This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

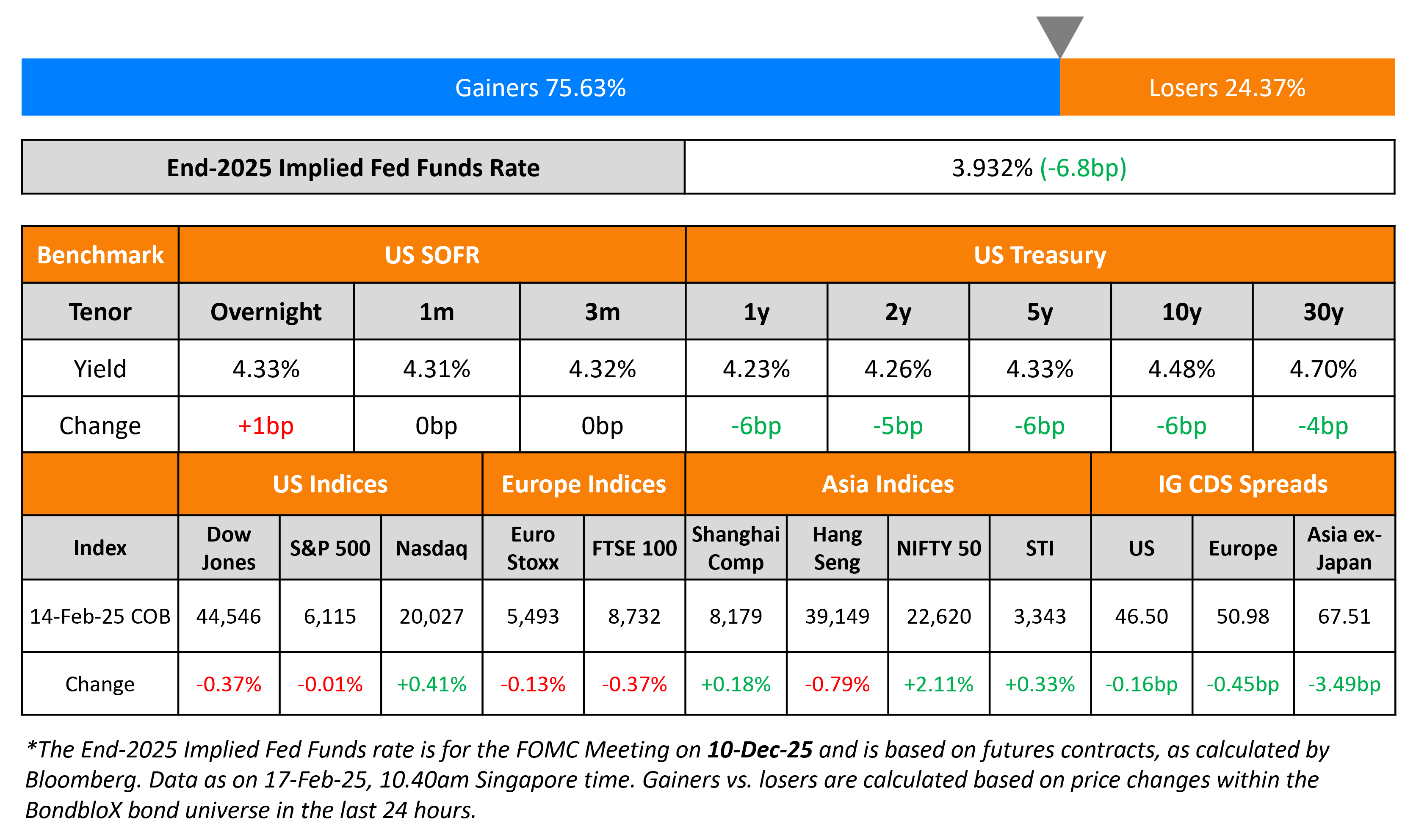

US Treasury Yields Ease Further On Weak Retail Sales Data

February 17, 2025

US Treasury yields fell by 5-6bp across the curve on Friday, with the 10Y now at 4.48%. The move came on the back of easing Retail Sales data. Retail Sales for the month of January contracted by 0.9% vs. expectations of -0.2% and the prior month’s revised reading of 0.7%.. The core reading also came in at -0.5%, lower than expectations of 0.3% and prior month’s upwardly revised figure of 0.5%. However, Industrial Production came in higher at 0.5% compared to expectations of 0.3%, but lower than previous month’s revised figure of 1.0%.

US equity markets saw the S&P ending flat and Nasdaq higher by 0.4%. Looking at credit markets, US IG and HY CDS spreads were 0.2bp and 0.3bp tighter respectively. European equity markets ended lower. The iTraxx Main and and Crossover CDS spreads tightened by 0.5bp and 4.3bp respectively. Asian equity markets have opened broadly mixed this morning. Asia ex-Japan CDS spreads were tighter by 3.5bp.

New Bond Issues

- Guocoland Limited S$ PerpNC5 at 4.65% Area

Cooperative Rabobank raised £500mn via a 6NC5 green bond at a yield of 4.93%, 17.5bp inside initial guidance of UKT+100-105bp area. The senior non-preferred bond is rated A3/A-/A+. Proceeds will be used to finance and/or refinance, in part or in whole, a portfolio of Eligible Green Assets, defined in accordance with the Rabobank Sustainable Funding Framework.

New Bonds Pipeline

- Emirates NBD hires for $ PerpNC6 bond

- Mongolia hires for $ bond

- Hutchison Ports hires for $ 5Y bond

Rating Changes

-

Moody’s Ratings upgrades Carnival Corporation’s CFR to Ba3, outlook positive

-

Fitch Upgrades Santander Holdings USA to ‘A-‘; Outlook Stable

-

Fitch Upgrades Santander Consumer Finance to ‘A’ Following Banco Santander’s Upgrade

-

Fitch Takes Various Actions on Five Guatemalan Banks After Revising Sovereign Outlook to Positive

-

Moody’s Ratings upgrades GE Aerospace senior unsecured ratings to A3; outlook positive

-

Moody’s Ratings upgrades Accell’s CFR to Caa3 on completed debt restructuring; stable outlook

-

Moody’s Ratings changes Walgreens’ outlook to negative; affirms ratings

Term of the Day

Sustainability Bonds

As per ICMA, an authority in capital markets, “Sustainability bonds are bonds where the proceeds will be exclusively applied to finance or re-finance a combination of both green and social projects.” These can be issued by financial/non-financial companies, governments or municipalities and should follow guidelines by the ICMA. The green and social aspects would be aligned to ICMA’s Green Bond Principles (GBP) and Social Bond Principles (SBP).

Talking Heads

On the Recovery of the Brazilian Bond Market

Mauro Favini, Vanguard

“Opportunities exist in Brazilian corps but you need to be comfortable with exposure to higher domestic rates and a likely coming slowdown as the high rates bite”

On Rising Distress for Junk Bonds

Marty Fridson, (formally) Merrill Lynch

“A tightening of credit standards puts more companies in serious risk of default…You’re not going to see the distress ratio zoom up immediately, but it will go up. The geopolitical situation is extremely volatile…at some point we’re going to see some kind of event that’s going to cause more havoc than we are anticipating”

On the Importance of US 10-year Treasury Yields

Scott Bessent, US Treasury

“Treasuries — debt issued by the US government — are widely regarded as the world’s safest securities…[providing] a benchmark for other borrowers, such as companies and homeowners with mortgages. The 10-year Treasury yield is a handy yardstick against which investors can compare possible returns or losses on riskier assets, such as stocks or corporate loans”

On bonds rallying as weak retail sales bolster Fed bets

David Russell, TradeStation

“The consumer sentiment report showed people were getting nervous and [14th Feb’s] weak retail sales number confirmed it…the resulting slack is good news for the Fed and tilts the balance a little bit more toward rate cuts.”

Top Gainers and Losers- 17-February-25*

Go back to Latest bond Market News

Related Posts: