This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Stable; GE, HDB, NAB, Wells Fargo Price Bonds

July 23, 2025

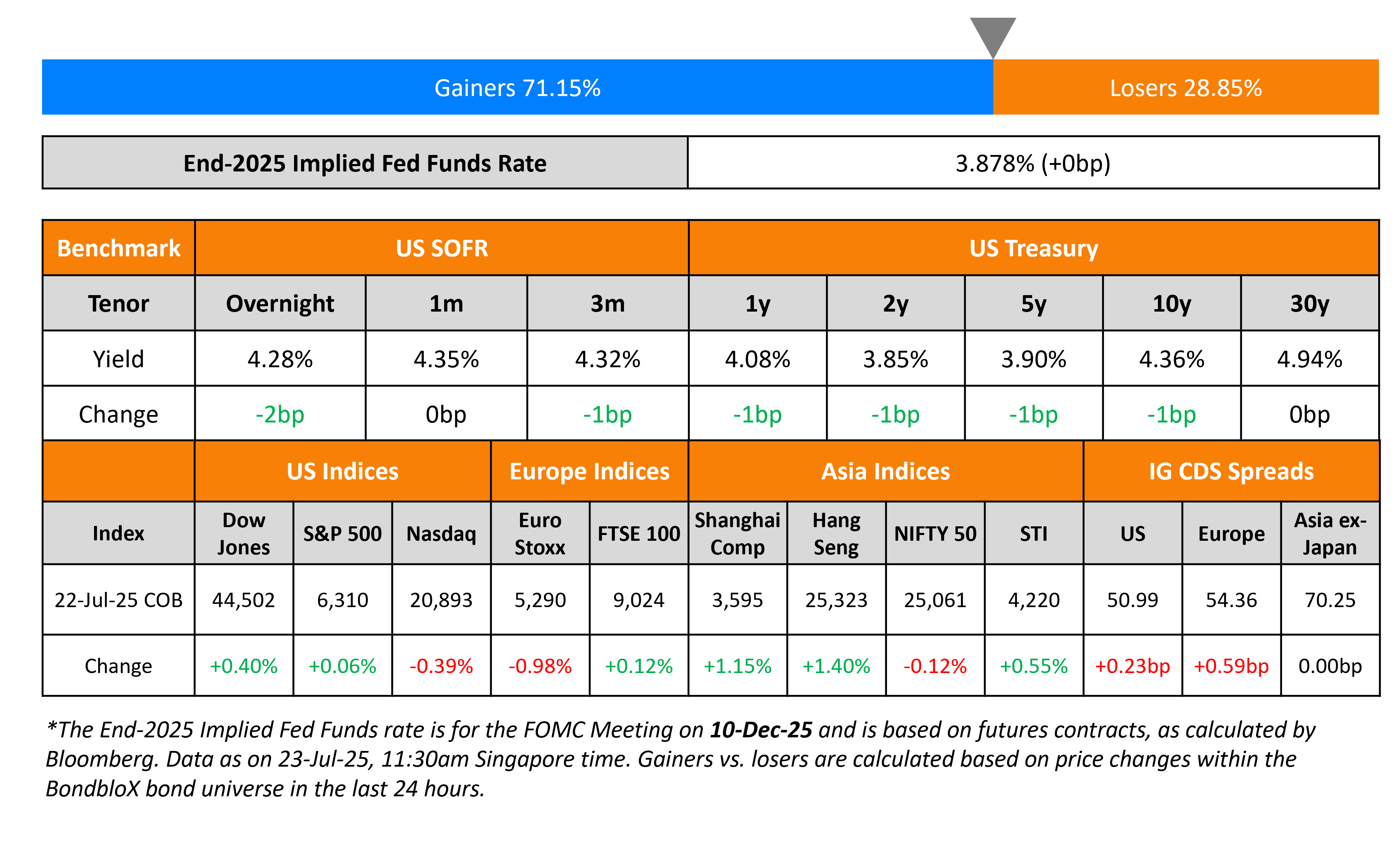

US Treasury yields were broadly stable on Tuesday. US Treasury Secretary Scott Bessent said that he did not see any reason for Fed Chairman Jerome Powell to step down from his position before his tenure ends in May 2026. This comes after US President Donald Trump reiterated his criticism of Powell yesterday saying that he has, “done a bad job, but he’s going to be out pretty soon anyway”.

Looking at US equity markets, the S&P ended higher by 0.1% while the Nasdaq closed lower by 0.4%. US IG CDS spreads widened by 0.2bp and HY spreads widened by 0.7bp. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 0.6bp and 2.1bp respectively. Asian equity markets have opened in the green today, helped by Trump’s announcement on striking trade deals with Japan, Indonesia, Vietnam and the Philippines. Asia ex-Japan CDS spreads were unchanged.

New Bond Issues

General Electric (GE) raised $2bn via a dual-trancher. It raised $1bn via a 5Y bond at a yield of 4.345%, 28bp inside initial guidance of T+75bp area. It also raised $1bn via a long 10Y bond at a yield of 4.95%, 28bp inside initial guidance of T+90bp area. The senior unsecured notes are rated A3/A-. Proceeds will be used for general corporate purposes that may include debt refinancing.

Wells Fargo raised $1.5bn via a tap of its 5.15% 2031s at a yield of 4.589%, 23bp inside initial guidance of T+95bp area. The senior unsecured note is rated A1/BBB/A+. Proceeds will be used for general corporate purposes. The bond has a make whole call beginning on 30 April 2026 and ending on (including) 22 April 2030. Proceeds will be used for general corporate purposes.

Housing & Development Board (HDB) raised S$700mn via a 7Y bond at a yield of 1.976%. The senior unsecured note is rated AAA by Fitch. Proceeds will be used to finance development programmes of HDB and its working capital requirements as well as to refinance existing borrowings.

NAB raised AUD 1.5bn ($990mn) via a 15NC10 Tier 2 bond at a yield of 5.774%, ~12.5bp inside initial guidance of ASW+180/185bp area. The subordinated note is rated A3/A-/A-. The bond is priced at a new issue premium of ~26bp over its existing 6.342% 2039s (callable in June 2034) that currently yields 5.51%.

New Bonds Pipeline

- Adecoagro hires for $ bond

- Li & Fung hires for $ 3.5Y bond

- Telecom Argentina hires for $ 200 mn 7.35Y bond

- Astrea 9 hires for S$/$ bond

Rating Changes

- Fitch Upgrades illimity to ‘BB’ on IFIS’s Exchange Offer; Maintains Rating Watch Positive

- Uzbekistan-Based Kapitalbank Upgraded To ‘BB-’ On Strengthened Capital; Outlook Stable

- Fitch Affirms Ecobank Nigeria’s Long-Term IDR at ‘CCC’; Downgrades VR to ‘f’

-

Moody’s Ratings affirms Cooper-Standard’s CFR at Caa1, changes outlook to positive

- Correction: Fitch Revises Outlook on Continuum Green Energy to Stable; Affirms at ‘B+’

Term of the Day: Pre-Capitalized Securities (P-Caps)

Pre-Capitalized Securities or P-Caps, refer to a unique type of security issued by a company that gives it access to raising debt funding. They are considered to be similar to a revolving credit facility, but can be much longer dated (going over 10 years) with less counterparty risk. The benefit that P-Caps offer is that they are held off the balance sheet, in a trust until the company eventually needs the funds. Hence, they do not contribute to financial leverage. Besides, they also offer an interim credit facility to the issuer by providing them immediate liquidity especially in times of stress events. As per Santander, P-Caps are mostly issued by insurance companies and trade in the secondary market typically at a discount to comparable senior unsecured bonds from the same company. They add that P-Caps are generally rated in-line with senior debt.

Talking Heads

On Hunt for Yield Skewing Intricate Bond Math in Riskiest Bank Debt

Sriram Reddy, Man Group

“There are a lot of investors who invest purely based on yield and that leads to situations where the spread can get increasingly tighter…The market feels like it’s avoiding the spread perspective. And for us from a risk perspective, that’s almost like a coiled spring.”

Darpan Harar, NinetyOne

“When spreads are this tight, you’re not playing for further upside”

On Bessent Right to Question Fed on ‘Overreach’ – Lawrence Summers

“History teaches that the Fed should be autonomous and independent…When the political process gets in their way, the result is more inflation, less economic stability, and ultimately higher interest rates.

On De-risking Mood Adding More Demand for US Corporate Bonds

Edward Marrinan, SMBC Nikko Securities

“The sharp tightening of credit spreads seen since Liberation Day is based on perception that trade and tariff risks have peaked. . .it also can be attributed to investors’ confidence in US corporate fundamentals”

Michael Levitin, MidOcean Partners

“For the first time that I can think of in my career, we’re seeing a shift out of equities into debt”

Winnie Cisar, CreditSights

“Our base case for (investment grade) credit spreads is widening, not tightening, as we have a forecast of 110 bps through year-end, but that number is still well within the long-term median level for spreads (of) 130 bps”

Top Gainers and Losers- 23-Jul-25*

Go back to Latest bond Market News

Related Posts: