This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Eases by 4-6bp; Turkey, Frasers, Westpac Price Bonds; Europcar Downgraded

June 25, 2025

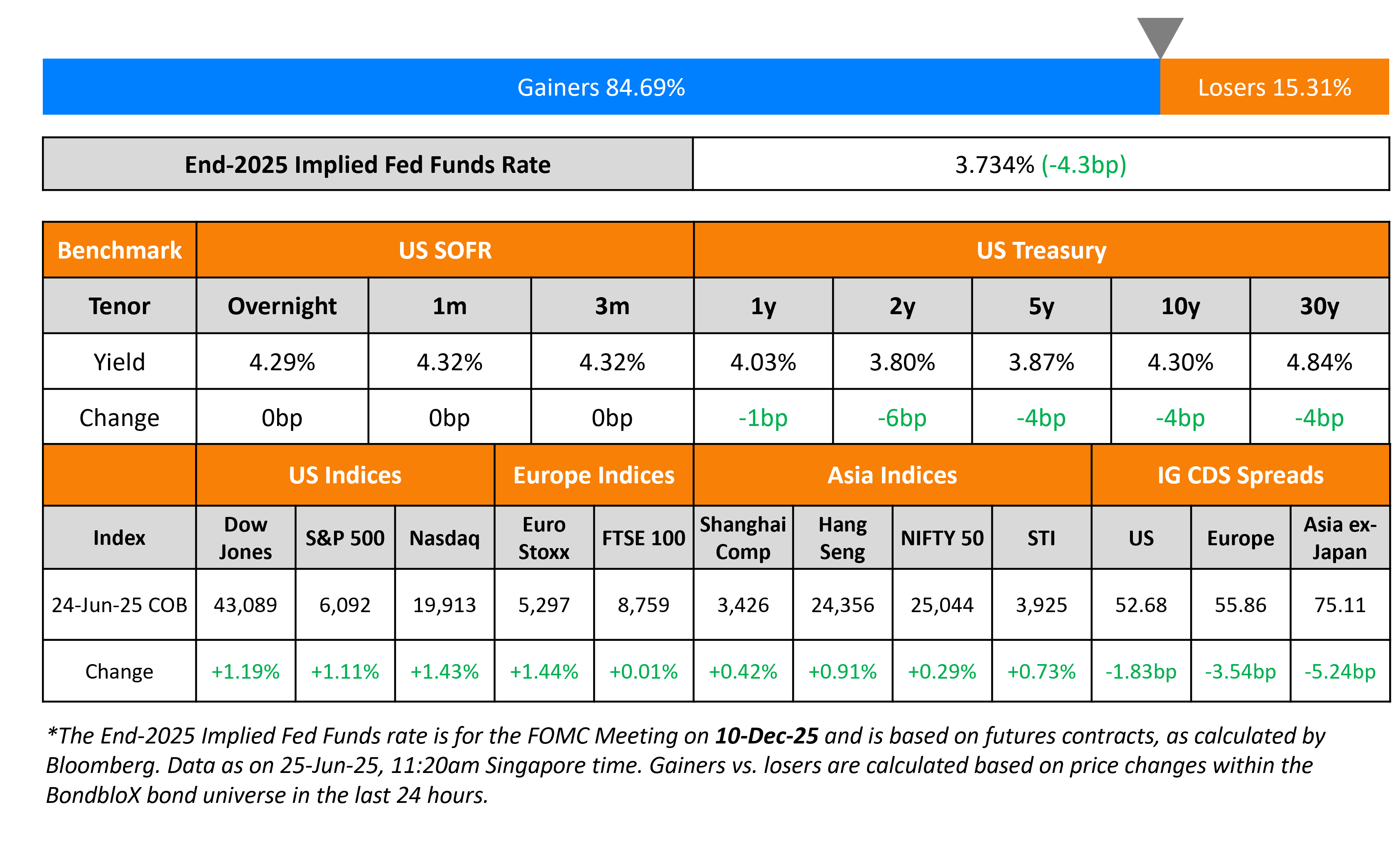

US Treasury yields eased by 4-6bp across the curve. The ceasefire announced between Iran and Israel continued to be fragile after early breaches by both the nations. Consumer Confidence Index for June came in at 93.0, vs. expectations of 99.4. Fed Chair Jerome Powell testified in front of the House Financial Services Committee on Tuesday. He described the US economy as “solid” and that it was still too early to understand the impact of tariff on inflation.

Looking at US equity markets, S&P and Nasdaq jumped higher by 1.11% and 1.43% respectively on Tuesday. In credit markets, US IG and HY CDS spreads tightened by 1.8 and 10.2bp respectively. European equity markets closed higher as well. The iTraxx Main CDS spreads and Crossover CDS spreads tightened by 3.5bp and 15.4bp respectively. Asian equity markets have broadly opened higher today. Asia ex-Japan CDS spreads tightened by 5.2bp.

New Bond Issues

- CapitaLand India Trust S$ PerpNC5 at 4.65% area

Republic of Turkiye raised $2.5bn via a 5Y sukuk at a yield of 6.85%, 40bp inside the initial guidance of 7.25% area. The senior unsecured note is rated B1/BB-/BB-, and received orders of $5.6bn, ~2.2x the issue size. The bond is priced at a new issue premium of ~21bp as compared to its equivalent 9.125% 2030s currently yielding 6.64%.

Frasers raised SGD 200mn via a PerpNC5 bond at a yield of 3.98%, 27bp inside the initial guidance of 4.25% area. The subordinated note is rated Baa2. If not called by 2 July 2030, the coupon will reset to prevailing SGD OIS + 222.1bp. Proceeds will be used for new investments, distributions, financing any asset enhancement works and refinancing any existing borrowings of the group.

Westpac raised $1.5bn in a two-tranche deal. It raised:

- $750mn via a 5Y bond at a yield of 4.354%, ~22.5bp inside the initial guidance of T+70-75bp area

- $750mn via a 5Y FRN at a yield of SOFR+82bp, vs. the initial guidance of SOFR equiv.

These senior unsecured notes are rated Aa2/AA-. Proceeds will be used for general corporate purposes.

Ford Motors raised €1bn via a 3Y long bond at a yield of 3.624%, 45bp inside initial guidance of MS+200bp area. The senior unsecured bond is rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

Nomura raised $2.25bn in a three-part deal. It raised:

- $1bn via a PerpNC5 bond at a yield of 7.375%, 37.5bp inside the initial guidance of 7.75% area. The subordinated note is rated Ba3/BB. If not called by 15 Jan 2031, the coupon will reset to 5Y UST + 308.4bp

- $750mn via a 5Y bond at a yield of 4.904%, ~27.5bp inside the initial guidance of T+130-135bp area. The senior unsecured note is rated Baa1/BBB+. Proceeds will be used for lending to Nomura Holdings’ subsidiaries, which will then be used for general corporate purposes.

- $500mn via a 10Y bond at a yield of 5.491%, ~32.5bp inside the initial guidance of T+150-155bp area. The senior unsecured note is rated Baa1/BBB+. Proceeds will be used for lending to Nomura Holdings’ subsidiaries, which will then be used for general corporate purposes.

Santander raised €1.5bn via a PerpNC6 AT1 bond at a yield of 6%, 50bp inside initial guidance of 6.5% area. The junior subordinated note is rated Ba1/BBB-. The bond is callable from 2 January 2031 to 2 July 2031 and on any coupon payment date thereafter. If not called by 2 July 2031, the coupon resets to 5Y Mid Swap + 381.9bp. Proceeds will be used for general corporate purposes, including, without limitation, managing potential refinancing of existing capital securities.

Banco BPM raised €500mn via a 10.5NC5.5 Tier 2 bond at a yield of 4.075%, 25bp inside initial guidance of MS+205bp. The subordinated note is rated Ba1/BB/BB and received orders above €925mn, 1.85x the issue size. If not called by 1 Jan 2031, the coupon resets to 5Y Mid Swap + 188.3 bp. Proceeds will be used for general corporate purposes.

CNP Assurances raised €500mn via a PerpNC7 RT1 bond at a yield of 5.5%, 50bp inside initial guidance of 6% area. The junior subordinated bond is rated Baa2/BBB (Moody’s/Fitch). If not called by 2 July 2032, the coupon resets to prevailing 5Y Mid Swap + 319.9bp. Proceeds will be used for general corporate purposes.

Toyota raised $1.5bn via a three trancher. It raised:

• $500mn via a 2Y bond at a yield of 4.186%, 27bp inside initial guidance of T+65bp area

• $500mn via a 5Y bond at a yield of 4.45%, 30bp inside initial guidance of T+90bp area

• $500mn via a 10Y bond at a yield of 5.053%, 28bp inside initial guidance of T+105bp area

The senior unsecured bonds are rated A1/A+. Proceeds will be used for eligible projects as defined in the company’s preliminary prospectus supplement.

New Bond Pipeline

- Shinhan Bank hires for $ 5Y bond

- LATAM Airlines hires for $ 5NC2 bond

- Dar Al-Arkan hires for $ 5Y bond

Rating Changes

- Fitch Affirms Krung Thai Bank at ‘BBB+’/’AAA(tha)’; Outlook Stable; Upgrades VR to ‘bbb’

- Europcar Rating Lowered To ‘B-‘ On Profitability Challenges; Outlook Stable

- Manuchar Group B.V. Outlook Revised To Negative On Weaker-Than-Expected Operating Performance; ‘B’ Rating Affirmed

- Fitch Downgrades Coronado Global Resources to ‘CCC-‘

Term of the Day: Restricted Tier 1(RT1)

Restricted Tier 1 (RT1) bonds are junior subordinated securities issued by insurers that qualify as capital under Europe’s insurance regulation (known as Solvency II). To qualify as Tier 1 capital, the bonds must be perpetual, no step-up in coupon and a contractual trigger to principal write-down or equity conversion. According to the Solvency II directive, RT1s will automatically convert into equity or be written down upon three events:

- Breach of the Solvency Capital Requirement (SCR), which defines the capital required to ensure that the insurance company can meet its obligations over the next 12 months, for more than three months

- Drop of solvency ratio below 75% of the SCR

- Breach of the Minimum Capital Requirement (MCR), which is the threshold below which the national regulator would intervene

Talking Heads

On 10-Year Treasury Bonds – Bill Gross, Pacific Investment

“I suggest a ‘little bull market’ for stocks and a ‘little bear market’ for bonds…little reason for rates to meaningfully fall from current levels”

On Colombia Bond Investors Ready to Ride Out Gustavo Petro’s Final Year in Office

Sarah Glendon, Columbia Threadneedle

“With a lot of the fiscal noise behind us, we can at some point look forward to hopefully a positive catalyst on the political front.”

Anthony Kettle, RBC BlueBay

“If the left was expected to remain in power for several more years, people would be much more concerned…people are trying to just look through the noise.”

On Key Gauge Signalling Waning Demand for US Dollar in $7.5 Trillion Market

Koichi Sugisak and Francesco Grechi, Morgan Stanley

“Recent cross-currency basis movements suggest investors have less appetite to buy dollar-denominated assets”

Guneet Dhingra, BNP Paribas SA

“Our view at BNP is that there is definitely a fair bit of cross-border flow, particularly from the US to Europe.”

Simon Freycenet and Friedrich Schaper, Goldman Sachs

“The modest currency base moves in the wake of ‘Liberation Day’ are notable, likely also reflecting the absence of a dash for dollars amid a more resilient global financial system than before”

Top Gainers and Losers- 25-Jun-25*

Go back to Latest bond Market News

Related Posts: