This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Ease by 6bp; Brazil, Cinda HK, CaixaBank Price Bonds

November 7, 2025

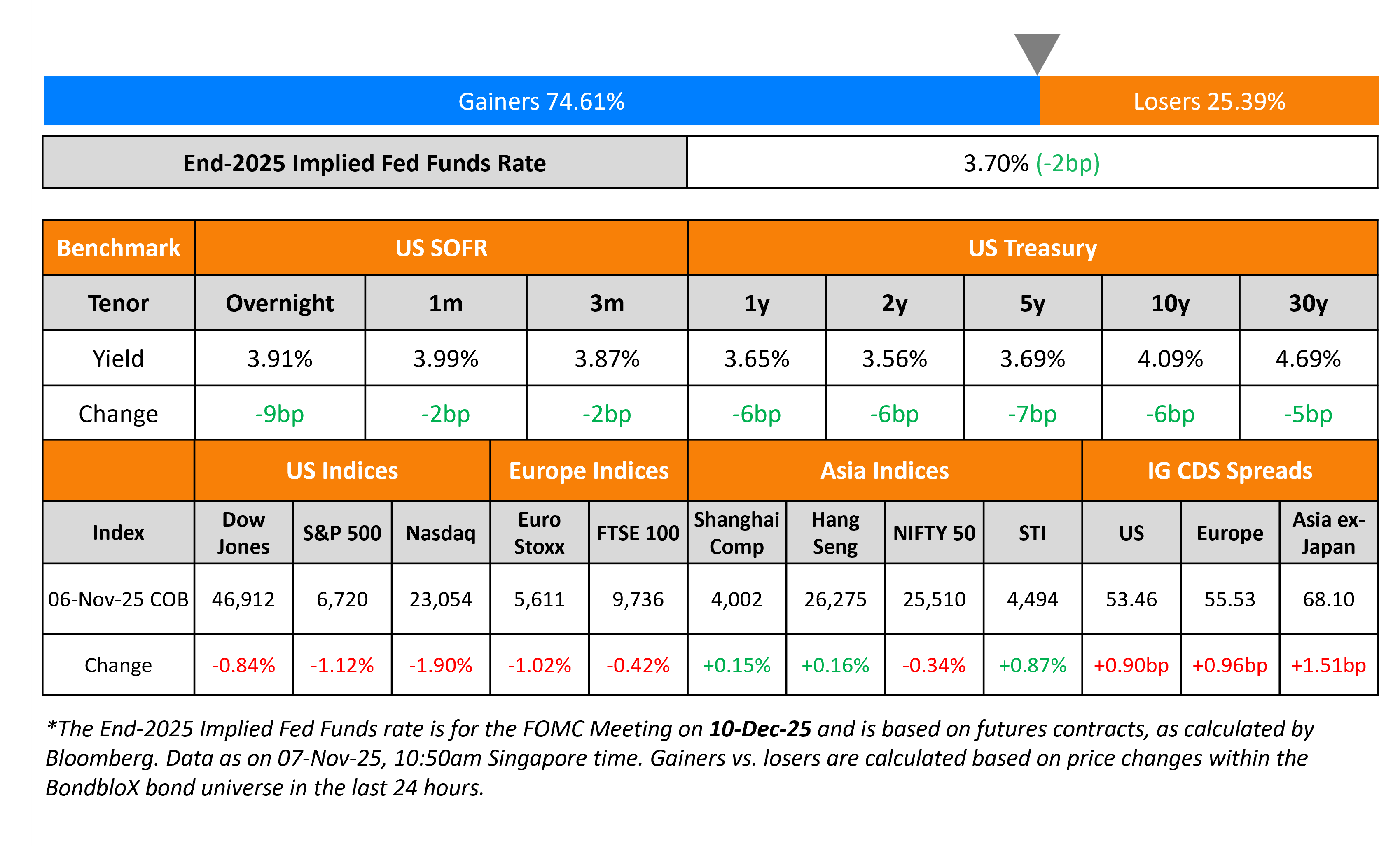

US Treasury yields retraced the move from a day earlier, falling by ~6-7bp yesterday. The risk sentiment deteriorated with the S&P and Nasdaq falling by 1.1% and 1.9% respectively. Separately, several Fed speakers spoke about their stance on monetary policy. Cleveland Fed President Beth Hammack highlighted her concerns about high inflation and said that “policy should be leaning against it”, adding that she “argues for a mildly restrictive stance”. St. Louis Fed President Alberto Musalem said that the Fed’s recent rate cuts were “appropriate”, but they should be careful to continue to lean against above-target inflation. Chicago Fed President Austan Goolsbee said that the lack of official inflation data during the government shutdown “accentuates” his caution about cutting rates. The Chicago Federal Reserve’s estimate for the unemployment rate in October climbed to 4.4% similar to September.

US IG and HY CDS spreads widened by 0.9bp and 6.2bp respectively. European equity indices ended lower too. The iTraxx Main CDS spreads were 1bp wider and the Crossover CDS spreads were wider by 5.8bp. Asian equity markets have opened in the red today. Asia ex-Japan CDS spreads widened by 1.5bp.

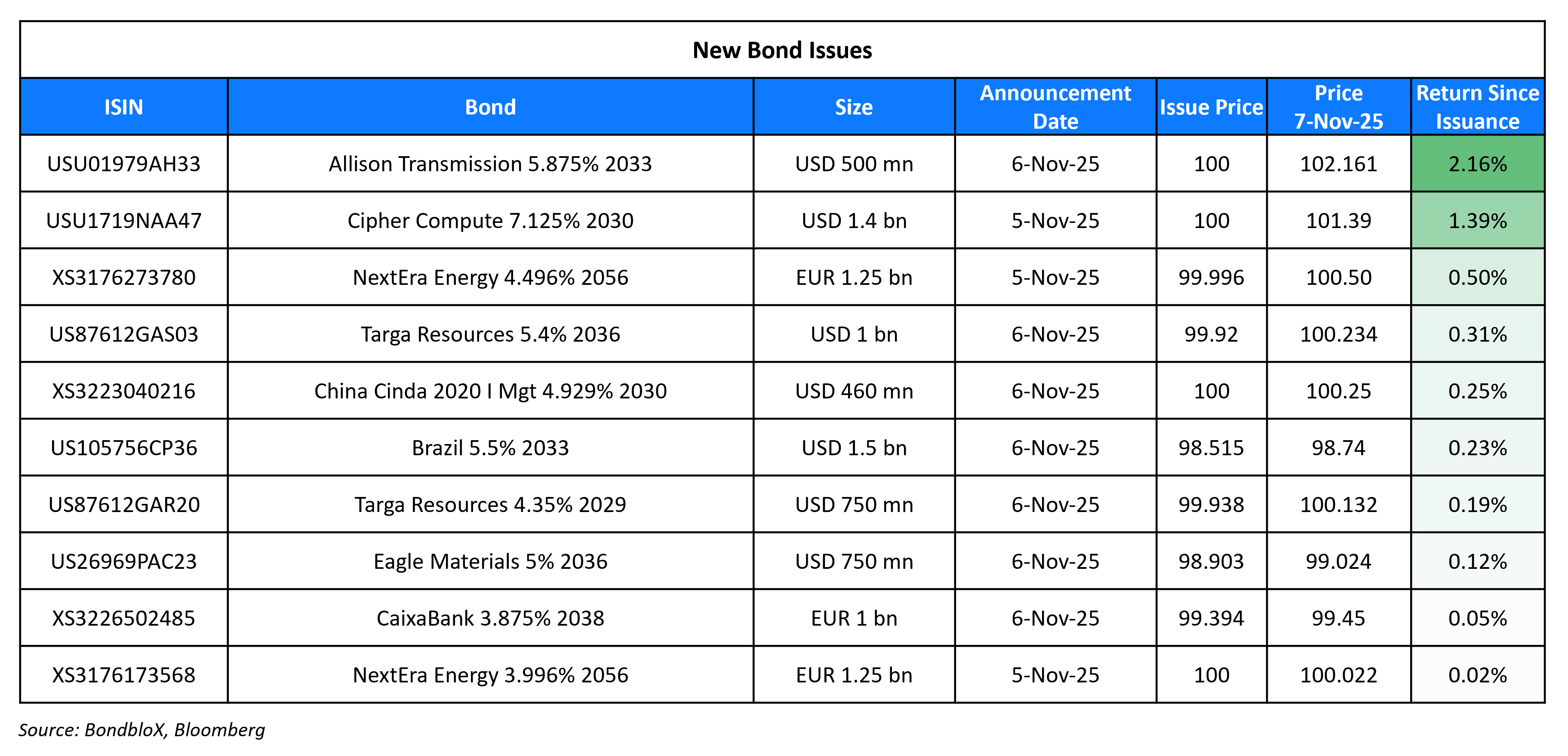

New Bond Issues

Brazil raised $2.25bn via a two-part deal. It raised $1.50bn via a long 7Y sustainability bond at a yield of 5.75%, 25bp inside initial guidance of 6.00% area. It also raised $750mn via a tap of its 6.625% 2035s at a yield of 6.20%, 30bp inside initial guidance of 6.50% area. The senior unsecured notes are rated Ba1/BB/BB. Proceeds will be used to repay outstanding federal public debt. Net proceeds from the long 7Y bond offering will be used for eligible green and/or social expenditures.

CaixaBank raised €1bn via a 12.5NC7.5 Tier-2 bond at a yield of 3.973%, ~22.5bp inside initial guidance of MS+165/170bp area. The subordinated note is rated Baa2/BBB/BBB. Net proceeds will be used to finance/refinance, in whole/part, eligible projects included in its social eligible portfolio.

Cinda HK raised $960mn via a two-part issuance. It raised $500mn via a 3Y bond at a yield of 4.379%, 50bp inside initial guidance of T+130bp area. It also raised $460mn via a 5Y FRN at SOFR+100bp, 50bp inside initial guidance of SOFR+150bp area. The notes are rated BBB+ by S&P, and have a change of control put at 101. Proceeds will be used towards payment of existing debt in accordance with applicable laws.

Cipher Compute raised $1.4bn via a 5NC2 bond at a yield of 7.125%, ~25bp inside initial guidance of 7.25-7.5% area. The senior unsecured note is rated Ba3/BB-. Proceeds will be used to fund the construction of a data center linked to Alphabet.

Rating Changes

- Ratings On Various Irish Banks Raised On Solid Risk-Adjusted Profitability; Outlooks Stable

- Fitch Downgrades Owens & Minor IDR to ‘B+’; Ratings on Negative Watch

- Fitch Downgrades FMC’s IDR to ‘BB+’; Outlook Stable

- Capital One Financial Corp. Outlook Revised To Positive From Stable On Improving Competitive Position

- Brighthouse Financial ‘BBB’ Issuer Credit Rating Placed On CreditWatch Negative On Announced Acquisition By Aquarian

- Rogers Communications Inc. Outlook Revised To Negative From Stable; ‘BBB-‘ Rating Affirmed

Term of the Day: Covenants

Debt covenants (also known as loan covenants, banking covenants or financial covenants) are lending restrictions in financial agreements that limit the actions of the borrowers. Lenders typically use covenants to ensure borrowers will operate within certain rules so that borrowers can repay their debt.

Covenants can either be positive or negative. With positive covenants, borrowers promise to do certain actions such as maintain a certain debt to equity ratio, interest coverage ratio, or level of cash flow, etc. With negative covenants, borrowers are restricted from certain actions such as to sell certain assets or incur more debt. Investors can find the covenants on a bond in its offering circular or prospectus.

Talking Heads

On Seeing the Dollar Drop Once US Key Data Void Ends

David Adams, Morgan Stanley

“The more that employment data show a consistently slow pace of hiring, the more investors will begin to price in this structural force via lower real and nominal rates, which in turn weighs on the dollar”

Derek Halpenny, MUFG

“The scale of deterioration in the NFP data up to what we have was such that historically it is very rare for the labor market to then suddenly turn around and improve”

On Fed’s independence has global importance – John Williams, NY Fed President

“The evidence is pretty very compelling that independent central banks have been able to make tough decisions and unpopular decisions in the short run that pay off in the long run, especially around price stability.”

On China’s Reit to grow to $1tn as developers shift strategy: Morgan Stanley

Stephen Cheung and Cara Zhu, Morgan Stanley

“The shift may alter the competitive landscape of developers, reshaping the industry’s long-term investment thesis… recurring income could cushion the earnings decline during a property down-cycle”

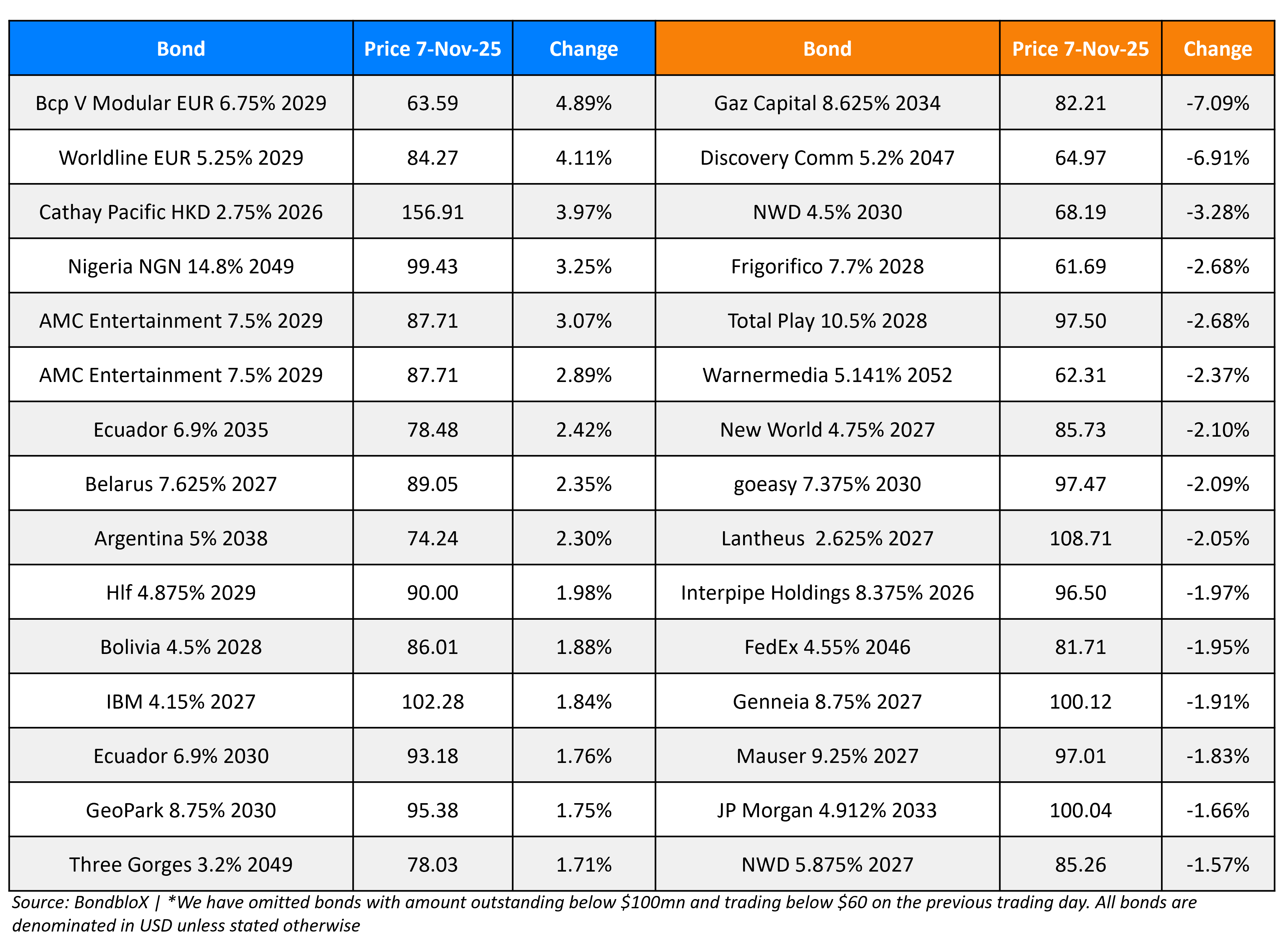

Top Gainers and Losers- 07-Nov-25*

Go back to Latest bond Market News

Related Posts: