This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

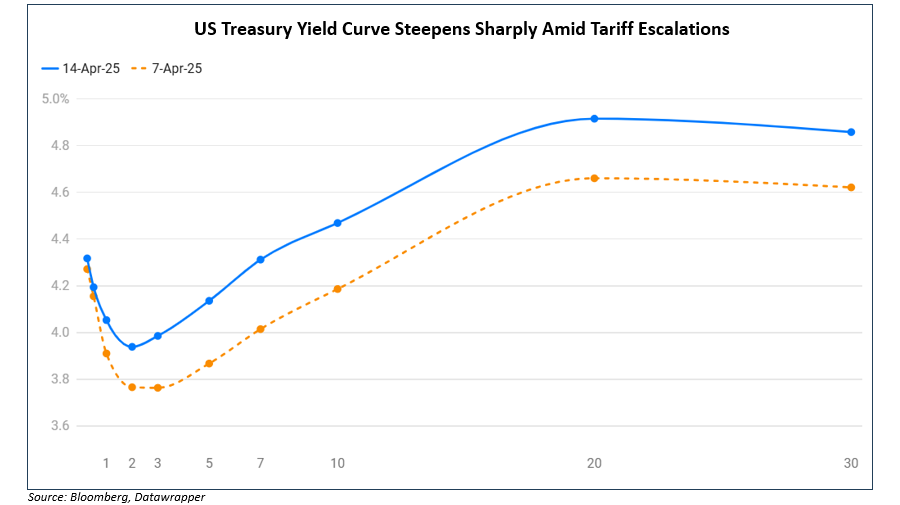

US Treasury Curve Steepens Sharply Amid Tariffs

April 14, 2025

The US Treasury curve flattened on Friday with the 2Y yield up 11bp while the 10Y yield was up 2bp. However, looking at the overall move since the trade escalations began, we note that the yield curve has steepened sharply, as seen in the chart below. For instance, over the past week, the 2Y yield has risen by 17bp while the 10Y yield has shot higher by 28bp. On Friday, China raised its retaliatory tariffs on US imports to 125%. The US administration announced that smartphones, computers and computer chips will be exempted from reciprocal tariffs. However, the Commerce Secretary Howard Lutnick said that critical technology products from China would face separate new duties along with semiconductors over the next two months.

Looking at US equity markets, the S&P and Nasdaq rallied, closing 1.8% and 2.1% higher. Looking at credit markets, US IG and HY CDS spreads tightened by 0.8bp and 13bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads tightened by 0.1bp and 4bp respectively. Asian equity markets have opened in the green this morning. Asia ex-Japan CDS spreads were tighter by 1.5bp.

New Bond Issues

Rating Changes

- Italy Rating Raised To ‘BBB+’ On External Buffers and Monetary Flexibility; Outlook Stable; ‘A-2’ Rating Affirmed

-

Fitch Downgrades Blackstone Mortgage’s IDR to ‘BB-‘; Outlook Stable

-

Fitch Downgrades China Energy Engineering to ‘BBB+’; Outlook Stable

-

Egypt Outlook Revised To Stable; ‘B-/B’ Ratings Affirmed

-

Fitch Revises BRF’s Outlook to Positive; Affirms IDR at ‘BB+’

-

Moody’s Ratings affirms HCA Inc.’s Baa3 ratings; revises outlook to positive

-

Moody’s Ratings affirms Xiaomi’s Baa2 ratings; revises outlook to positive

Term of the Day: Restructuring Support Agreement (RSA)

A Restructuring Support Agreement (RSA) is a preliminary reorganization plan formed between the debtor and key institutional creditors who typically have a higher position in the capital structure. The RSA is a written contract that details an agreed upon framework for the treatment of debt and a timeline for the company’s reorganization. An RSA allows the parties involved to negotiate and agree upon the terms of the treatment of claims and the course of the bankruptcy process. This helps in reducing the uncertainty for both debtors and creditors with respect to bankruptcy proceedings.

Talking Heads

On Oaktree, TCW and Sona Spotting Opportunity in Market Turmoil

Brian Gelfand, TCW

“The market is running from credits with tariff-related risk… going to be survivors in that cohort and we want to identify those and invest in them at improved prices”

Howard Marks, Oaktree Capital

“We’re likely to invest our latest opportunistic debt fund faster than otherwise would have been the case”

Owain Griffiths, Sona Asset

“We are constructive on the longer term. There are reasons to be cautiously optimistic on Europe”

On wanting stronger yen, says Tokyo shouldn’t sell Treasuries

Itsunori Onodera, chair of the Liberal Democratic Party’s Policy Research

“As a U.S. ally, the government shouldn’t think about intentionally using U.S. Treasury holdings… weak yen has been among factors pushing up prices. To strengthen the yen, it’s important to strengthen Japanese companies”

On Treasury Market Rout Even Worse for Inflation-Linked Bonds

Michael Pond, Barclays Capital

“We’ve seen this movie before… We’ve been warning for a while about exactly this sort of breakdown in the TIPS market… TIPS market has a tendency to break”

Top Gainers and Losers- 14-April-25*

Go back to Latest bond Market News

Related Posts: