This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Higher by 2-3bp; Intrum, Cirsa, Tendam Upgraded

July 25, 2025

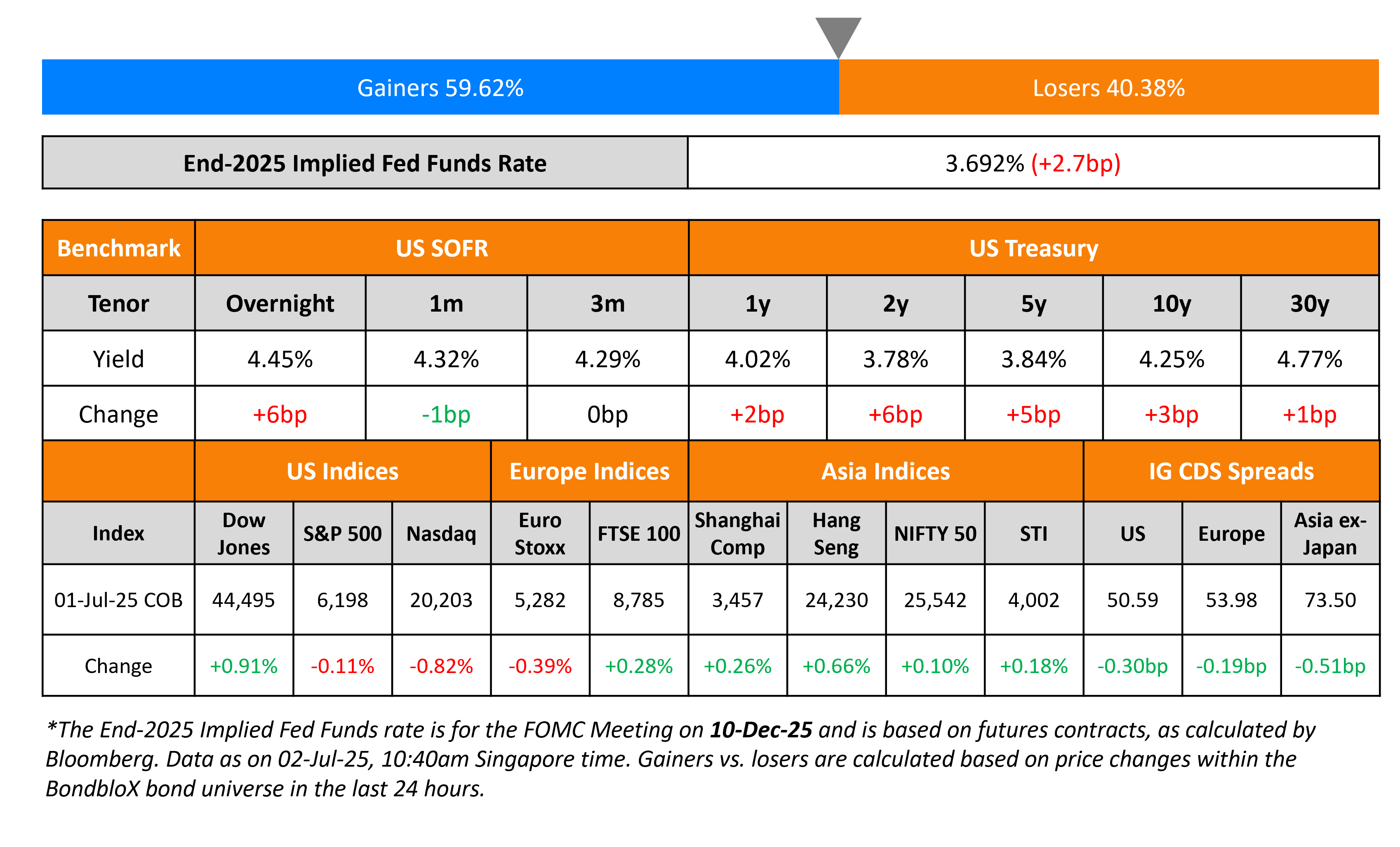

US Treasury yields ticked higher by 2-3bp.The July preliminary S&P US Manufacturing PMI fell to 49.5 from 52.9, also coming-in lower than expectations of 52.7. The Services PMI rose to 55.2 from 53.0, beating expectations of 52.9. US President Donald Trump and Fed Chairman Jerome Powell met as part of the Fed’s renovation project, with the former saying that there was “no tension” between the two. However, Trump continued to indicate his interest in seeing rate cuts happening in the US soon.

Looking at US equity markets, both the S&P and Nasdaq ended higher by 0.1% and 0.2% respectively. US IG CDS spreads were almost unchanged while HY CDS spreads widened by 2bp. European equity markets ended mixed too. The iTraxx Main CDS spreads widened by by 0.1bp while Crossover CDS spreads tightened by 2.4bp. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads were flat.

New Bond Issues

New Bonds Pipeline

- Li & Fung hires for $ 3.5Y bond

- Telecom Argentina hires for $ 200 mn 7.35Y bond

- Astrea 9 hires for S$/$ bond

Rating Changes

-

Intrum AB (Publ) Upgraded To ‘CCC+’ From ‘D’ On Debt Restructuring; Outlook Stable

-

Cirsa Enterprises S.A. Upgraded To ‘BB-‘ On Completed IPO And Debt Repayment; Outlook Stable

-

Tendam Brands Upgraded To ‘BB+’ On Completed Acquisition By Multiply Group; Outlook Stable

-

Guitar Center Inc. Downgraded To ‘CC’ From ‘CCC’ On Proposed Debt Exchange; Outlook Negative

Term of the Day: Scheme of Arrangement (SoA)

Scheme of Arrangement (SoA) is a legal mechanism used by a company in financial difficulty to reach a binding agreement with its creditors to pay back all, or part, of its debts over an agreed timeline. Typically, the company draws up scheme proposals for its creditors and sends it to them with notice of a creditors meeting. During the meeting, the company explains the proposals and creditors decide to vote in (or against) favor of the scheme. The scheme is then approved by a High Court, after which debts are written down as per the SoA. SoAs go through a court approval, making it different from consent solicitations.

Talking Heads

On Risk of Tighter Money Sparking Debate Over the Fed Funds Rate

Beth Hammack, Cleveland Fed President

“It’s a question we should be asking about, how relevant is the fed funds vs how relevant are some of these other rates”

Lou Crandall, Wrightson ICAP

“Fed funds aren’t at the center of money-market dynamics the way they were for decades,”

Teresa Ho, JPMorgan

“Focusing on fed funds is odd because Federal Home Loan Banks aren’t the true liquidity providers of the marketplace,”

On US Markets Are Almost ‘Too Hot’ – Deutsche Bank Analysts

margin debt is – by some metrics – higher than during the US tech bubble and near all-time highs… it is “getting closer to that point where market euphoria is becoming too hot to handle.”

On ECB in ‘Wait-and-See’ Mode After Holding Rates – Christine Lagarde, ECB President

With inflation at 2%, “we are well positioned to wait and see… We are in a good place now to hold and to watch how these risks develop over the course of the next few months.”… while the economy has proved resilient, the environment is still “exceptionally uncertain, especially because of trade disputes.” Other challenges include a strong euro and a jump in public spending on infrastructure and defense.

Top Gainers and Losers- 25-Jul-25*

Go back to Latest bond Market News

Related Posts: