This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Retreat after Surge Post Trump’s Win

November 7, 2024

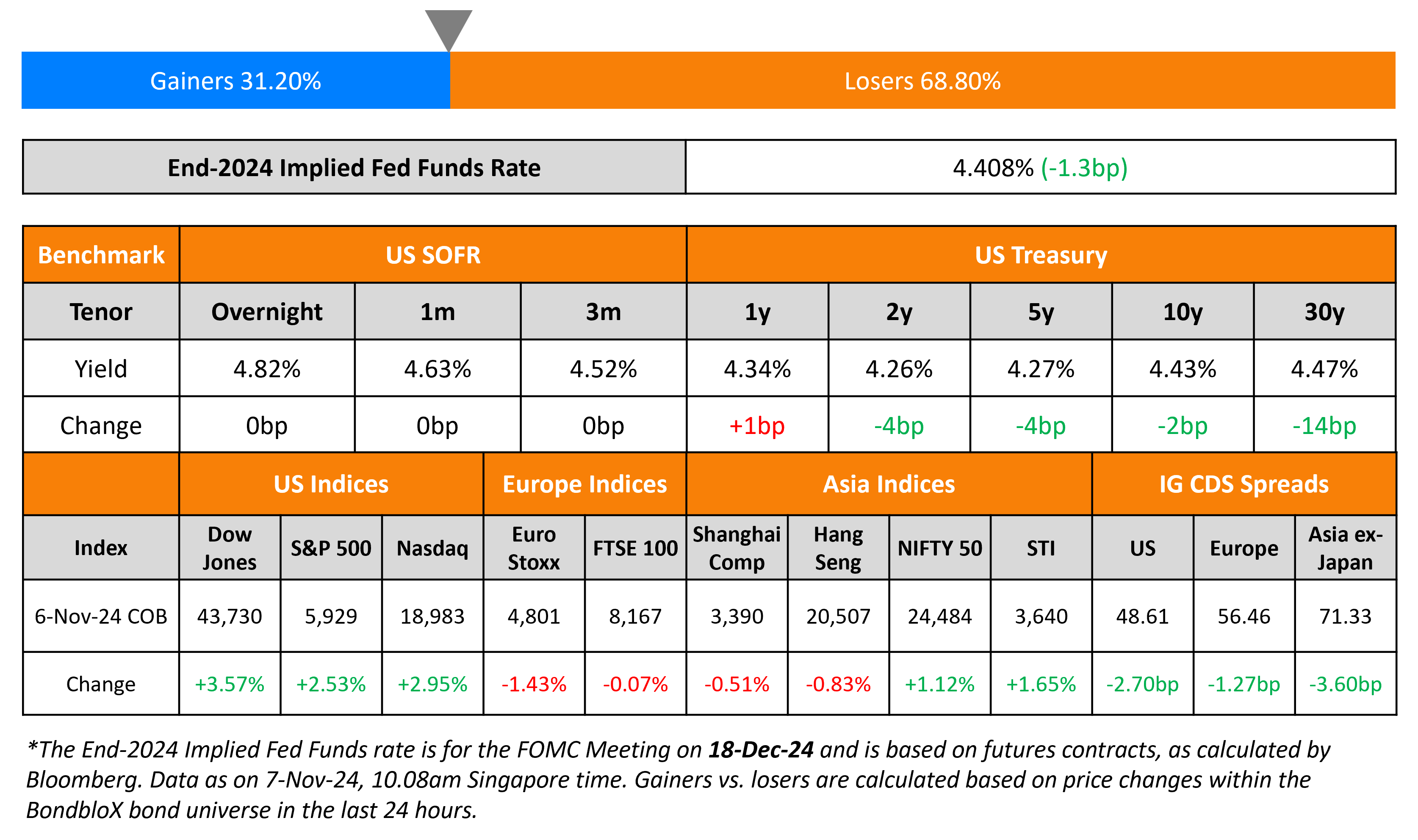

US Treasury yields retreated from their highs following a sharp spike from the sell-off brought about by Donald Trump’s victory yesterday. The US 10Y Treasury yield touched an intraday high of 4.49%, its highest level since July. The Republicans took back control of the Senate and might further expand on their majority in the House. Analysts noted that the bond market expects stronger growth, accompanied by higher inflation upon Trump’s win. Although markets are still pricing in 43bp in rate cuts by end-2024, some have noted that price pressures brought about by potential tariffs and tax cuts are expected to slow or even halt some anticipated rate cuts next year. Separately, the US Treasury held a 30Y auction, with the bid-to-cover ratio coming in at 2.64x vs. 2.5x last month. The indirect acceptance rate came in at 62.7%, lower than the prior auction’s 80.5%. US IG and HY CDS spreads tightened by 2.7bp and 18.7bp respectively. Looking at US equity markets, S&P and Nasdaq both closed sharply higher by 2.5% and 3% respectively.

European equities closed lower across the board. In terms of Europe’s CDS spreads, the iTraxx Main and Crossover spreads tightened by 1.3bp and 5.4bp respectively. Asian equities have opened mixed this morning. Asia ex-Japan CDS spreads tightened by 3.6bp.

New Bond Issues

New Bond Pipeline

-

Singapore Medical Group hires for S$ 5Y bond

- Tata Capital hires for $ bond

Rating Changes

- Fitch Revises Peru’s Outlook to Stable; Affirms at ‘BBB’

- Fitch Downgrades LimakPort’s Notes to ‘B-‘; Outlooks Negative

Term of the Day

Debtor-in-Possession Financing

Debtor-in-possession (DIP) Financing is a funding option available to distressed companies that have filed for Chapter 11 bankruptcy protection, where lenders believe that the company has a realistic chance of turning itself around. DIP financing is not an option available to distressed companies that simply want to liquidate the company. DIP financing can be a lifeline for distressed companies as it may find it hard to borrow from typical channels after filing for Chapter 11.

From a lender’s perspective, DIP financing can be attractive given the special treatment of such financing under US bankruptcy laws, which dictate that DIP lenders are to be paid before other creditors. DIP financing is subject to court approval wherein the distressed borrower must prove to the courts that the existing or older creditors will not be made worse by the new financing.

Talking Heads

On Investors’ Reaction to Trump’s Win

Jordan Rochester, Mizuho

“It’s going to be a strong year for those good at trading headlines, and a difficult one for those not used to following Trump tweets”

Ryan Grabinski, Strategas Securities

“The biggest takeaway from last night is that we received certainty that the market craves. This will allow both business and consumer confidence to improve”

Dave Lutz, JonesTrading

“The current moves in equities, bonds and other assets could partially reverse if the House goes Democrat, which remains to be seen”

On Warning of ‘Huge’ Impact of Trump Tariff Plans – ECB Vice President, Luis De Guindos

“If a jurisdiction as important as the US imposes tariffs of 60% to any other important jurisdictions…China… assure you that the direct effects and the indirect effects and the deviations of commerce will be huge… we will incorporate into our projections the trade policy that is announced by the new US administration”

On US Bond Yields Surging as Trump Win Stokes Inflation Expectations

Stephen Dover, Franklin Templeton

“The bond market anticipates stronger growth and possibly higher inflation. That combination could slow or even halt anticipated Fed rate cuts”

Lawrence Gillum, LPL Financial

“Move higher in yields is a concern from the bond market that Trump’s economic policies could be inflationary… could potentially complicate the Fed’s ability to cut rates “

Michael Schumacher and Angelo Manolatos, Wells Fargo

“We think Treasury yields are near a peak”… those “who had been contemplating adding duration but wanted to wait for the election results should get ready to act”.

Top Gainers & Losers – 07 Nov 24*

Go back to Latest bond Market News

Related Posts: