This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Treasury Curve Flattens Further; S&P PMIs Come Mixed

April 24, 2025

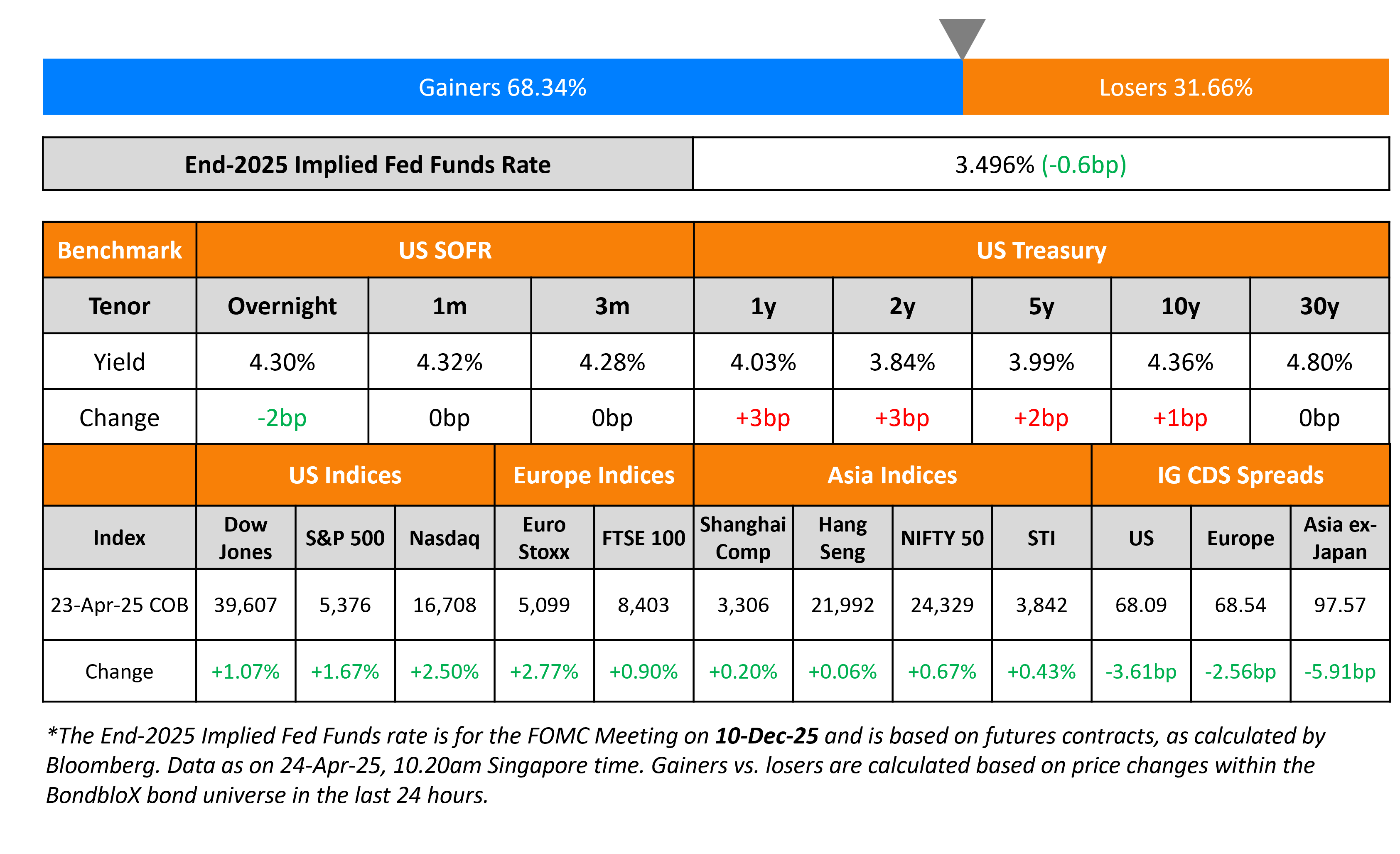

The US Treasury curve flattened further as short-end yields rose by ~3bp while long-end yields held steady. The S&P Manufacturing PMI came-in at 50.7 in April, better than the surveyed 49.0. The Services PMI came-in at 51.4, lower than expectations of 52.6.

Looking at equity markets, the S&P and Nasdaq extended their rally yesterday, up by 1.7% and 2.5% respectively. Looking at credit markets, US IG and HY CDS spreads tightened by 3.6bp and 18.1bp respectively. European equity markets ended higher. The iTraxx Main spreads were 2.6bp tighter while Crossover CDS spreads tightened 12.4bp. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 5.9bp.

New Bond Issues

- Nippon Life $ 30NC10 at 7.25% area

- Sumitomo Mitsui Finance $ 5Y at T+160bp area

Rating Changes

-

Mizuho FG And Core Banks Affirmed On Improved Capital; Hybrid Debt Ratings Raised; Outlooks Stable

-

Fitch Upgrades Klépierre’s IDR to ‘A-‘/Stable; Senior Unsecured to ‘A’

-

Moody’s Ratings upgrades Lottomatica to Ba2; outlook stable

-

Moody’s Ratings upgrades Saudi Re’s IFSR to A2; outlook stable

-

Toll Road Investors Partnership II L.P. Debt Rating Lowered To ‘B+’, Outlook Negative

-

Moody’s Ratings affirms China Oil and Gas’ Ba3 CFR and changes outlook to stable

Term of the Day: PMI

PMIs or Purchasing Managers’ Index are an index composed of a monthly survey of purchasing managers/supply chain managers across industries. This is a diffusion index, a statistical measure of summarizing the common tendency of a series – if there are more number of values rising than falling, the index is above 50 and the index goes below 50 if the falling values exceed those rising. For PMIs, a value below 50 indicates contraction and a value above 50 shows expansion. These surveys are taken over different areas of the supply chain business: New Orders, Employment, Inventories, Supplier Deliveries and Production covering imports, exports, prices and backlogs. In most countries, Markit publishes the PMI numbers while other organizations publish them too. Markit generally publishes the month’s PMIs in last week of the month.

Talking Heads

On Tariffs Likely More Disinflationary Than Inflationary – Christine Lagarde, ECB President

“It is very unclear what the net impact will be. Particularly if there is no countermeasures decided by Europe, I think the net inflation is uncertain at the moment.. probably it’s going to be disinflationary more than inflationary”

On Warning of New Global Debt Surge as Economic Growth Weakens – IMF Economists

“This upward trend is likely to continue, with public debt nearing 100% of GDP by the end of the decade, surpassing pandemic levels… Tighter and more volatile financial conditions in the United States may have ripple effects on emerging markets and developing economies, leading to higher financing costs”

On Doubt Over US Treasuries’ Haven Status Being Bad for World – Bundesbank President, Joachim Nagel

“It is not good news that there is a lot of doubt regarding the safe haven of US Treasuries… Germany is the stability anchor of Europe — German bunds are a perfect example of this… We need a good US Treasury market”

Top Gainers and Losers- 24-April-25*

Go back to Latest bond Market News

Related Posts: