This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Yields Almost Unchanged on Friday; Intrum, ADT, Hess Upgraded

July 28, 2025

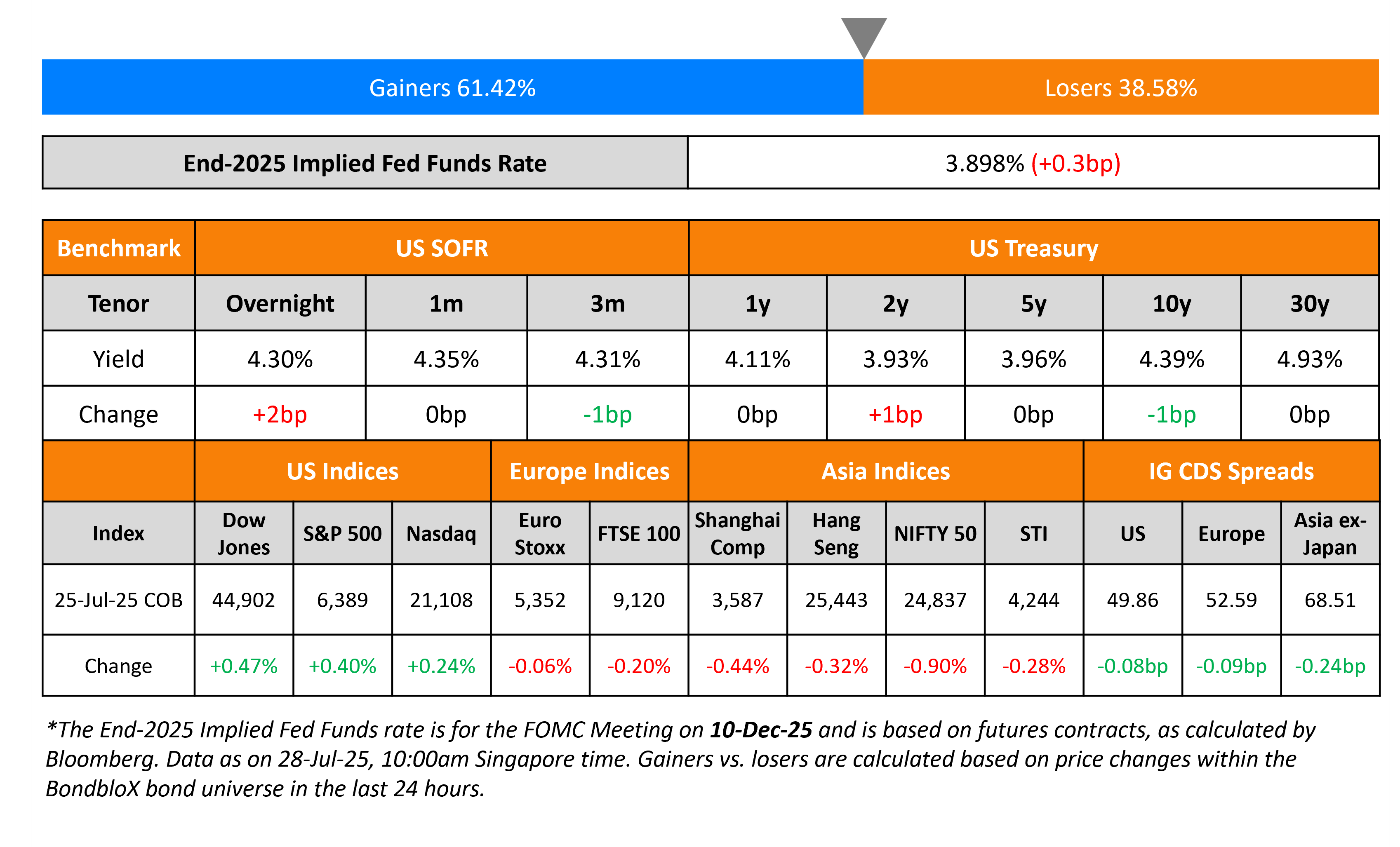

US Treasury yields were almost unchanged on Friday. US preliminary Durable Goods Orders for June saw a 9.3% drop, coming-in slightly better than expectations of a 10.7% drop, partly driven by lower orders for Boeing aircrafts. Core Durable Goods Orders rose by 0.2%, better than expectations of a 0.1% rise. A trade agreement between the US and the EU was finalised, with a 15% tariff to be imposed on most EU goods. Separately, the US and China will resume tariff talks, with some analysts expecting an extension of the pause on tariffs by another 90 days.

Looking at US equity markets, both the S&P and Nasdaq ended higher by 0.4% and 0.2% respectively. US IG CDS spreads were 0.1bp tighter and HY CDS spreads tightened by 0.2bp. European equity markets ended lower. The iTraxx Main CDS spreads tightened by 0.1bp while Crossover CDS spreads tightened by 1.5bp. Asian equity markets have opened broadly lower today. Asia ex-Japan CDS spreads were 0.2bp tighter.

New Bond Issues

New Bonds Pipeline

- Li & Fung hires for $ 3.5Y bond

- Astrea 9 hires for S$/$ bond

Rating Changes

- Moody’s Ratings upgrades Intrum’s CFR to Caa2 following debt restructuring, assigns B3 ratings to New Money Bonds and Caa3 ratings to new Guaranteed Senior Global Notes, outlook stable

- ADT Inc. Upgraded To ‘BB’ On Improvement In Credit Metrics And Decreasing Sponsor Ownership; Outlook Stable

-

Fitch Upgrades Hess Corporation’s IDR to ‘AA’; Outlook Stable

-

Singapore Post Ltd. Downgraded To ‘BBB-‘ From ‘BBB’ As It Scales Down Operations; Outlook Stable

- Moody’s Ratings changes CrowdStrike’s outlook to positive

Term of the Day: High Frequency Indicators

High frequency indicators are economic data points that are published more frequently than other typical data points, which are typically published on a monthly basis. For example, every week in the US, the Department of Labor reports the ‘Unemployment insurance weekly claims’, aka initial jobless claims. Other data points like weekly consumer sentiment indices, Weekly Economic Index (WEI) published by the Federal Reserve Bank of New York, Atlanta Fed’s GDPNow, weekly inflation expectations survey by Michigan, mobility and travel indices etc. are also considered high frequency indicators. These indicators can be inputted into economic models and help give a picture of economic conditions in advance, before the actual data release which may come out only once a month.

Talking Heads

On EM Debt Hedge Funds Eyeing Safeguards as World-Beating Rally Blooms

Demetris Efstathiou, Blue Diagonal

President Donald Trump’s administration has caused a “breakdown of the traditional safe haven correlations” by shaking up the post-Cold War world order…“It is very hard to predict what they will do next with tariffs, and on top of that you have ongoing wars”

Evgueni Konovalenko, ProMeritum Investment

“Liquidity management will be critical in the second half of the year because of an unpredictable environment and geopolitical risks,”

On Rising Fiscal Deficits Driving Billions Into Credit

BlackRock strategists

“Credit has become a clear choice for quality.”

Jason Simpson, State Street Investment

“What we’ve seen on the government fiscal side is not great news…Corporates seem to be chugging along nicely.”

On US economic data quality a worry – Reuters Poll

Erica Groshen, 2013-17 BLS commissioner

“I can’t help but worry some deadlines are going to be missed and undetected biases or other errors are going to start creeping into some of these reports just because of the reduction in staff…current administration’s changes will make civil service employees more like political appointees”

BLS spokesperson

“Response rates to most federal surveys have been declining for many years…BLS is exploring ways to overcome response rate and limited resource challenges”

Ethan Harris, Bank of America

“Budget cuts are coming at a time when it’s getting harder and harder to run surveys. You have to sample more people and chase people down, and that’s a labor-intensive effort”

Top Gainers and Losers- 28-Jul-25*

Go back to Latest bond Market News

Related Posts: