar”

On Credit Liquidity Gone as E-trading Thrives – Barclays

“The illiquidity premium that once drew pensions and insurers to public markets is gone…Looking ahead, it could lower funding costs for smaller public issuers, as investors begin to price in stronger market liquidity”

On Jobs Data Shattering Wall Street’s Calm

Jeff Schulze, ClearBridge Investments

“Today’s release is best characterized as ‘bad news is bad news’ in our view…With job creation at stall-speed levels and the tariff headwind lying ahead, there’s a strong possibility of a negative payroll print in the coming months which may conjure up fears of a recession.”

Joe Saluzzi, Themis Trading

“Lots of folks have their eyes on the exit door…Weak job numbers should solidify the rate cut story for September, but there is some worry that the Fed is waiting too long.”

Charlie Ripley, senior investment strategist for Allianz Investment

“Investors may have gotten too complacent while waiting for the impacts of slower economic activity resulting from tariffs and higher interest rates”

Top Gainers and Losers- 4-Aug-25*

Go back to Latest bond Market News

Related Posts: