This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Jump as ADP and ISM Services Provide Positive Surprise

July 7, 2023

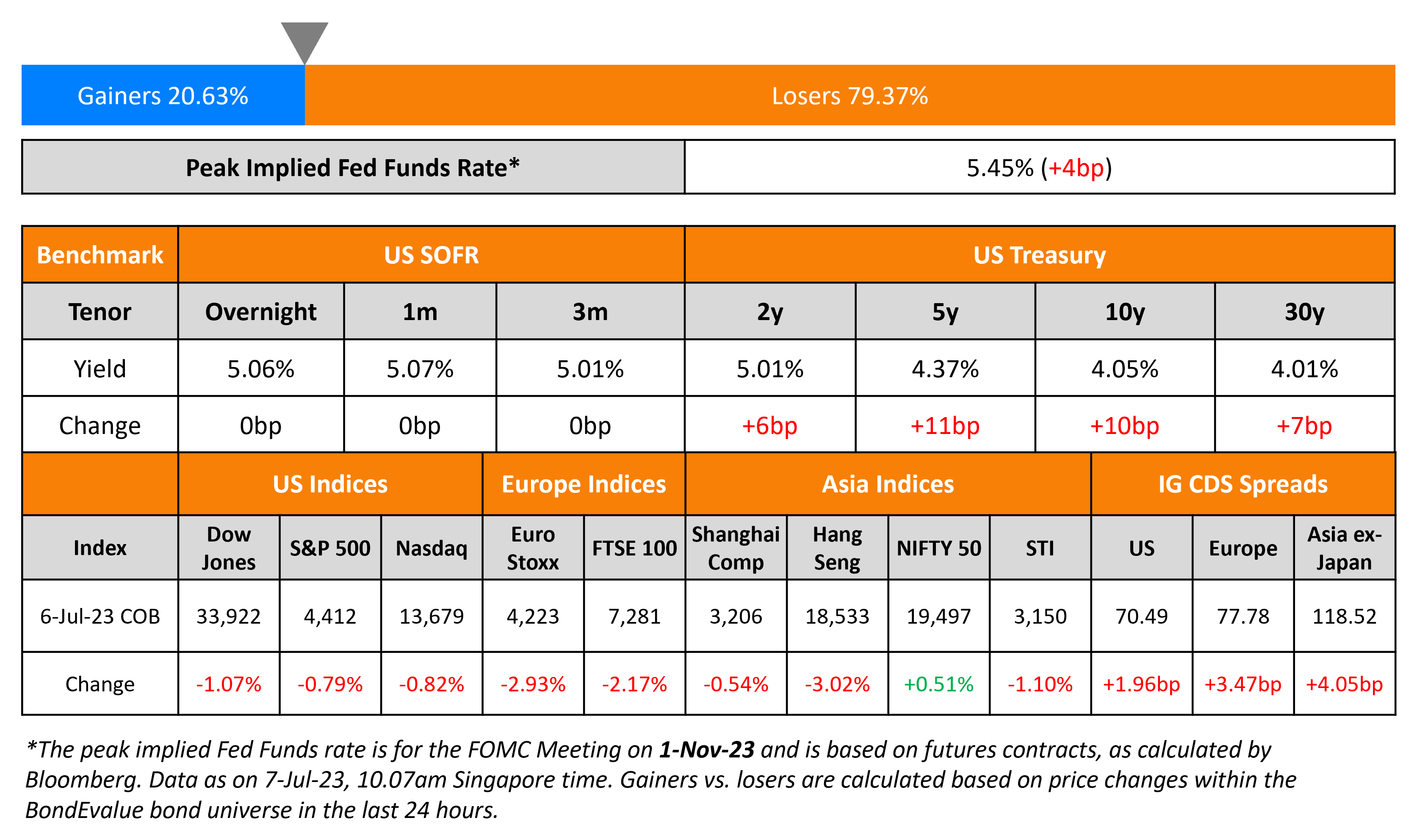

US Treasury yields jumped higher on Thursday as the curve steepened again, with the 10Y yield up 10bp while the 2Y yield was up 6bp. First, the US ISM Non-Manufacturing PMI increased to 53.9 last month from 50.3 in May, also beating expectations of a 51 print, indicating expansion in the services sector. Also ADP Payrolls came at 497k, significantly higher than the 225k expected also implying a strong economy. ADP is seen as an indicator that could help predict NFP that is due today although analysts note that the correlation has weakened in recent months. NFP is expected at 230k today with Average Hourly Earnings expected to rise by 4.2% YoY. The solid data continues to underscore the strength in the economy, further reinforcing the hawkish stance by the Fed. The peak Fed Funds rate jumped 4bp higher to 5.45%. US equity indices were lower with the S&P and Nasdaq down ~0.8%. US IG and HY CDS spreads widened 2bp and 12bp respectively.

European equity indices closed lower with European main CDS spreads wider by 3.5bp and Crossover CDS wider by 13bp. Asia ex-Japan CDS spreads were 4.1bp wider and Asian equity markets have opened lower today.

New Bond Issues

SMFG raised $4.3bn via a six-tranche deal as detailed below:

The senior unsecured bonds are rated A1/A- (Moody’s/S&P) and the subordinated notes at A2/BBB+ (Moody’s/S&P). The new 3Y bonds are priced 26bp tighter to its existing 6.44% 2026s that yield 6.14%. On the other hand, the new 5Y offers a new issue premium of 10bp over its existing 5.52% 2028s that yield 5.7% .The new 7Y offers a new issue premium of 7.5bp over its existing 5.71% 2030s that yield 5.75%, and the new 10Y bond offers a new issue premium of 8.6bp over its existing 5.766% 2033s that yield 5.69%. Proceeds will be used to extend loans to its subsidiary, Sumitomo Mitsui Banking Corporation (SMBC). Funds from the first 5 tranches will be used to extend unsecured loans, intended to qualify as internal TLAC, while funds from the 20Y tranche will be used to extend a subordinated loan, intended to qualify as Tier 2 Capital and internal TLAC. Thereafter, SMBC intends to use the proceeds of the loans for general corporate purposes.

Toyota raised $1.5bn via a three-part sustainability deal. It raised

- $500mn via a 3Y bond at a yield of 5.275%, 22bp inside initial guidance of T+80bp area.

- $500mn via a 5Y bond at a yield of 5.118%, 25bp inside initial guidance of T+100bp area.

- $500mn via a 10Y bond at a yield of 5.123%, 27bp inside initial guidance of T+135bp area.

The bonds have expected ratings of A1/A+. Proceeds will be used for eligible sustainability projects as defined in the issuance’s prospectus supplement. The new 3Y bonds offer a new issue premium of 3.5bp over its existing 1.339% 2026s that yield 5.24%. The new 5Y bonds were priced at a new issue premium of 13.8bp over its existing 3.669% 2028s that yield 4.98%.

Deutsche Bank NY raised $1.25bn via a 4NC3 senior bond at a yield of 7.146%, 35bp inside initial guidance of T+280bp area. The bonds are unrated. Proceeds will be used for general corporate purposes. The new bonds are priced 8.4bp tighter to its existing 2.311% 2027s, callable in 2026 that yield 7.23%.

New Bond Pipeline

- Shinhan Financial hires for $ 5Y social bond

Rating Changes

- Moody’s downgrades DWCM’s and Wanda HK’s ratings, changes outlook to negative

Term of the Day

Purchasing Managers Index (PMI)

PMIs or Purchasing Managers’ Index are an index composed of a monthly survey of purchasing managers/supply chain managers across industries. This is a diffusion index, a statistical measure of summarizing the common tendency of a series – if there are more number of values rising than falling, the index is above 50 and the index goes below 50 if the falling values exceed those rising. For PMIs, a value below 50 indicates contraction and a value above 50 shows expansion. These surveys are taken over different areas of the supply chain business: New Orders, Employment, Inventories, Supplier Deliveries and Production covering imports, exports, prices and backlogs. In most countries, Markit publishes the PMI numbers while other organizations publish them too. Markit generally publishes the month’s PMIs in last week of the month.

Talking Heads

On Disappointing Credit Market Returns Add Fuel to Bearish Bets

John Luke Tyner, fixed income PM at Aptus Capital Advisors

“Credit in general is going to underperform what most people expected. It’s priced for absolute perfection and absolute disinflation which is not happening very quickly.”

Michael Contopoulos, director of fixed income at Richard Bernstein Advisors

“Some will say that the investment-grade market is a good place to be — I mean, that’s high quality, certainly — but we don’t think corporate credit is actually where you want to be positioned at the moment”

BofA strategist Yuri Seliger

“Investors are still worried about a potential slowdown in growth or a recession in 2024. One way to position for that is to be underweight to things that are sensitive to recession risk — which would be stocks and high-yield”

Meghan Robson, head of US credit strategy at BNP Paribas

“Investment-grade valuations on a relative basis look attractive to us… more likely to have stable demand as investors like less risky assets heading into a slowdown”

On Europe Has a Hot Money Problem Too – Top ECB Official

“When I see banks relying on brokered deposits, I really worry. I cannot think of any more volatile deposits than that… We should differentiate the liquidity coverage ratio requirements for those banks more than we do today”

On The Worst Is Over for Capital Markets in Brazil – Itau Bankers

“We are starting to see more transactions where the use of proceeds is to fund growth and new investments… As soon as the market realized that interest rates were going to drop, we started to see a strong pickup in offerings… Those oversubscribed deals show investor appetite is returning”

Top Gainers & Losers – 07-July-23*

Go back to Latest bond Market News

Related Posts: