This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Bear Steepened; Raiffeisen Bank Upgraded; DP World to invest $800m in Syria’s Port of Tartus

July 14, 2025

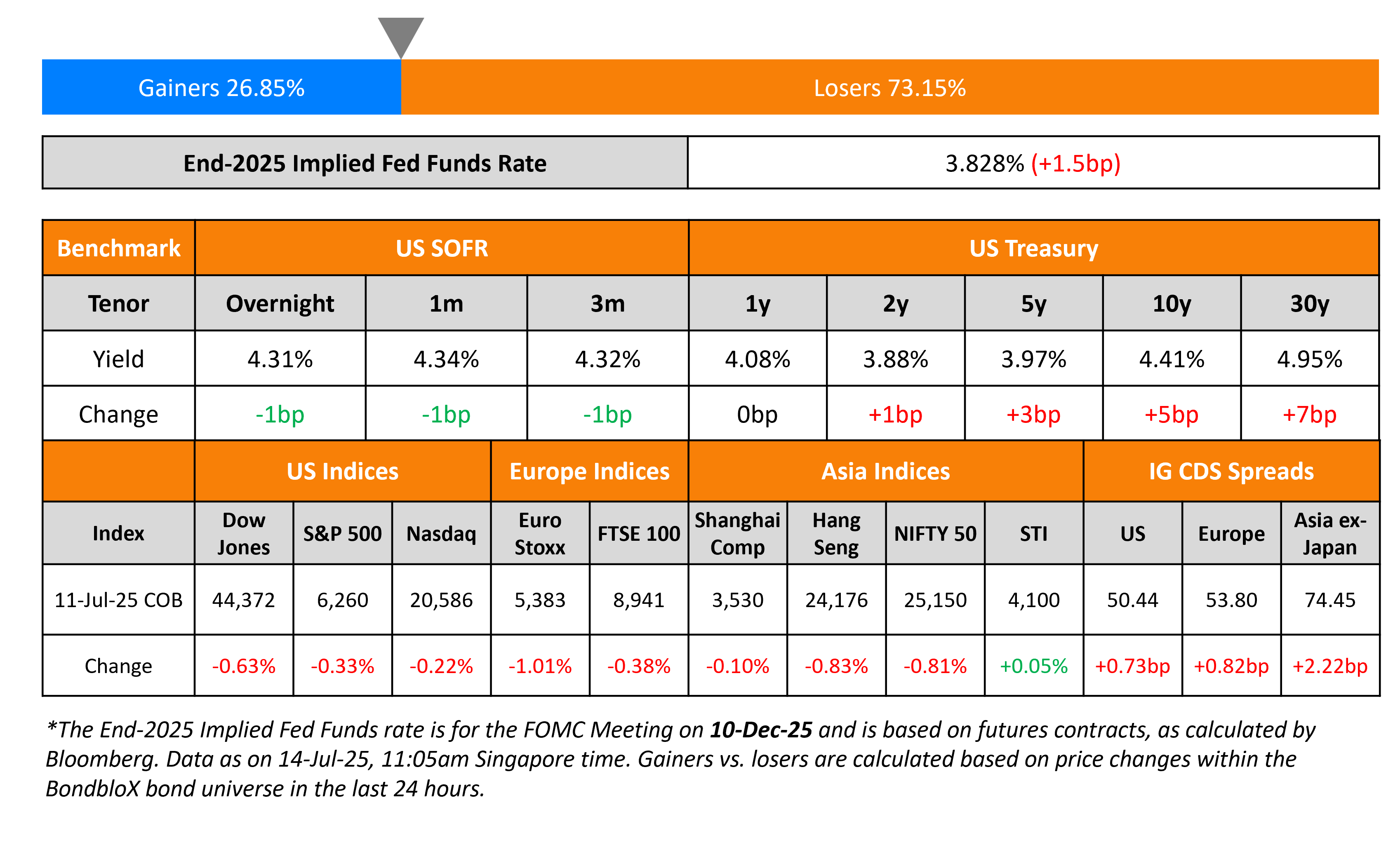

US Treasury yields rose with the curve by a bear steepening move – the 2Y yield was up 1bp while the 10Y rose by 5bp. US President Donald Trump shared screenshots on Truth Social showing a 30% tariff on goods from the EU and Mexico. The EU has paused trade retaliation against the US after the above 30% tariff threat.

Looking at US equity markets, the S&P and Nasdaq closed lower by 0.3% and 0.2%, respectively. US IG and HY CDS spreads widened by 0.7bp and 5.4bp respectively. European equity markets ended lower too. The iTraxx Main CDS spreads widened by 0.2bp while Crossover CDS spreads widened by 4.1bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were wider by 2.2bp.

New Bond Issues

Rating Changes

- Moody’s Ratings upgrades Raiffeisen Bank Zrt.’s senior unsecured ratings, outlook stable

- Moody’s Ratings downgrades Televisa’s ratings to Ba1; negative outlook

- Fitch Revises Outlook on Henan Water to Positive; Affirms at ‘A-‘

- Fitch Revises Outlook on Renesas to Negative; Affirms at ‘BBB’

Term of the Day: Bear Steepening

Bear Steepening refers to a move in the yield curve where the longer-dated bond yields move higher than the shorter-dated bond yield (far maturity bonds sell-off more than near maturity ones). A bear steepening move can occur due to different reasons some of them being long term expectations of inflation picking up, higher supply of longer-dated bonds, central bank tapering purchases with a focus on the long-end bonds etc.

Talking Heads

On Worst Spate of Downgrades Since 2021 Signalling Pain

Jon Curran, Principal Asset Management

“Credit picking is super important now. You have to get your calls right…The vulnerability to downgrades is higher.”

Sonali Pier, Pimco

“We’ve maintained a light footprint in areas of the market where we foresee more downgrade and fallen angel risk”

Christina Padgett, Moody’s Ratings

“Businesses are vulnerable to tariffs but also living with uncertainty”

On Risk of Powell Ouster Is Underpriced – George Saravelos, Deutsche Bank Strategist

market is “pricing a very low probability” of Powell being removed from office…“Investors would likely interpret such an event as a direct affront to Fed independence, putting the central bank under extreme institutional duress…Beyond that, we worry about the very vulnerable external funding position which the US economy currently finds itself in”

On Bond Traders Casting Doubt on September Fed Cut Before Key CPI Data

Zachary Griffiths, CreditSights

“The CPI figures could set the tone for the direction of the Fed and risk sentiment for the second half of the year”

Tracy Chen, Brandywine Global

“I don’t see how the Fed can cut in September. The resilience of the job market and the frothy risk asset market do not justify the cut.”

John Lloyd, Janus Henderson

“Even if the next cut comes after September, it doesn’t necessarily derail the path of easing… We have two cuts priced in through December…Could one of those come out?”

Top Gainers and Losers- 14-Jul-25*

Go back to Latest bond Market News

Related Posts: