This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Cuts Q1 Borrowing Estimates

January 30, 2024

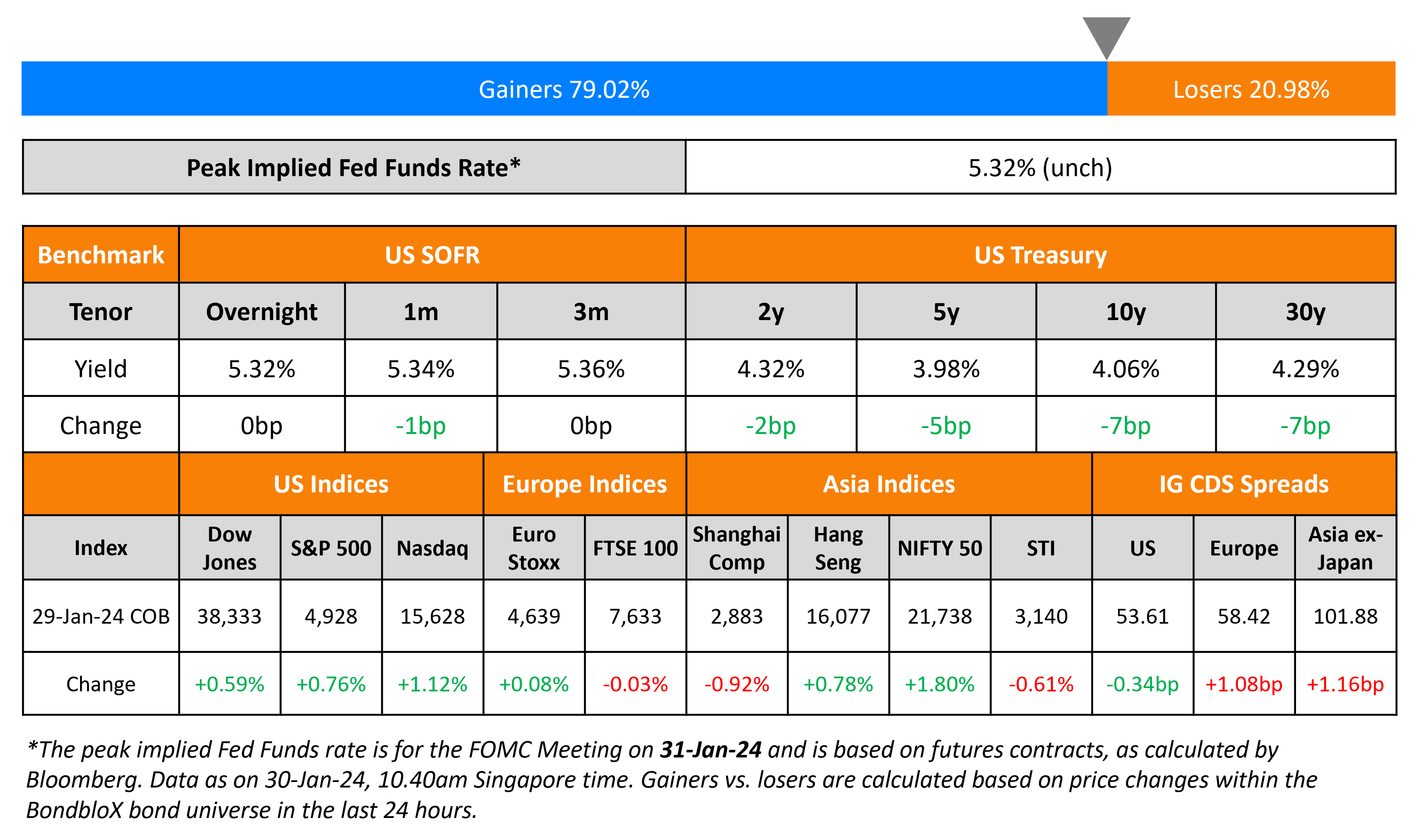

US Treasury yields moved lower by 5-7bp across the 5Y, 10Y and 30Y tenors on Monday. The move lower in yields came after the US Treasury reduced its federal borrowing estimate for 1Q 2024. This move was unexpected as it now estimates $760bn in net borrowing for the current quarter, down from a previous $816bn estimate released in late October 2023. Looking at credit markets, US IG CDS spreads tightened 0.3bp and HY spreads were 4bp tighter. Equity markets saw the S&P and Nasdaq rise 0.8% and 1.1% respectively.

European equity markets ended flat. Credit markets in the region saw the European main CDS spreads widen by 1.1bp while crossover spreads tightened by 4bp. Asian equity markets have opened in the red today. Asia ex-Japan IG CDS spreads widened by 1.2bp.

.png)

New Bond Issues

- Vista Land $ 5NC3 at 9.125% area

- Ji’an Chengtou Holding $ 3Y Green at 7.8% area

Hyundai Capital Services raised $1bn via a two-part deal. It raised $500mn via a 3Y bond at a yield of 5.224%, 35bp inside initial guidance of T+140bp area. It also raised $500mn via a 5Y bond at a yield of 5.22%, 35bp inside initial guidance of T+155bp area. The senior unsecured notes are rated Baa1/BBB+ (Moody’s/Fitch). Proceeds will be used for general corporate purposes.

IBM raised $5.5bn via a seven-tranche deal:

The senior unsecured bonds are rated A3/A-/A-. Proceeds will be used for general corporate purposes including debt repayment.

New Bond Pipeline

- Science City Guangzhou Investment hires for $ Green bond

- Greenko Plans for up to $450mn bond

Rating Changes

- Moody’s upgrades Embraer’s rating to Ba1, stable outlook

- Cirsa Enterprises S.A.U. Upgraded To ‘B+’; Outlook Stable; Proposed Notes Rated ‘B+’

- Core & Main Inc. Issuer Credit Rating Raised To ‘BB-‘ On Improved Financial Risk; New Debt Rated; Outlook Positive

- Moody’s downgrades Lippo Malls Indonesia Retail Trust to Caa3/Ca; recognizes distressed exchange

Term of the Day

Total Loss Absorbing Capacity (TLAC)

Total Loss Absorbing Capacity (TLAC) is an international standard designed for banks, particularly Global Systemically Important Banks (G-SIBs) by the Financial Stability Board (FSB) in 2015 to ensure that these banks have ample equity and bail-in debt in place to minimize tax payer and government bailout mechanisms. Securities eligible under TLAC include common equity, subordinated debt, some senior debt and unsecured liabilities with a maturity greater than one year. FSB requires that 33% of TLAC be filled with debt securities and a maximum of 67% with equity.

Talking Heads

On Bullish Stock-Market Sentiment Sending Contrarian Signal Ahead of Fed

Thomas Lee, head of research at Fundstrat Global

“Going to be tough for stocks the next few months because the dialog for equities will be focused on what framework the Fed will use for cutting interest rates”

Athanasios Psarofagis, ETF analyst at BI

“We’re still not seeing a parabolic move in stock sentiment… still room for investors to get more bullish throughout this year even if equities hit a roadblock soon”

On Bond investors gear up for looming Fed interest rate cuts

Kathy Jones, chief fixed income strategist at Charles Schwab

“We have throughout the past year suggested extending duration in anticipation of the cycle turning”

Jeff Klingelhofer, co-head of investments at Thornburg Investment

“We have moved to longer duration for all the portfolios we manage. The bar for reverting back to higher rates is quite high and we’re unlikely to go there”

On Treasury Cutting Quarterly Borrowing Estimate to $760bn

Peter Boockvar, author of the Boock Report

“Because of the enormous debts and deficits being accumulated”, Treasury’s announcements are now market-moving events”

Top Gainers & Losers- 30-January-24*

Go back to Latest bond Market News

Related Posts: