This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Inch Higher by 3-4bps; Adecoagro Prices $ Bonds

July 24, 2025

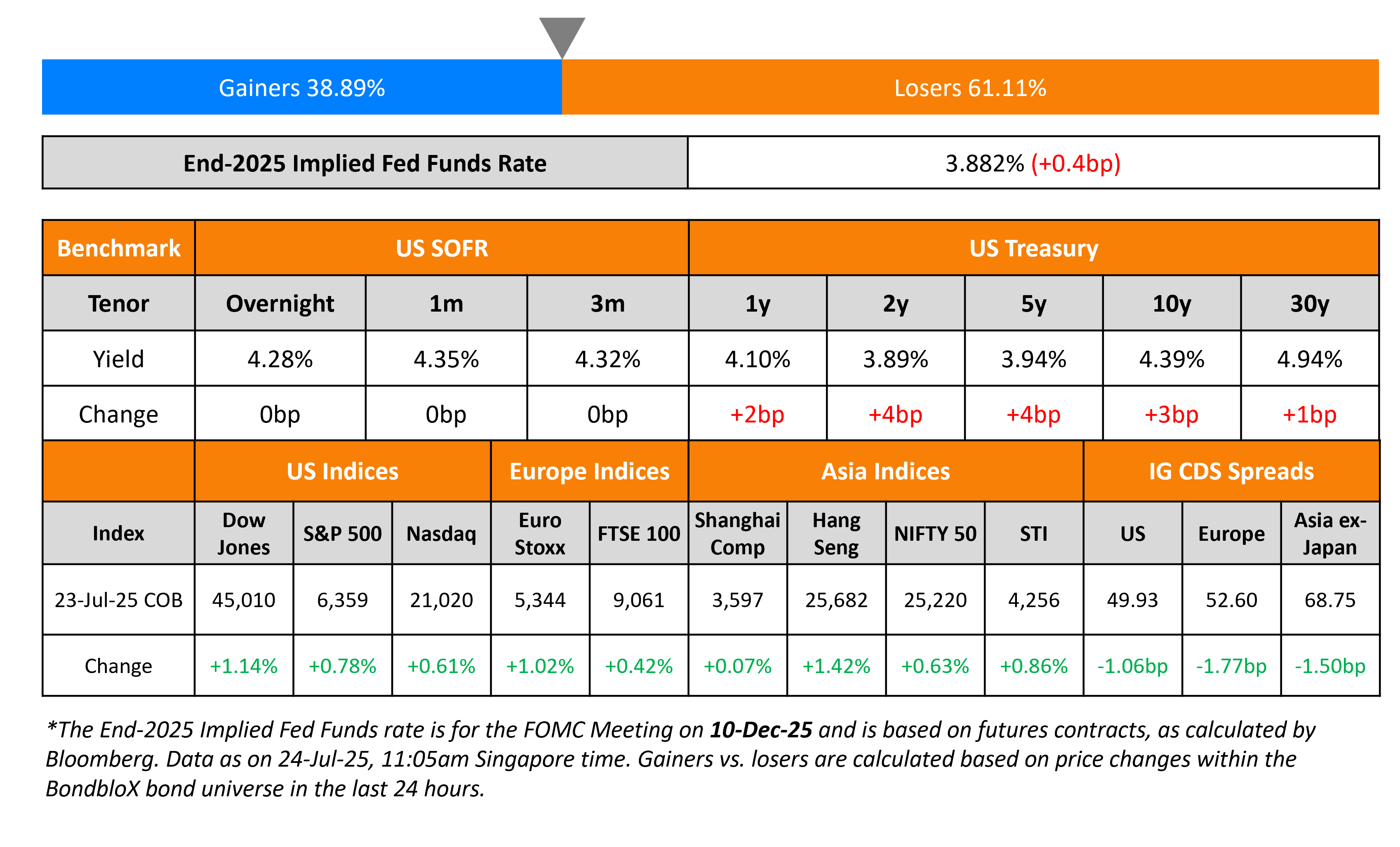

The US Treasury curve saw yields inch higher by 3-4bp. While there were no major data points on Wednesday, the US and EU were said to be moving towards a trade agreement with a 15% tariff on most imports, as per sources. Separately, US Treasury Secretary Scott Bessent said that the Fed’s summary of economic projections (published in every quarterly FOMC meeting) was “politically biased” without offering further details.

Looking at US equity markets, both the S&P and Nasdaq ended higher by 0.8% and 0.6% respectively, led by tech companies’ earnings beating expectations. US IG and HY CDS spreads tightened by 1.1bp and 5.7bp respectively. European equity markets ended higher too. The iTraxx Main CDS spreads tightened by 1.8bp and Crossover CDS spreads tightened by 6.4bp. Asian equity markets have opened in the green again today. Asia ex-Japan CDS spreads were tighter by 1.5bp.

New Bond Issues

Adecoagro, a South American Agro company, raised $500mn via a 7Y bond at a yield of 7.50%, ~25bp inside initial guidance of the high 7% area. The senior unsecured note is rated Ba2/BB. Proceeds will be used to fund the concurrent tender offer for its existing 6% 2027s and, the remainder, if any, for general corporate purposes, including capex and liability management.

New Bonds Pipeline

- Li & Fung hires for $ 3.5Y bond

- Telecom Argentina hires for $ 200 mn 7.35Y bond

- Astrea 9 hires for S$/$ bond

Rating Changes

-

Moody’s Ratings upgrades Digicel’s ratings to B2; maintains positive outlook

- Innovate Corp. Downgraded To ‘CC’ On Planned Debt Exchange; Outlook Negative

-

Moody’s Ratings changes Flos B&B Italia S.p.A.’s outlook to negative and affirms B2 CFR

Term of the Day: Asset Backed Securities

Asset Backed Securities (ABS) are securities that are collateralized or backed by a pool of assets. This pool of assets are made by a process of securitization and could be in the form of loans, credit card debt, mortgages etc. with each security backed by a fraction of the total pool of underlying assets. Thus, an investor gets interest and principal payments while also assuming the risk of the underlying assets. The underlying pool of assets are structured in different tranches with the highest priority of repayment going to the top tranche and then to the second tranche and so on.

Talking Heads

On Firing Powell Not Helping Debt Costs – Deutsche Bank

“Taking market moves at face value, we find that the cost savings from lower front-end yields would be largely offset by higher long-term yields…Specifically, the Treasury would only save $12bn to $15bn through 2027 if the president fired Powell…The market’s response would depend on a number of factors that are highly uncertain…There is no structured way to calibrate this response ahead of time”

On Becoming Disenchanted With Powell – Mike Johnson, House Speaker

“I think all the scrutiny is appropriate…it has a direct bearing on the lives of every single American…Just shaving off a small amount, the interest rate could really do a great deal of good to the sectors of the economy that are still lagging a little bit…I’m not even sure where the original constitutional authority is for the Fed…There is probably some need to reform”

On Japan’s PM Exit May Add Fuel to Trade Deal Rally

Michael Brown, Pepperstone Group

“The resignation comes at a relatively logical juncture. The bull case for Japanese equities is that a new PM would come in with more authority, providing some more certainty to the market…I don’t see this as being particularly negative for the yen or JGBs, despite the usual correlations”

Charu Chanana, Saxo Markets

“Ishiba’s exit removes a politically weakened leader and opens the door for a more market-aligned, pro-business leadership…Japanese equities should benefit in the near-term from reduced political uncertainty”

Top Gainers and Losers- 24-Jul-25*

Go back to Latest bond Market News

Related Posts: