This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

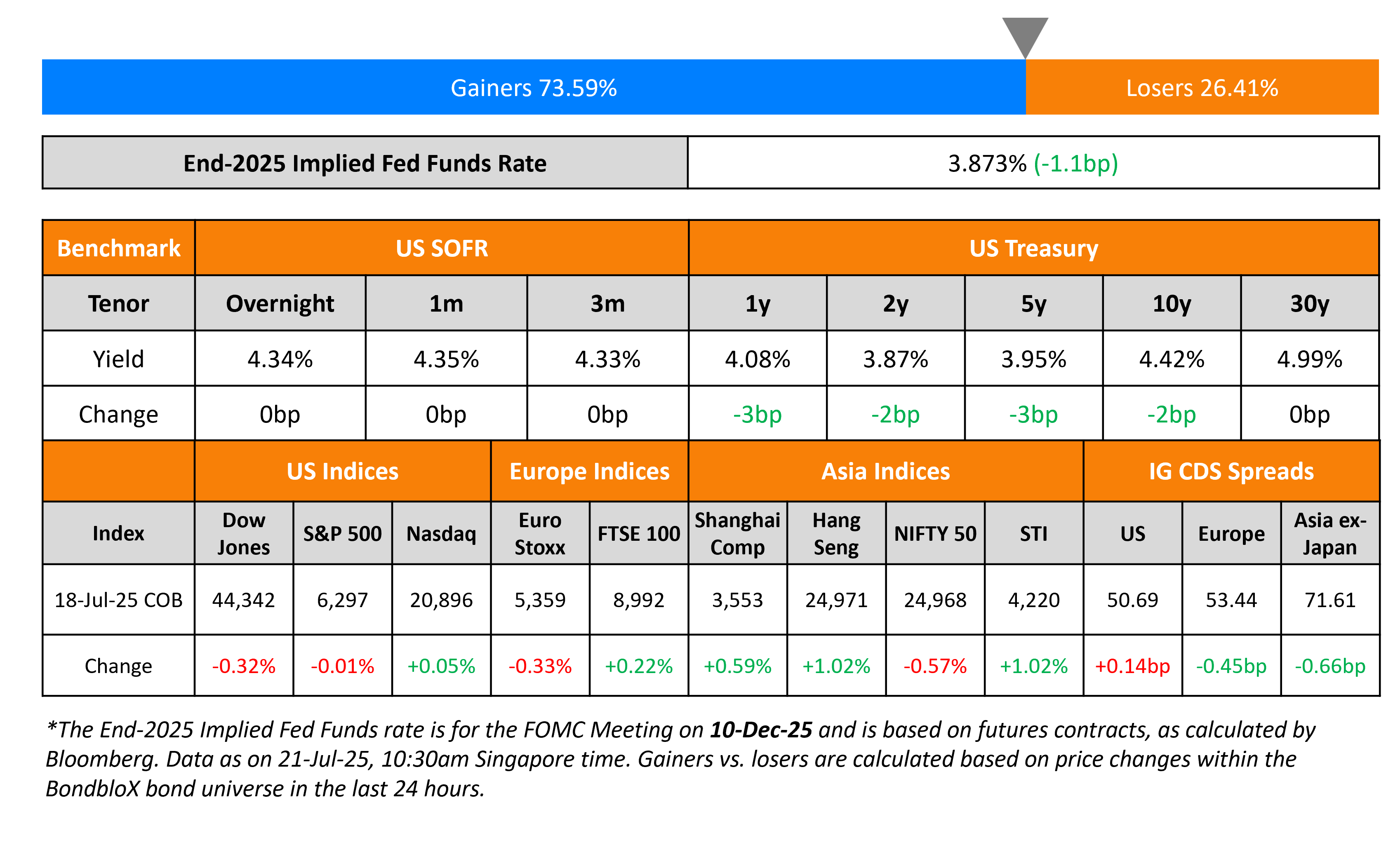

US Treasury Yields Ease by 2-3bp; Michigan Consumer Sentiment Slightly Better Than Expected

July 21, 2025

US Treasury yields eased by 2-3bp. The preliminary University of Michigan Consumer Sentiment Index reading came-in at 61.8 for July, slightly better than expectations of 61.5 and the prior month’s 60.7 reading. US Commerce Secretary Howard Lutnick stated over the weekend that August 1 is the hard deadline for countries to strike trade deals with the US, adding that there is no flexibility. He added, “Nothing stops countries from talking to us after August 1, but they’re going to start paying the tariffs on August 1”. Separately, Fed Governor Christopher Waller reiterated his stance for a July rate cut, indicating that he might dissent if the FOMC votes to keep rates unchanged.

Looking at US equity markets, both the S&P and Nasdaq ended almost flat. US IG and HY CDS spreads widened by 0.2bp each. European equity markets ended mixed. The iTraxx Main CDS spreads tightened by 0.5bp and Crossover CDS spreads tightened by 1.6bp. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were tighter by 0.7bp.

New Bond Issues

New Bonds Pipeline

- Adecoagro hires for $ bond

- NAB hires for A$ 15NC10 Tier 2 MTN bond

Rating Changes

-

Fitch Upgrades Northern Oil and Gas, Inc.’s IDR to ‘BB-‘; Outlook Stable

- Moody’s Ratings downgrades LifeScan’s PDR to D-PD following bankruptcy filing

- Moody’s Ratings affirms WPP’s Baa2 ratings; outlook changed to negative

Term of the Day: Euroclearability

Euroclear is a financial services company that specializes in the settlement of securities transactions as well as the safekeeping and asset servicing of these securities. A capital market becomes Euroclearable when it establishes a clearing and settlement link with Euroclear, the international central securities depository (ICSD), and adopts the legal, regulatory and other market standards that allow Euroclear to provide the same ease of access and degree of asset protection expected by international investors in any well-established market. Euroclear settles domestic and international securities transactions, covering bonds, equities, derivatives and investment funds.

Talking Heads

On Trump Threats Send Wall Street Hunting for Perfect Powell Hedge

Mark Dowding, RBC Global

“We would have always assumed there is no basis for firing a Fed chair and the Fed has been immune from political interference…this is now changing”

Meghan Swiber, Bank of America

“We’re seeing an inflation market pricing a premium around the Fed independence risk…you ultimately have the market trading and perceiving more persistent upside risk to the inflation landscape”

Ed Al-Hussainy, Columbia Threadneedle

“The nightmare scenario is the Fed loses its independence, tariff inflation is big and the fiscal policy turns out to be more simulative ahead of mid-term election, and it’s all happening at the same time”

On Dollar Rethink Is Pushing Emerging World to Sell More Euro Debt

Stefan Weiler, JPMorgan

“If you have an ambition to issue in euros, this is the time to do it…Borrowers have been noticeably more active in diversifying and exploring also some niche markets.”

Matthew Graves, PPM America

“We have been more active in looking for opportunities outside of US dollars credits…Directionally, we like owning euros versus dollars right now.”

Kamakshya Trivedi and Strategists, Goldman Sachs

The pickup in euro debt sales “is likely to extend given our outlook for less exceptional US growth and for further dollar depreciation”

On Junk Bond Investors Piling into the Riskiest Debt

Robert Tipp, PGIM

“As investors have become more comfortable, they’ve begun to reach for risk

Rajeev Sharma, Key Private Bank

“The BBs are getting stuck in the middle without the risk-reward benefits that you’re getting in other rungs of rating categories”

Bill Zox, Brandywine Global Investment

“The equities market is telling you that recession probability is not elevated right now…So that all seems to be consistent with, the dedicated high-yield investor going from BBs to Bs”

Top Gainers and Losers- 21-Jul-25*

Go back to Latest bond Market News

Related Posts: